Break-in at LA mayor's home happened during a security shift change, suspected burglar charged

-

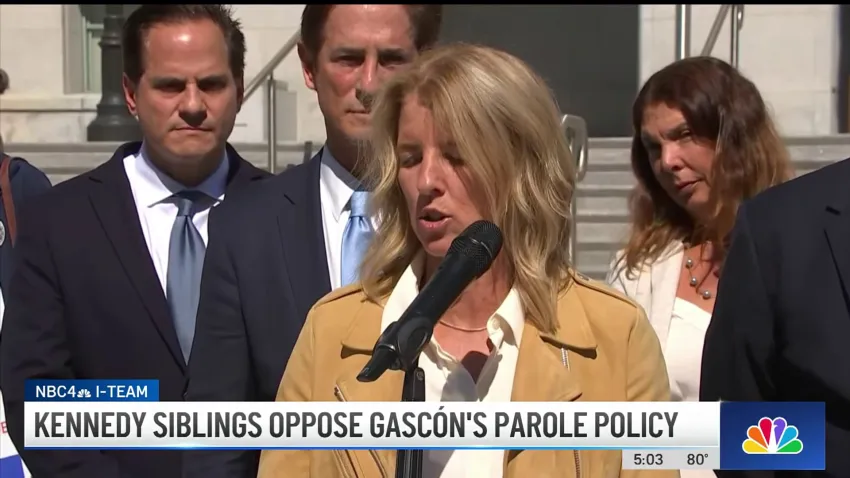

Kennedy children announce support for George Gascón's challenger

Two of slain Sen. Robert Kennedy’s children endorsed Nathan Hochman, who is running to unseat the Los Angeles district attorney. The I-Team’s Eric Leonard reports.

-

Kennedy children denounce George Gascón's parole policy, endorse challenger

Children of slain Sen. and Presidential candidate Robert Kennedy denounce reform policy of LA County district attorney.

-

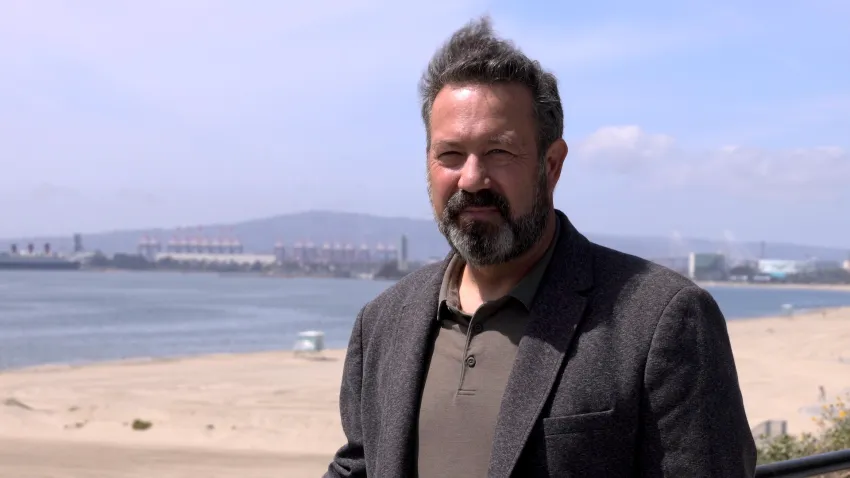

Man lost $21,000 in SIM swap scam. Here's how to protect yourself

Crooks hijacked a man’s cellphone number and then stole money from his bank account using two-factor authentication.

-

Murders are dropping across the country, but not in LA

Murder mystery: why are more people being killed in Los Angeles than in other big cities in California and the US?