Here are the most important news, trends and analysis that investors need to start their trading day:

- Dow looks steady after starting week off 269 points

- Coinbase shares fall after company reveals SEC plans to sue

- BlackRock responds to Soros' criticism over China investments

- White House proposes stopgap to avoid government shutdown

- Amazon expands grab and go; Apple sets September event

1. Dow looks steady after starting week off 269 points

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

U.S. stock futures were flat Wednesday, one day after the Dow Jones Industrial Average dropped 269 points, or nearly 0.8%, on lingering concerns about the Covid delta variant's impact on the economic reopening. The S&P 500 fell for the second straight session from Thursday's record close. The Nasdaq eked out a gain for another record finish. After the bell, original meme stock GameStop is set to release quarterly results.

The 10-year Treasury yield, which moves inversely to price, dropped to 1.35% on Wednesday, ahead of the government's release of its latest JOLTS, Job Openings and Labor Turnover Survey, at 10 a.m. ET. The Federal Reserve is out with its Beige Book survey of economic activity across its 12 districts at 2 p.m. ET.

Bitcoin was under pressure again early Wednesday. It dropped as much as 10% on Tuesday, just one day after topping $52,000 and reaching its highest level since May. The volatility in recent days came ahead of and following El Salvador on Tuesday becoming the first country to adopt bitcoin as legal tender.

Money Report

2. Coinbase shares fall after company reveals SEC plans to sue

Coinbase has received notice of a possible enforcement action from the Securities and Exchange Commission related to its interest-earning product, which the company had planned to launch in the coming weeks. The cryptocurrency exchange and services firm received a so-called Wells notice from the SEC a week ago, saying the regulator intends to sue Coinbase over the product, called Coinbase Lend, the company disclosed in a Tuesday night blog post. Shares of Coinbase fell 3% in premarket trading Wednesday.

3. BlackRock responds to Soros’ criticism over China investments

BlackRock, the world's largest asset manager, has responded to sharp criticism from billionaire investor George Soros over the firm's investments in China. Writing in The Wall Street Journal on Tuesday, Soros described BlackRock's initiative in China as a "tragic mistake" that would "damage the national security interests of the U.S. and other democracies." Soros' comments come after BlackRock launched a set of mutual funds and other investment products for Chinese consumers. BlackRock told CNBC on Wednesday its China mutual fund subsidiary set up its first fund there after raising over $1 billion from more than 111,000 investors.

4. White House proposes stopgap to avoid government shutdown

The White House is proposing a stopgap spending measure to fund the government beyond the end of its fiscal year this month. The bill would include billions of dollars in aid to help people recover from Hurricane Ida and to assist in the relocation of Afghans who fled Kabul. The plan to avoid a government shutdown comes as lawmakers haggle over a bipartisan $1 trillion infrastructure bill and a Democrat-backed $3.5 trillion budget reconciliation package.

To help pay for that $3.5 trillion spending plan, congressional Democrats are floating a slew of taxes, including new levies on the wealthy. A couple of proposals from Senate Finance Committee Chairman Ron Wyden call for so-called mark-to-market taxes on derivatives and carried interest, which may result in levies on gains every year.

5. Amazon expands grab and go; Apple sets September event

Amazon said Wednesday it's bringing its automated grab-and-go technology to two Whole Foods stores — one in California, the other in Washington, D.C. Shoppers who want to skip the checkout line can enter the store by either scanning an app, inserting a credit or debit card linked to their Amazon account, or placing their palm over the company's palm-scanning payment system, called Amazon One. Shares of Amazon, as of Tuesday's close, were off 7% from their all-time high of $3,773.08 in July. The stock was steady in Wednesday's premarket.

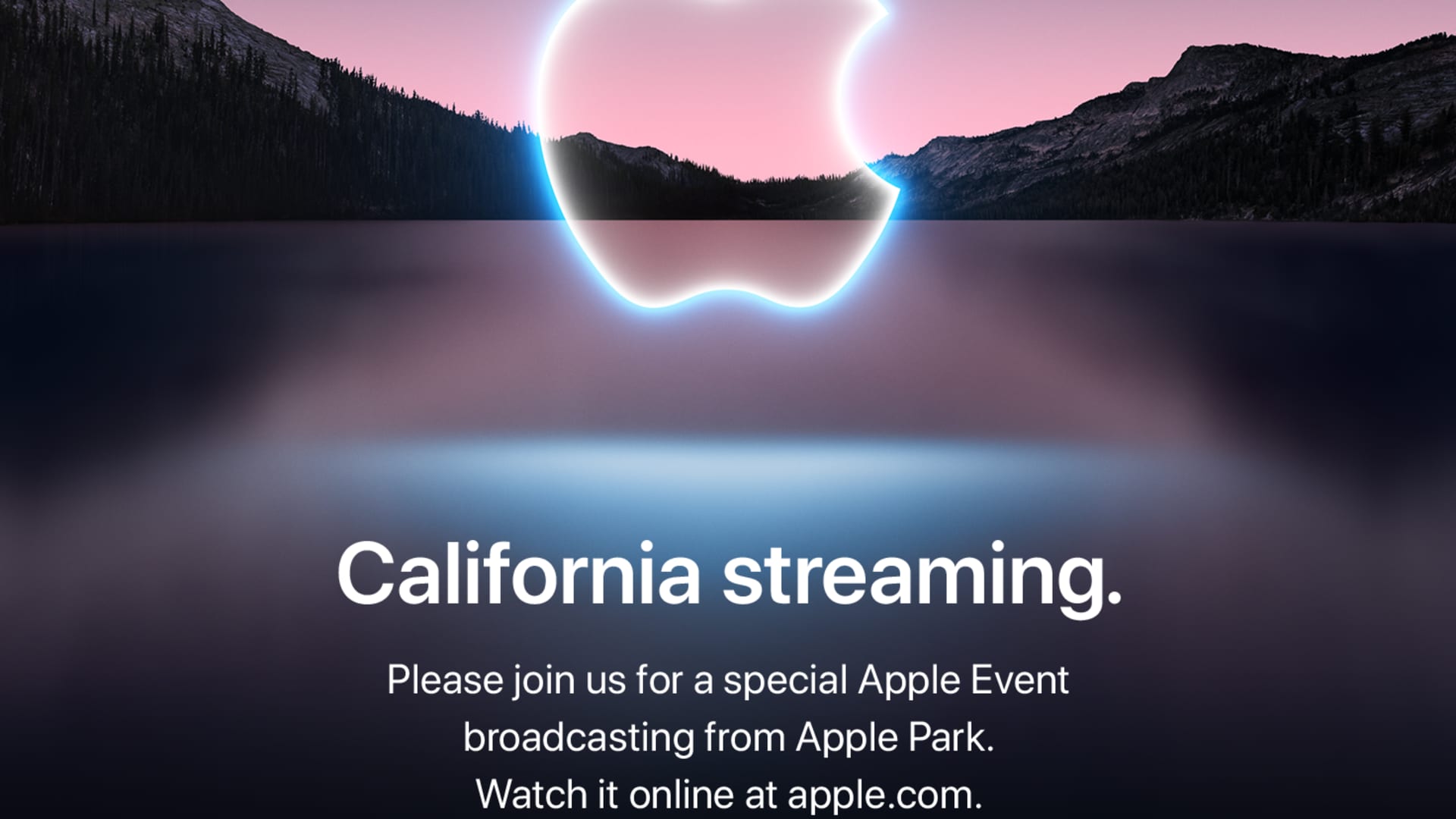

Apple shares were also steady in the premarket. The stock hit an all-time high of $157.26 on Tuesday after the tech giant sent invitations to the media for its annual September product event. New iPhones are expected. Apple could also release new Apple Watch and AirPods models. The virtual event will be streamed on Apple's website. The company typically announces new iPhones in September. But last year, due to Covid, Apple announced the iPhone 12 in October. The September event was used to reveal new watches and iPads as well as a streaming exercise class subscription and a bundle of other Apple services.

— Follow all the market action like a pro on CNBC Pro. Get the latest on the pandemic with CNBC's coronavirus coverage.