Here are the most important news, trends and analysis that investors need to start their trading day:

- Stock futures flat after Dow joined records Friday

- U.S. oil prices jump to 6-year highs after OPEC+ breakdown

- Shares of China's Didi tank, less than a week after U.S. IPO

- Hackers demand $70 million in global ransomware attack

- Amazon gets new boss as Bezos prepares to leave for space

1. Stock futures flat after Dow joined records Friday

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

U.S. stock futures were flat to start the holiday-shortened trading week as U.S. oil prices hit six-year highs Tuesday. U.S. equity trading was closed Monday in observance of the Fourth of July. The Dow Jones Industrial Average, which logged a fourth straight positive session Friday, finished at its first record close since early May. The S&P 500, on a seven-day winning streak, saw a fresh record high close. The Nasdaq also ended Friday with a record close. All three stock benchmarks were higher last week, with help from Friday's better-than-expected June jobs report. Bond yields ticked lower Tuesday. Gold prices jumped to a nearly two-week high, back above $1,800 per ounce.

2. U.S. oil prices jump to 6-year highs after OPEC+ breakdown

U.S. benchmark West Texas Intermediate crude Tuesday topped $76.98 per barrel, its highest price since November 2014. International benchmark Brent crude was trading around late 2018 highs above $77. The moves came after talks between OPEC and its oil-producing allies were postponed indefinitely, with the group failing to reach an agreement on output policy for August and beyond. Prices later Tuesday morning turned negative. Back April 2020, OPEC+ took historic measures and removed nearly 10 million barrels per day of production in an effort to support prices as demand for petroleum-products plummeted during the early days of the Covid lockdowns.

Money Report

3. Shares of China's Didi tank, less than a week after U.S. IPO

Shares of ride-hailing giant Didi Chuxing crashed as much as 25% to under $12 each in premarket trading Tuesday, before paring some of those losses, less than a week after the Chinese app listed as a public company on the New York Stock Exchange. Didi priced its IPO at $14 per share. The fall comes after China announced late Friday that new users in that country won't be able to download the Didi app while a cybersecurity review of the company is conducted. The Didi action is the latest in a high-profile Chinese crackdown on its tech titans after years of relatively little regulation.

4. Hackers demand $70 million in global ransomware attack

As many as 1,500 businesses around the world have been affected by a ransomware attack centered on Florida-based information technology firm Kaseya. Russia-linked gang REvil, which extorted $11 million from meat processor JBS last month, said it would unscramble all affected machines for $70 million in cryptocurrency. President Joe Biden said Saturday he ordered a "deep dive" by U.S. intelligence into the Kaseya breach, warning the United States would respond if it were to determine Kremlin involvement. A spokesman for Russian President Vladimir Putin said Moscow was not aware of the attack.

5. Amazon gets new boss as Bezos prepares to leave for space

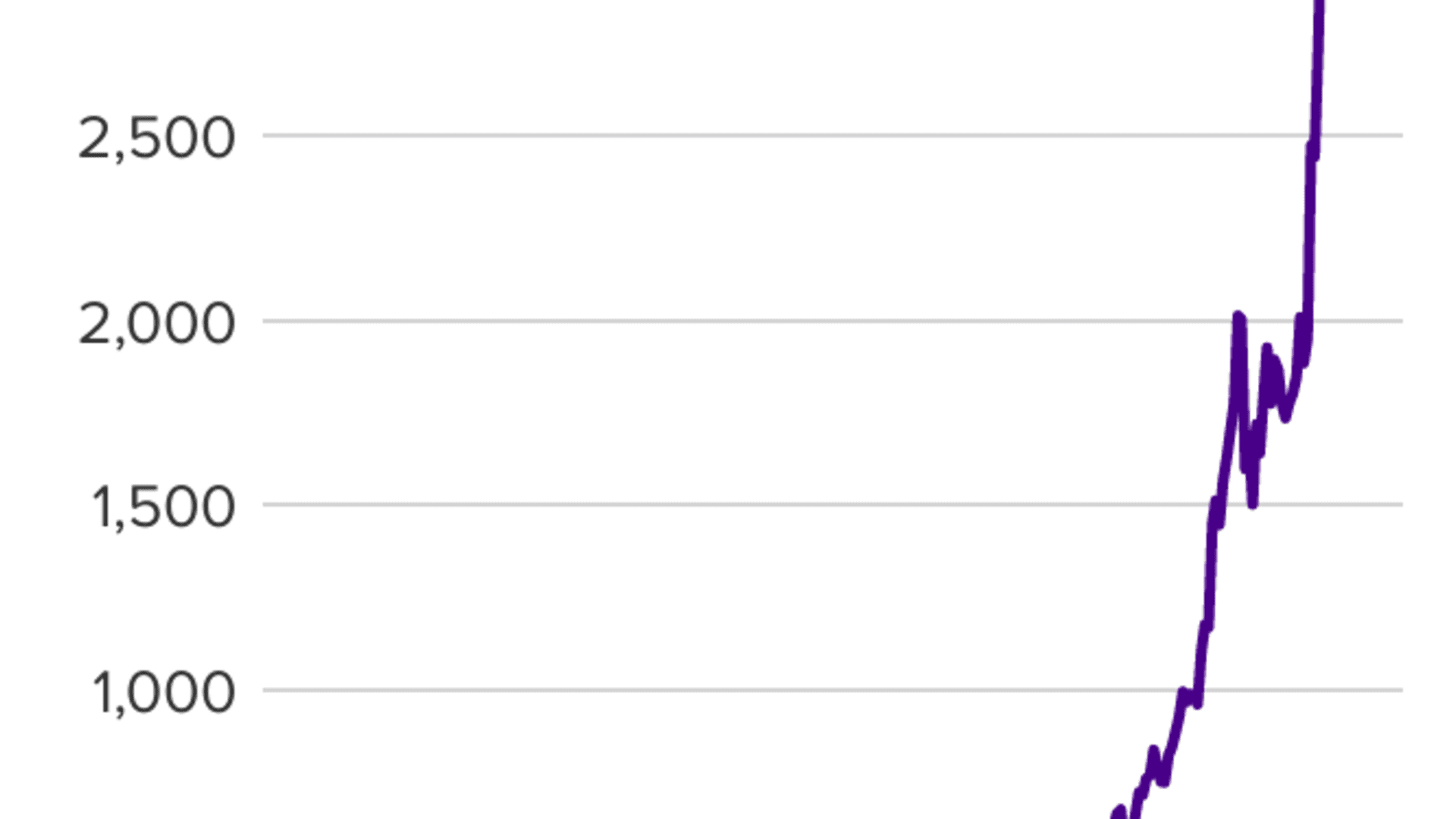

Jeff Bezos on Monday handed over the Amazon CEO reins to cloud boss Andy Jassy, capping the founder's monumental run leading the tech powerhouse since its inception in 1994. The stock over those 27 years has gained nearly 234,000%. Bezos remains at the company as executive chairman.

The 57-year-old is preparing to funnel his energy toward other pursuits, including his space company Blue Origin and his planned trip to space later this month. Jassy, 53, inherits a company in Amazon that's hitting its stride, surpassing $100 billion in quarterly sales for the first time ever in the fourth quarter of 2020.

— Reuters and The Associated Press contributed to this report. Follow all the market action like a pro on CNBC Pro. Get the latest on the pandemic with CNBC's coronavirus coverage.