This story is part of CNBC Make It's Millennial Money series, which details how people around the world earn, spend and save their money.

Isaac Diaz turned 40 last month, but his big birthday getaway didn't exactly go as planned. That was OK — Diaz is no stranger to making the best of any situation.

Diaz took time off from his busy job as a video producer to relax and unwind in Puerto Rico. But when he broke up with his girlfriend mid-trip, he spent the majority of his birthday flying home to Los Angeles. His birthday dinner was a beer and an overpriced chicken club sandwich.

"I was just sitting there thinking, 'This was not what I envisioned turning 40 would be,'" he says with a laugh.

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

A few days later, his family and friends threw him a big backyard bash, which he says just goes to show that there are positives in every situation.

Finding those silver linings has been an important lesson for Diaz, who spent years hustling at freelance gigs. He didn't land a stable, full-time staff position that he genuinely loved until 2019. Now Diaz earns about $70,000 a year from his job as a video producer at a television network, as well as about $5,000 a year from side projects and freelance gigs.

"It isn't a ton of money, but it's enough to not be broke," he says.

Money Report

Though he thought he'd be married with kids and own a home by now, Diaz has made his peace with where he is. And that extends to his finances, which he says aren't perfect. Although Diaz contributes to his 401(k) and saves $175 from every paycheck, he still feels behind, in part, because he spent years paying off credit card debt that he racked up starting in college.

"I feel like I should have things together, but I don't have it all together and I'm learning that that's OK. Being 40 doesn't mean that you have to be perfect. Being 40 doesn't mean that you have to have all those things that you thought you needed together," he says.

How he makes his monthly budget work

While his income is pretty steady these days, Diaz's expenses are currently in flux, thanks to the recent breakup. He lived with his ex, so he's planning to stay with family and friends this summer while he looks for a new place.

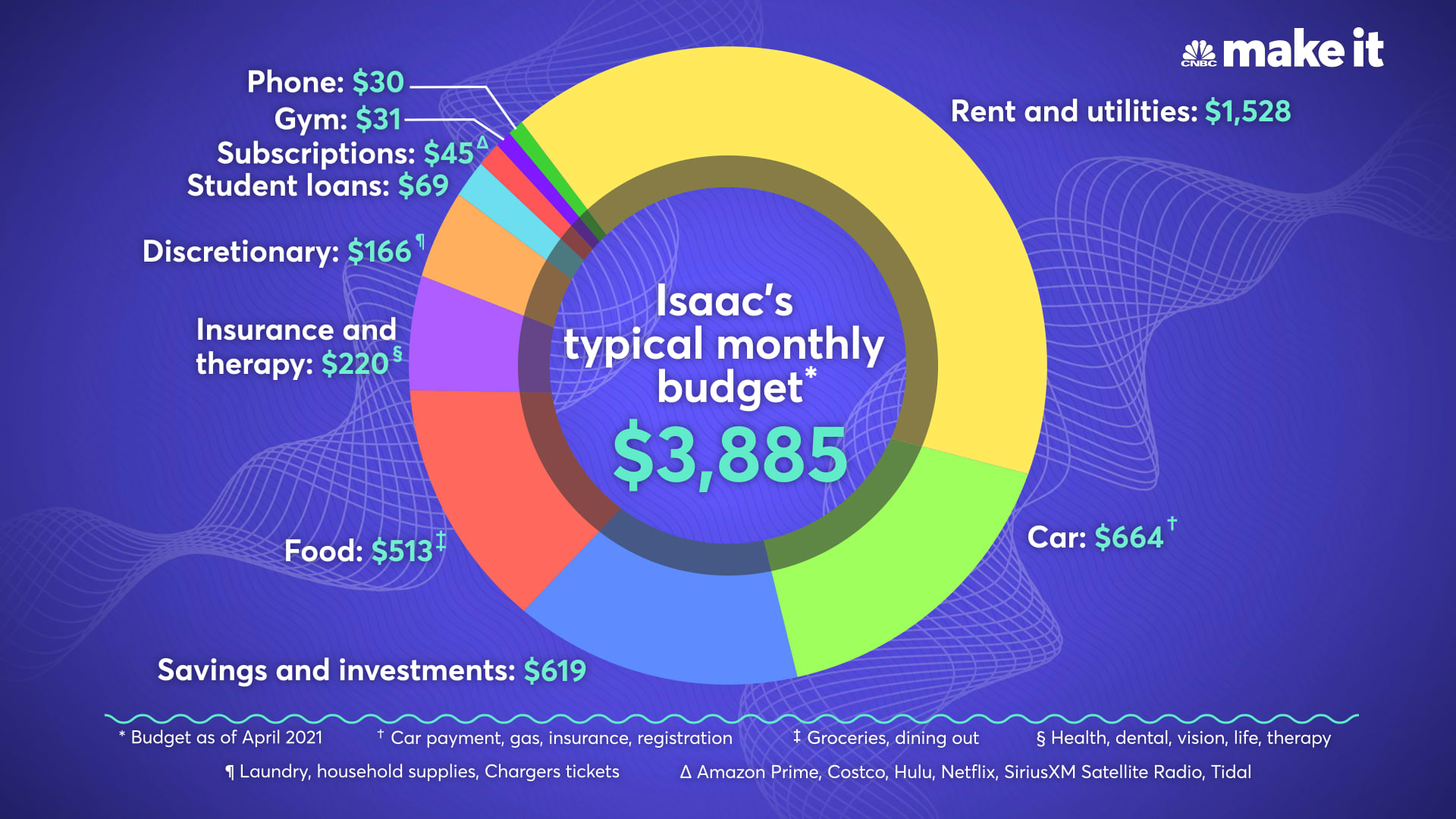

To show how Diaz typically spends his money, here's a look at his expenses as of April 2021:

- Rent and utilities: $1,528 (includes Wi-Fi and utilities)

- Car expenses: $664 ($371 for car payment, $191 for gas and $26 for DMV costs)

- Savings and investments: $619

- Food: $513 ($167 for groceries, $346 for dining out)

- Insurance and therapy: $220 (includes health, dental, vision, and life insurance, as well as monthly therapy sessions)

- Household expenses: $91

- Monthly cost of his season tickets for the L.A. Chargers: $75

- Student loans: $69 (He has about $6,300 total left to pay.)

- Subscriptions: $45 (includes Amazon Prime, Costco, Hulu, Netflix, SiriusXM and Tidal)

- Gym: $31

- Phone: $30 (Diaz is on a family plan.)

After working to pay down credit card debt when he was younger, Diaz says he now makes it a priority to keep his monthly expenses under control. He currently has no credit card debt and is in the midst of paying off the loan for his 2013 Acura TSX, which has about a $4,999 balance remaining as of April.

Although Diaz lives within his means, he makes room to spend on experiences, including food and travel. (He put most of his travel plans on hold during the pandemic but expects to plan a trip soon.) Over the years, he's traveled to European cities such as London and Paris, as well as countries such as the United Arab Emirates and Thailand.

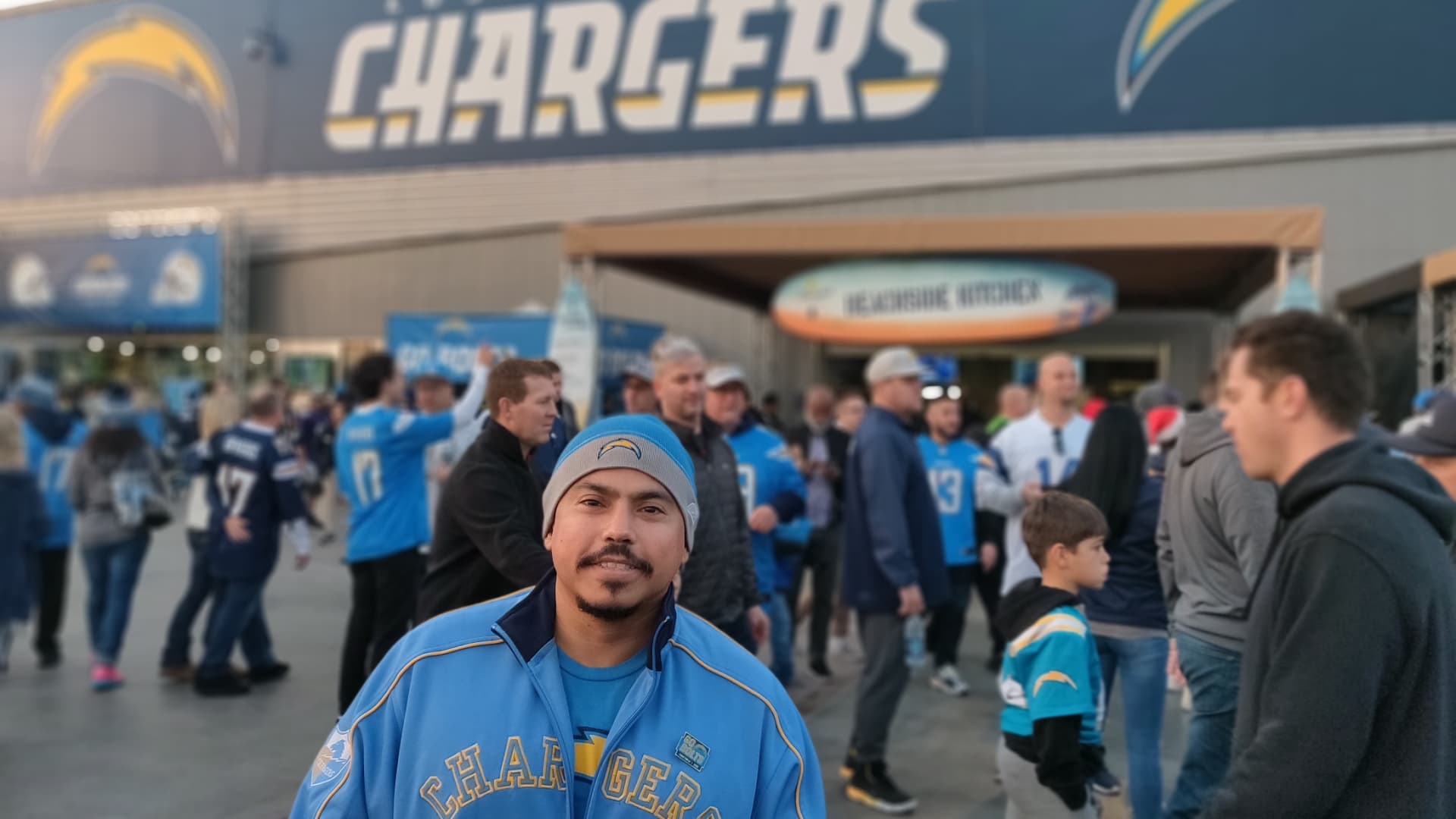

Diaz is also a lifelong fan of the Los Angeles Chargers. He splits the annual $2,704 cost of season tickets, as well as the cost of traveling to a few away games, with two of his friends. "It's definitely a priority for me," Diaz says. "We have such a great time, we make amazing memories and we travel the country to see other football stadiums."

How he got where he is today

For Diaz, it's been a winding road to get where he is.

Diaz grew up in the San Diego area, but moved to Los Angeles for college. After graduating with a degree in cinema and television arts from California State University Northridge in 2003, Diaz struggled to find work in his field. For a few years after college, he worked for a pharmacy before finding a job as an assistant to a music executive.

That eventually led Diaz to pursue freelance video gigs, but those jobs weren't always enough to pay the bills, let alone save money or invest.

"Some months where we were super busy, we'd be bringing in $20,000 or $30,000, and other months we don't bring in anything at all," Diaz says. "And to be honest, I wasn't very good at budgeting for that sort of fluctuation." Diaz started to accrue credit card debt in college and, because of the fluctuations in his freelance income, that continued well into his 30s.

In 2015, his freelance gigs started to dry up. "I had to move back home to San Diego," says Diaz.

He'd always been close with his parents and two younger siblings, but going home "was one of the hardest things I've ever had to do. I'm sitting there, 35 years old, and having to move from an apartment that I was maintaining on my own, back home with my parents."

But according to Diaz, "it was actually a blessing in disguise." It gave Diaz more time with his mother, who had just started treatment for uterine cancer. Three years later, she passed away.

"Looking back now, I'm glad I made the move home. But at the time...I did not feel very successful at all," Diaz says.

He credits his mom with helping him through it. "She helped me say, 'Hey look, you need to get up, dust yourself off, get back out there,'" Diaz says. Both of his parents encouraged him to find a new job, even if it wasn't in video production. And so he did, taking a job at a software company.

While he was able to move up from customer service to account manager in just a year and a half with the company, Diaz says he realized it wasn't what he wanted to do with his life.

So he quit. He started applying for video production jobs, landing his current job a few months later in October 2019 and moving back to Los Angeles.

"I didn't have any safety net. There was no plan," Diaz says. "I don't recommend doing it the way I did. I just needed to do something that I was passionate about."

And thankfully for Diaz, it worked out. The stable income also allowed Diaz to get serious about his finances by contributing to his 401(k), making plans to clear out all his debts and save for future goals, such as buying property.

What he hopes the future holds

Although Diaz loves his job and is comfortable with what he's achieved, over the next five years, he wants to continue to take on new challenges at work, grow his video production skills and eventually, get into television and film development.

He also plans to continue to work on his finances, starting with adding to the roughly $20,000 he has in retirement accounts and investments.

Diaz wants to invest in real estate and buy a multi-unit property in the future. "I'm ready to get my own property and so I'm trying to get all my ducks in a row," Diaz says. "I want to make sure that I'm setting myself up for success."

Diaz hopes to settle down in the near future as well: "Eventually, I do want to have a family," he says.

Diaz sees his 40s as a new chapter of life. "It's turning the page. Now I can take what I've learned in my 30s and apply that to my 40s. I can't wait to be able to put those things into action."

What's your budget breakdown? Share your story with us for a chance to be featured in a future installment.

Sign up now: Get smarter about your money and career with our weekly newsletter