Growing up in a single-parent home, I was always taught to have a frugal mindset. My mom clipped coupons every week, and her money concerns often became mine.

I thought that going to college and getting a high-paying job would solve all my financial problems. But even as my wife and I advanced in our careers, the majority of our earnings went into basic living expenses and paying off student debt.

But last year, at age 37, I achieved a net worth of $1 million. We took charge of our finances by saving more, starting side hustles and investing in real estate.

We also wanted to be financially responsible role models for our two young children. In 2020, my wife and I launched Parent Portfolio to help families learn to build generational wealth and raise financially literate kids.

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

Here are the five top money rules I teach my kids:

1. Always rethink one-time purchases.

We live within our means. So even as our income increases, we never increase our spending. That's not to say we don't enjoy the fruits of our labor — it's more about being mindful.

When my kids want to buy a toy, for example, I ask them three questions:

- "Is this something you really need?"

- "Do you see yourself using it often in the future?"

- "Are there less expensive options that provide the same purpose?"

We also walk them through our own decision-making process and point out the value of items we buy and use frequently.

Money Report

2. Budgeting gives you more freedom.

Many people see budgets as being restrictive, but I actually see it as a tool to create more financial freedom; it saves you money by preventing you from overspending.

When my son wanted money for his school's book fair, we gave him a budget of $40. To him, it became a game of how many books he could get under $40 that had value to him.

Another important lesson: Budgeting isn't a "set it and forget it" practice. We revisit our budgets every month to make changes based on our current situation.

3. Don't let social media influence your spending.

It's easy to forget that social media is often just a highlight reel. When people post photos of lavish vacations or fancy new cars, that is only part of the story.

We handle this kind of peer pressure by limiting our kids' technology usage. We only allow them to be on their tablets on weekends, and for no longer than two hours a day.

We strive to set good examples, too. We never take out our phones when we eat together, and we use social media disabling apps to limit our daily activity to one hour a day.

4. Know where money comes in, and where it goes out.

We use age-appropriate language, tools and real world examples to teach our kids about more complex money topics.

To give them a tangible sense of what we do with our real estate business, for example, and where the money we earn comes from, we take them to project sites and introduce them to the contractors we work with.

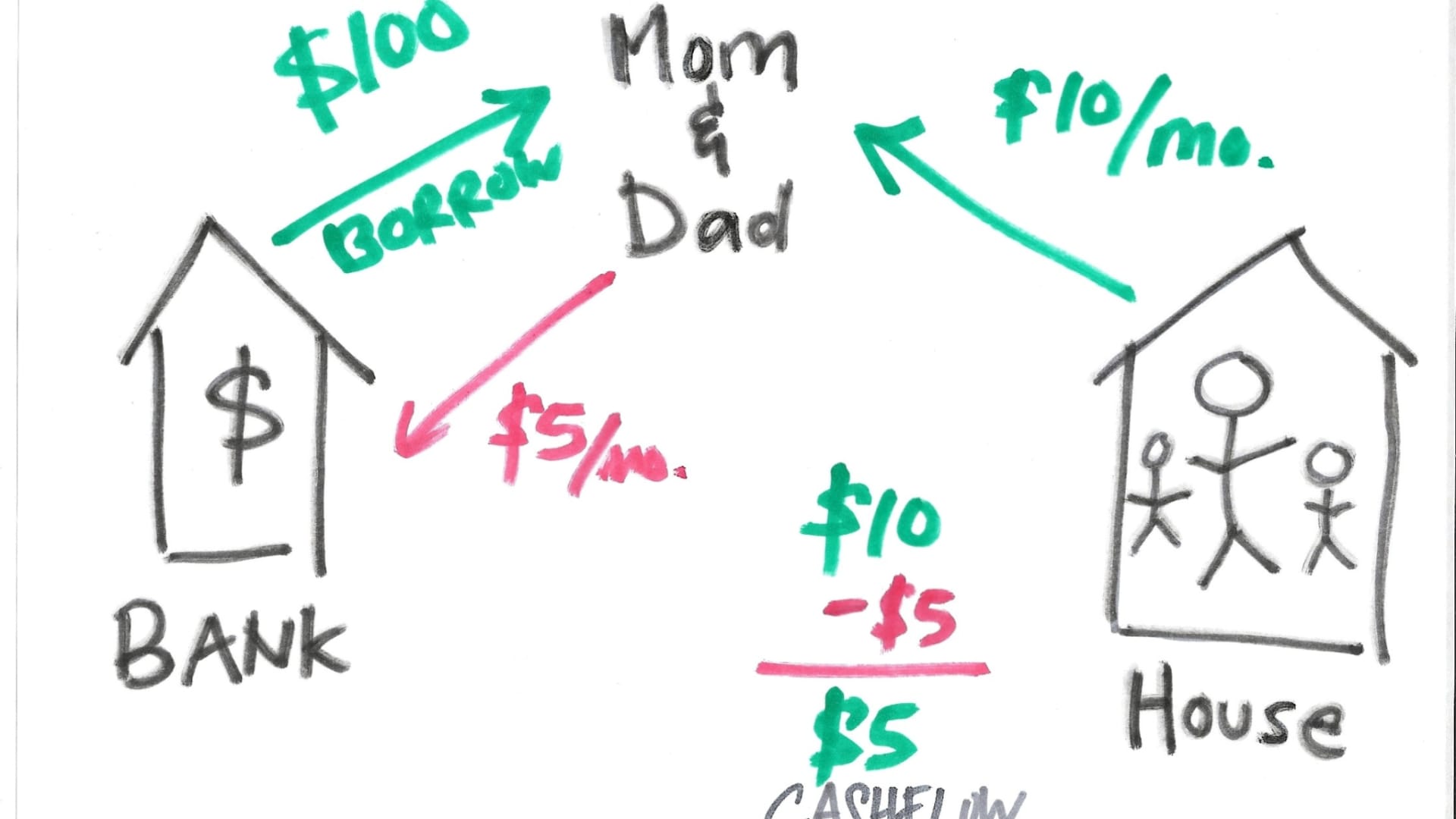

We also use a lot of visuals. To illustrate how transactions work between banks, borrowers, tenants and landlords, I drew up a simple sketch with arrows pointing to each group.

5. Start saving early, and don't expect to get rich overnight.

One of the stories I like to tell my kids is about the tortoise and the hare. The moral is that it's more prudent to do things slowly and steadily.

Building wealth is very similar in that it doesn't happen overnight. When our kids receive monetary gifts, we deposit them into their bank accounts.

"For now, your mother and I are responsible for providing for your needs and wants," I tell them. "A bank is a safe place to put your money because it allows the funds grow over time. And when you're old enough, you can use that money for your own goals."

In a world of instant gratification, it's even more important to teach kids the value of patience and starting early.

Jonathan Sanchez is the co-founder of Parent Portfolio, a website that helps families learn to grow wealth and raise financially responsible kids. Follow him on Twitter @TheParentPort.

Don't miss:

- This 24-year-old lost her waitressing job. Now she makes $8,600 per month in passive income—and works 'just 2 hours a day'

- I talked to 70 parents who raised highly successful adults—here are 4 things they never did when their kids were young

- A Harvard-trained economist shares his top 21 money rules: 'Own your home, don't rent—and try to buy in cash'

Want to earn more and work less? Register for the free CNBC Make It: Your Money virtual event on Dec. 13 at 12 p.m. ET.

Sign up now: Get smarter about your money and career with our weekly newsletter