Here are the most important news, trends and analysis that investors need to start their trading day:

- Stock futures drop after Wall Street extends its multiday losing streak

- Wholesale inflation rose 11% in April as producer prices keep accelerating

- Bitcoin plunges to 16-month lows while the entire crypto market slumps

- Disney sinks as CFO warns streaming won't be as strong later this year

- Beyond Meat plummets after wider-than-expected quarterly loss, revenue miss

1. Stock futures drop after Wall Street extends its multiday losing streak

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

U.S. stock futures dropped Thursday as the broad sell-off and revaluation of risk assets continued with little place to hide. Confirmation on somewhat moderating inflation did not move the needle.

- The morning after earnings, Dow component Disney dropped nearly 5% to $100 per share in the premarket.

- Apple, recently slumping with the rest of the market, has been dethroned as the world's most valuable company by oil giant Saudi Aramco.

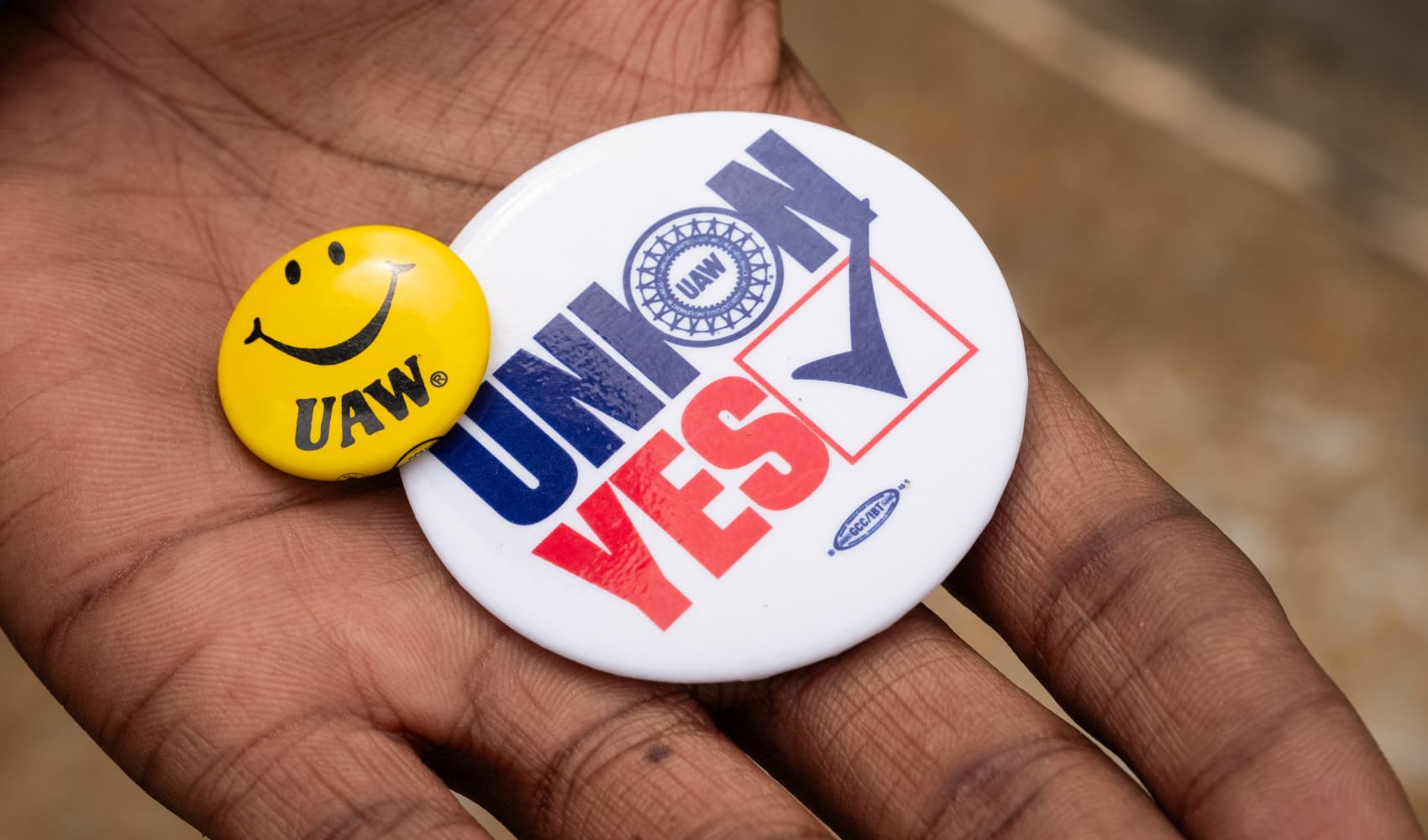

- Ford and General Motors both fell sharply in the premarket. Wells Fargo downgraded both stocks two notches to underweight from overweight, saying 2022 could be "peak profits" for legacy automakers.

- Bitcoin and the entire crypto market's recent downturn intensified Thursday.

- Treasury prices, which move inversely to yields, jumped as investors sought the perceived safety of bonds.

- The Dow Jones Industrial Average, the S&P 500 and the Nasdaq on Wednesday fell 1%, more than 1.6% and nearly 3.2%, respectively, as multiday losses mounted.

2. Wholesale inflation rose 11% in April as producer prices keep accelerating

The producer price index, this week's second major inflation report, rose 0.5% in April, as expected. The core rate, which excludes food and energy prices, gained a less-than-expected 0.4%. Year-over-year, April PPI was up 11% and core was up 8.8%. On Wednesday, April consumer prices logged another strong advance, albeit at a slightly slower rate.

- A read on the second pillar of the Federal Reserve's dual mandate of fostering price stability and maximum employment was also out before the opening bell Thursday. Initial jobless claims for the week ended May 7 rose slightly to 203,000. Estimates had called for fewer first-time claims for last week.

- While lower early Thursday, bond yields have been rising to multiyear highs, with the 10-year Treasury yield topping 3%, as traders revolt against the Fed, worrying that inflation will remain high even as the economy slows.

3. Bitcoin plunges to 16-month lows while the entire crypto market slumps

Money Report

Bitcoin slipped at one stage to below $27,000 on Thursday for the first time in more than 16 months, as the cryptocurrency market extended its losses, in part, on fears over rising inflation. Bitcoin, touted as a store of value like gold by proponents, has been trading in tandem with tech stocks and the Nasdaq recently. The world's largest crypto has fallen 60% from its all-time high in November.

- Tether, the world's largest stablecoin, broke below its $1 peg Thursday, adding to market concern after the downfall of stablecoin protocol Terra. TerraUSD, or UST, is also supposed to mirror the value of the dollar, but it plummeted to less than 30 cents Wednesday, shaking investor confidence in decentralized finance. TerraUSD was trading around 45 cents Thursday.

4. Disney sinks as CFO warns streaming won't be as strong later this year

Shares of Disney initially rose in after-hours trading Wednesday. But they quickly turned lower after the company's CFO acknowledged that the second half of the year may not be quite as strong relative to the first half when it comes to streaming. Disney+ ended its fiscal second quarter with 137.7 million subscribers, up 7.9 million from a year ago and better than estimates. Investors were keen to see those Disney+ numbers after Netflix last month reported a decline in paid subscribers for the first time in more than 10 years.

- Disney's fiscal second-quarter revenue rose 23% to to $19.25 billion, helped by strong theme park sales. Revenue would have been $1 billion higher, if not for the early termination of some licensing agreements to make more content available for streaming. Disney reported adjusted earnings of $1.08 per share.

5. Beyond Meat plummets after wider-than-expected quarterly loss, revenue miss

Beyond Meat shares tumbled 25% in Thursday's premarket, the morning after the maker of plant-based meat alternatives reported a wider-than-expected quarterly loss and lower-than-expected revenue. The company cited a number of areas that were a drag on results, including steeper discounts and cheaper prices for international consumers and the launch of the company's plant-based jerky, which weighed heavily on margins.

- Looking to soothe investors, management said the just-reported first quarter is expected to be the low point for margins in 2022, and jerky production should be much more efficient by the second half of this year. Beyond Meat did reiterate its full-year revenue forecast of $560 million to $620 million.

— Sign up now for the CNBC Investing Club to follow Jim Cramer's every stock move. Follow the broader market action like a pro on CNBC Pro.