- New $1,400 stimulus checks are helping Americans keep up with bills and other necessities, as well as pay down debt.

- Recipients said they expect the funds to provide them a financial boost for less than three months, and in some cases not at all.

- One year into the coronavirus pandemic, the results could point to shifting attitudes toward money.

As new $1,400 Covid stimulus checks roll in, Americans are using them to pay monthly bills, regardless of their incomes, a new survey finds.

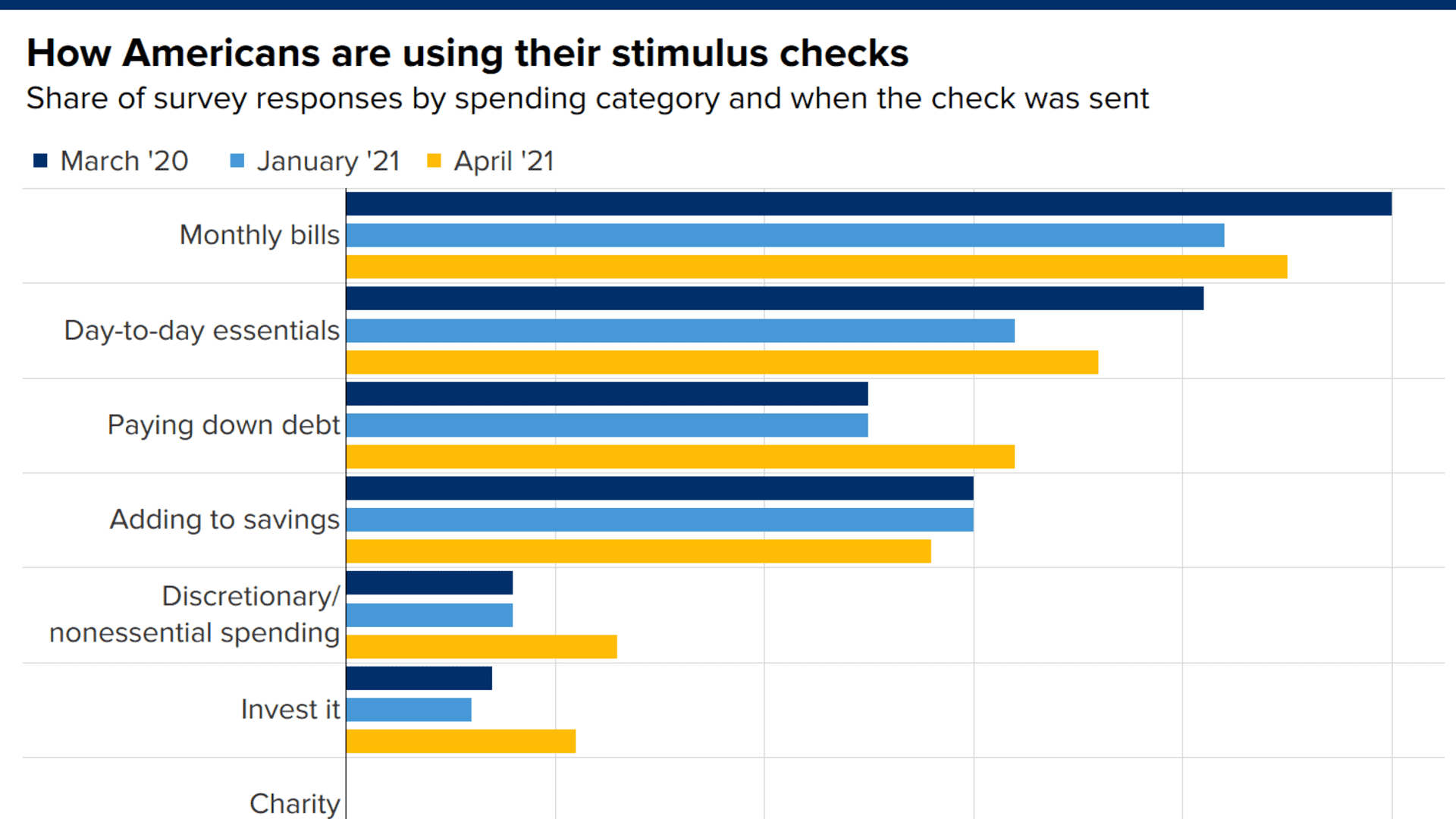

Bankrate.com found that 45% of Americans plan to use the latest round of checks for monthly expenses, followed by 36% who plan to use the money for day-to-day essentials, 32% who want to pay down debt and 28% who intend to add to their savings. (Respondents were allowed to choose more than one use.)

Notably, just 13% of survey respondents said they will put the $1,400 payments toward discretionary activities or nonessential items.

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

The payments of up to $1,400 per person, plus $1,400 per dependent, were approved by Congress in March through the American Rescue Plan Act.

To date, the government has sent more than 156 million payments totaling about $372 billion.

"Just as with the two previous rounds of stimulus, monthly bills and day-to-day essentials are the two most common uses," said Greg McBride, chief financial analyst at Bankrate.com.

Money Report

Bankrate.com's survey also found the cash infusion likely will not last long.

About 61% of respondents said the money may contribute to their financial well-being for less than three months. Meanwhile, 34% said the funds would last less than one month, including 14% who said it would not help them sustain their financial well-being at all.

The online survey was conducted between March 24 and March 26, and included 2,626 adults.

Separate survey data from the U.S. Census Bureau from March 17 to March 29 found that people who had received a stimulus payment in the past seven days mostly used it to pay down debt.

The results could point to changing financial behavior, just as the financial crisis prompted Americans to be more conservative with their money.

"Nothing like a recession really underscores the importance of emergency savings and reducing your debt burdens," McBride said.

That's as another survey from Bankrate.com found that fewer than 4 in 10 Americans have enough savings to cover an unexpected $1,000 expense.

"The first order of business for most households is they need to boost their emergency savings," McBride said.

"If this stimulus payment does that, in the long run the economy will perform better if Americans have more savings and less debt," he said.