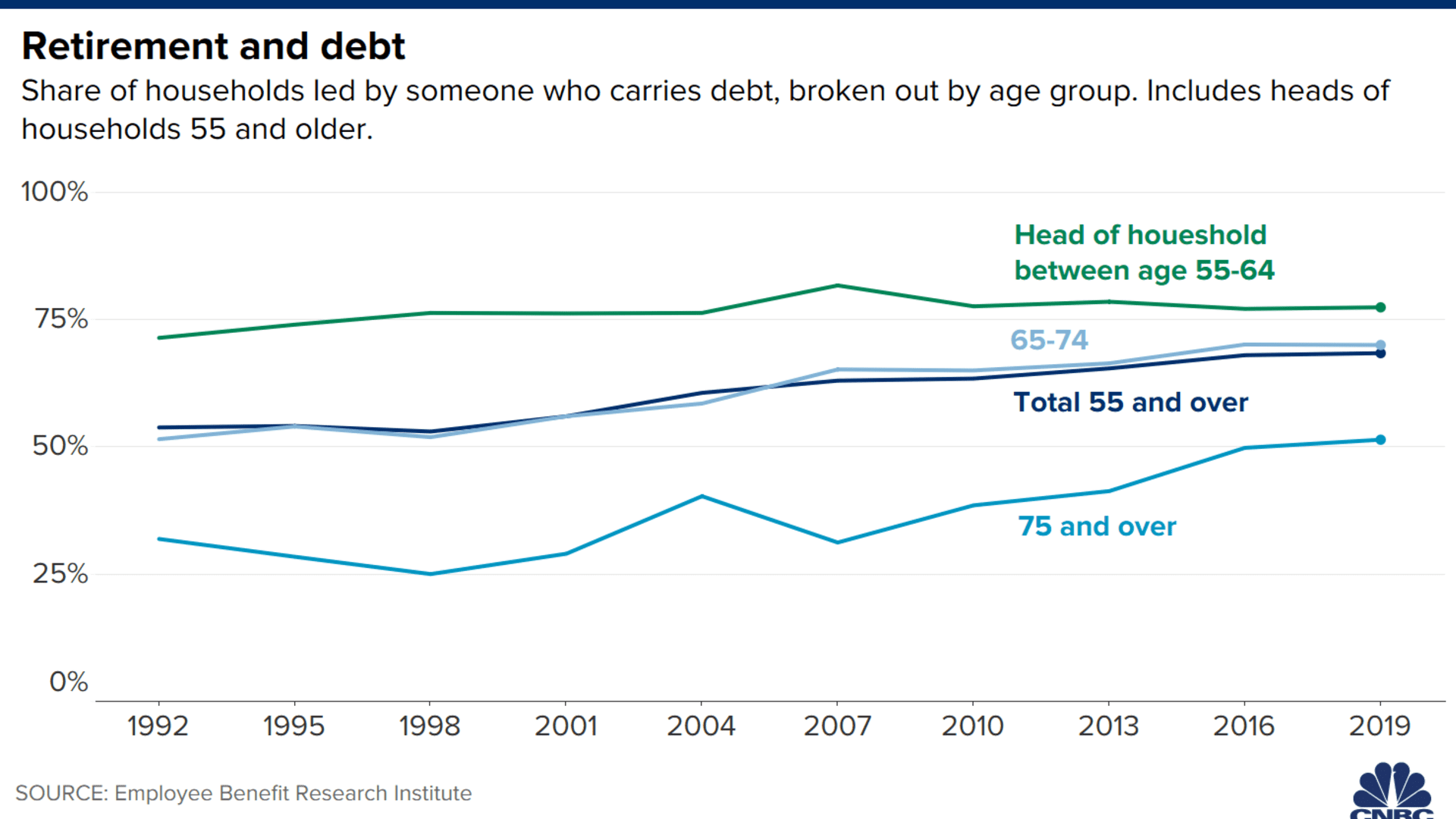

- The share of people age 75 or older who lead a household and carry debt reached 51.4% in 2019, up from 38.5% in 2010.

- The increased debt amount among the oldest cohort compares with a drop among people age 65 to 74.

- Retirement savers should pay attention the both sides of their balance sheet, says one expert.

U.S. retirement savers may want to look to their elders for a cautionary tale about racking up debt: It might be with you well into your golden years.

The share of people age 75 or older who lead a household and carry debt jumped to 51.4% in 2019 from 41.3% in 2013 and 31.2% in 2007, according to new research from the Employee Benefit Research Institute. In the 65-to-74 age group, 70% carried debt last year, up from 66.4% in 2013 and 65.2% in 2007.

While some of that may have changed in 2020, families headed by someone age 75 or older had growth in both median housing and median credit card debt last year, the study said.

"Even pre-pandemic, those households were still getting into more debt than they had in prior years," said Craig Copeland, senior research associate for the institute and author of the report.

"That's not a place you can easily recover from," Copeland said. "It's not like you can easily get a job at that age and get back on track."

Money Report

The median income for individuals in that age group who are not working is about $20,500, according to the Pension Rights Center.

The average overall debt in the age-75-plus-led households grew 38.8% to $44,828 in 2019 from $32,294 in 2010, the study shows. That compares with a decrease in the 65-to-74 age group to $73,397 last year, from $83,505 in 2010.

Likewise, the share of income going to debt payments rose to 7.3% among the oldest age group, up from 4.5% in 2007 (although lower than the 7.7% in 2004). Roughly 5% in the oldest group have debt payments that exceed 40% of their income, the study says.

Additionally, while non-housing debt as a share of income had been below 2% in the 75-plus age cohort compared with others age 55 to 74 (with the exception of 2004), it now is in line with them, pushing 3%.

The research notes workplace financial wellness programs that include money management skills can benefit individuals during their working years, which conceivably would help them as they transition into retirement.

More from Personal Finance

Here are three of my worst money mistakes

"There's a lot of focus on building up assets, how much you should have in your 401(k) but you should also look at the other side of your balance sheet," Copeland said.

He said that while it's great to contribute to your retirement savings, pay attention to the short-term matters, as well — which means having a cash cushion and avoiding credit card debt as best you can.

"One issue the pandemic has brought into focus is that many people don't have emergency savings to draw on," Copeland said. "People weren't even able to get through the first few months of this without stimulus money and unemployment, and we're going on almost a year."