The market is behaving as if it sees quite clearly how 2021 will turn out: Vaccines arrive, jets refill the skies, the economy revives, corporate profits snap higher, all while the Federal Reserve stays out of the way and maximally easy.

And in recent weeks, Wall Street has become quite persuasive in telling this tale. The most economically sensitive parts of the market are accelerating skyward, credit markets are drum tight, the tape is inured to bad Covid news and investors are ardently (too ardently?) throwing money at risky assets.

With all this pervasive perceived certainty, perhaps it's a good time to consider a few underappreciated subplots that could emerge as central narratives to jostle investor assumptions as 2021 unfolds.

Will a booming recovery test the Fed's dovish doctrine?

Fed officials could not be more clear about their determination to keep short-term rates at zero for years and to allow inflation to overshoot above their 2% target for some time to push the economy back toward full employment.

Chair Jerome Powell famously said he's "not even thinking about thinking about" raising rates. In recent remarks to Congress he granted that if things break right there could be "upside risk" to growth for a while next year but it wouldn't change his stance.

We can take him and his colleagues at his word. But consider the makings of a potentially hot-running economy, even for a couple of quarters, and ask whether the markets might insist on testing the Fed's resolve.

Money Report

Even without further fiscal support, consumers collectively are sitting on more than $1 trillion in "excess savings" over and above pre-Covid levels. The housing market is piping hot. S&P 500 companies have a record $2 trillion in cash and those with debt have refinanced at rock-bottom rates and extended maturities to record length.

A lot of this cash could spill into the economy in a hurry if normalcy returns and animal spirits percolate.

Already, market-implied inflation expectations are back to pre-Covid levels near 1.9%, so a hot streak for growth could nudge them toward levels where some market participants will begin to see a "mission accomplished" moment nearing for the Fed.

It would be a great "problem" to encounter for the real economy. But chances are, a market-induced tightening scare would be unfriendly to equity valuations in the short-term.

Will the release of pent-up demand help Main Street more than Wall Street?

That $1 trillion or so in extra cash in consumer bank accounts from unspent stimulus checks and untaken vacations since March are the potential energy for a spending revival fully anticipated by investors.

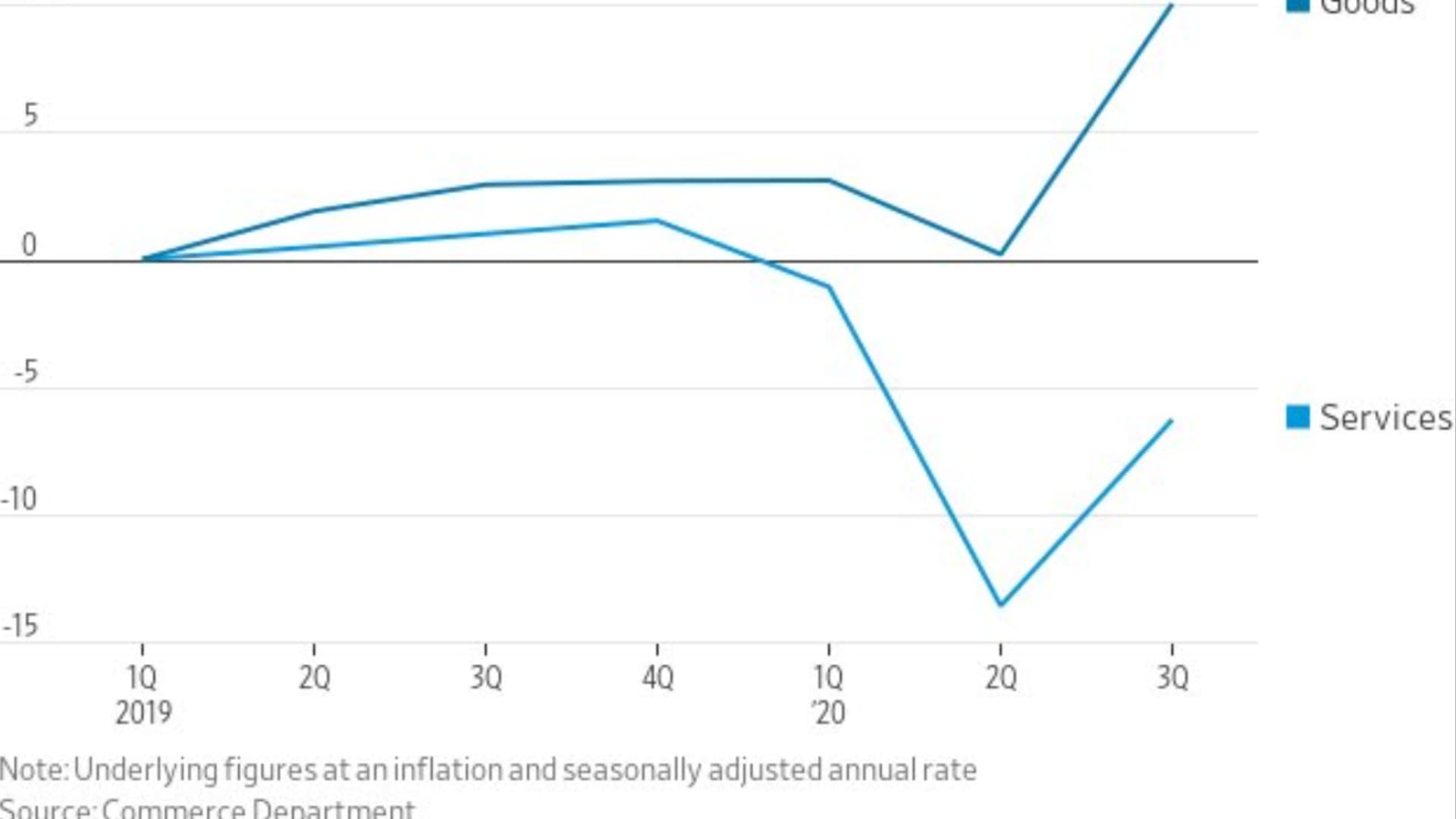

Yet during the pandemic, there has been a spending binge on "stuff" – cars, appliances, sporting goods, dog toys. It's only the services economy – restaurants, gyms, hotels, casinos, elective medical procedures – that remains underwater, as the official goods- and services-sector consumption trends show.

Yet because the forgone activities under Covid skew more toward local businesses, the public equity markets probably capture a good deal more of the goods-producing economy than the services economy.

Sure, the hardest-hit publicly traded travel companies are in position to reap a likely surge in demand for getting away. Yet even here, the market has accounted for a good deal of this.

Airlines and cruise lines have had to issue so much more equity and debt, and lock in much higher interest costs, to the point their total enterprise value is not nearly as far off pre-Covid highs as the raw share prices make it seem. Wolfe Research on Friday downgraded some airline stocks, in part because of this dynamic.

No doubt a freer consumer will boost the overall economy and support corporate profitability generally. Yet expect a lot of push-and-pull between those companies that over-earned in 2020 and face harder comparisons, while a lot of the rejuvenated spending goes to help Main Street, which so badly needs it.

Might we be on the verge of '90s-style investor excitement?

This would be a stark "upside risk," though not the sort Jay Powell meant.

Most every gauge of investor sentiment and risk appetite is on the very high end of a multi-year range, many of them dating back to January 2018, when a ferocious 14-month breakaway rally peaked and led to a year of treacherous chop.

Retail and professional investor surveys, record four-week stock-fund inflows and, most starkly, unheard-of volumes in single-stock call options - low-dollar-cost upside bets with high payoff potential but high chance of expiring worthless.

On top of this, the S&P 500 is as far above its 200-day moving average as it was on Sept, 2, when the market peaked ahead of a brief but sharp 10% gut check.

None of this precludes further gains – a market that stays overbought is often a sign of a powerful, persistent uptrend. We saw this in both 2013 and 2017 (though each started from milder levels of optimism and speculative fever). And such excesses can always be relieved by a period of flat churning or mild pullbacks too.

Still, this stretched sentiment backdrop lowers the threshold for the magnitude of surprise that could prompt a shakeout.

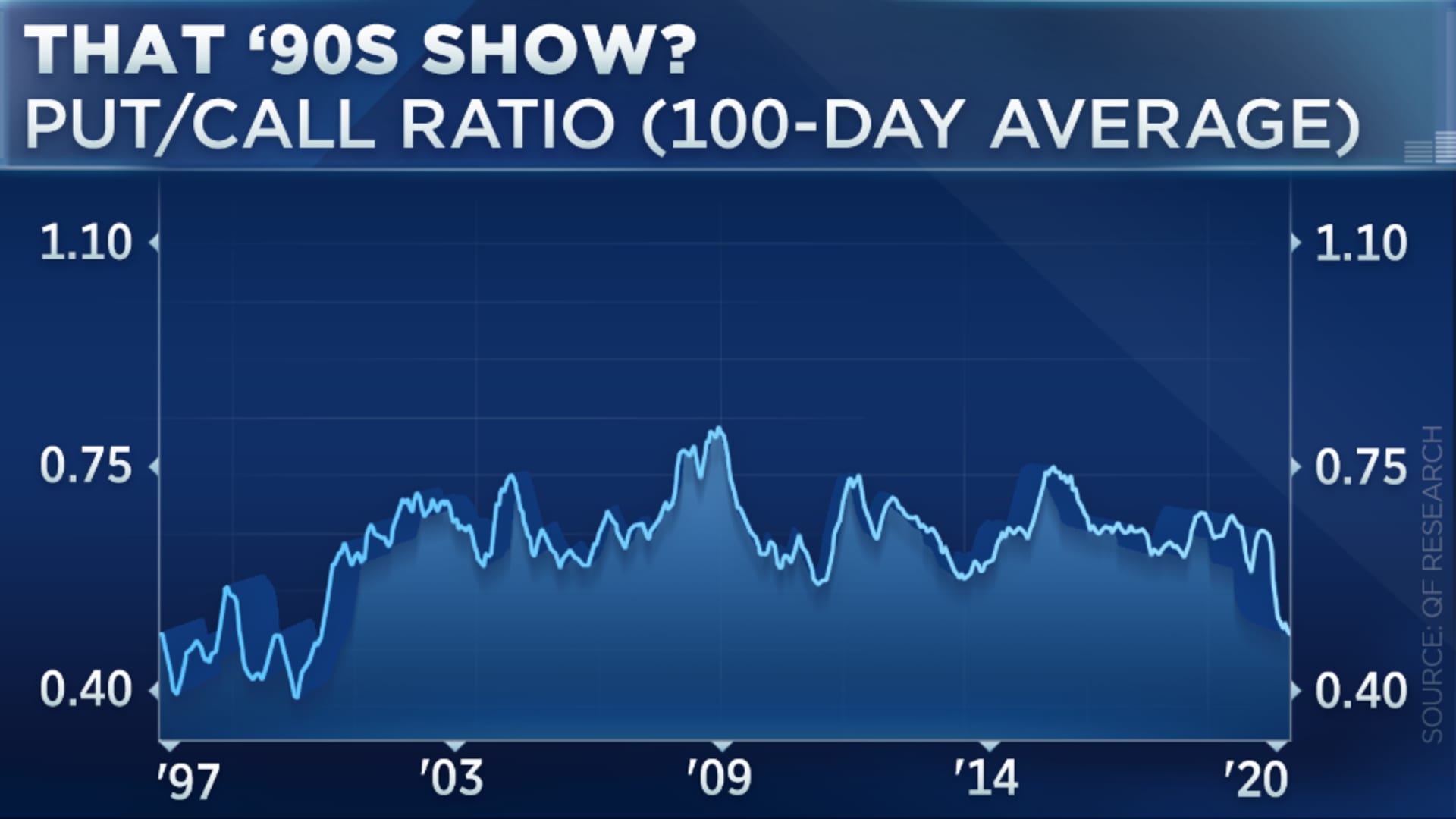

That said, what if 21st century rules no longer apply? The current action appears extreme only on the scale that has applied over the past 20 years or so. In the second half of the 1990s, public fervor for stocks stayed intense for years and the returns were excellent until the peak in 2000 – after which the market was cut in half over two-and-a-half years.

The ratio of puts to call options is now alarmingly low and suggests index vulnerability – unless it's about to crack below the longstanding floor into the late-'90s range.

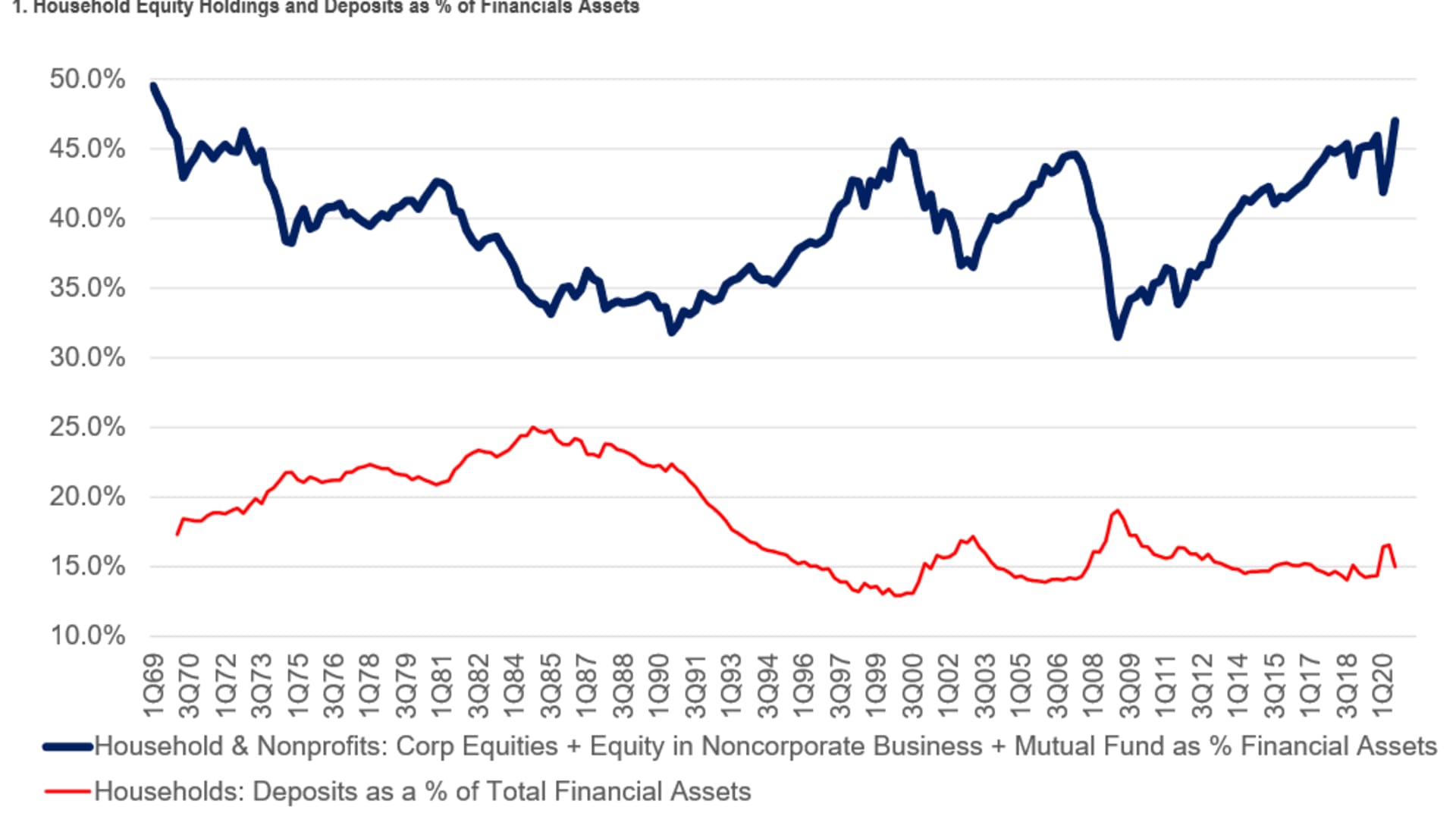

Equity valuations are also at levels exceeded only by the '90s boom years. And household exposure to equities already matches that of those heady days two decades ago, notes Citi.

This is not a prediction of a replay of the single most generous and reckless market in modern times. But if 2021 saw an echo of those days, it would make quite a story.