Continuing the expanded child tax credit, which is set to expire after 2021, would help millions of American children, including lifting some out of poverty, according to new research.

As many as 65.6 million American children — 90% of all kids in the U.S. — would benefit from an expanded child tax credit, such as the one proposed in President Joe Biden's American Families Plan, a study from the Center on Budget and Policy Priorities has found.

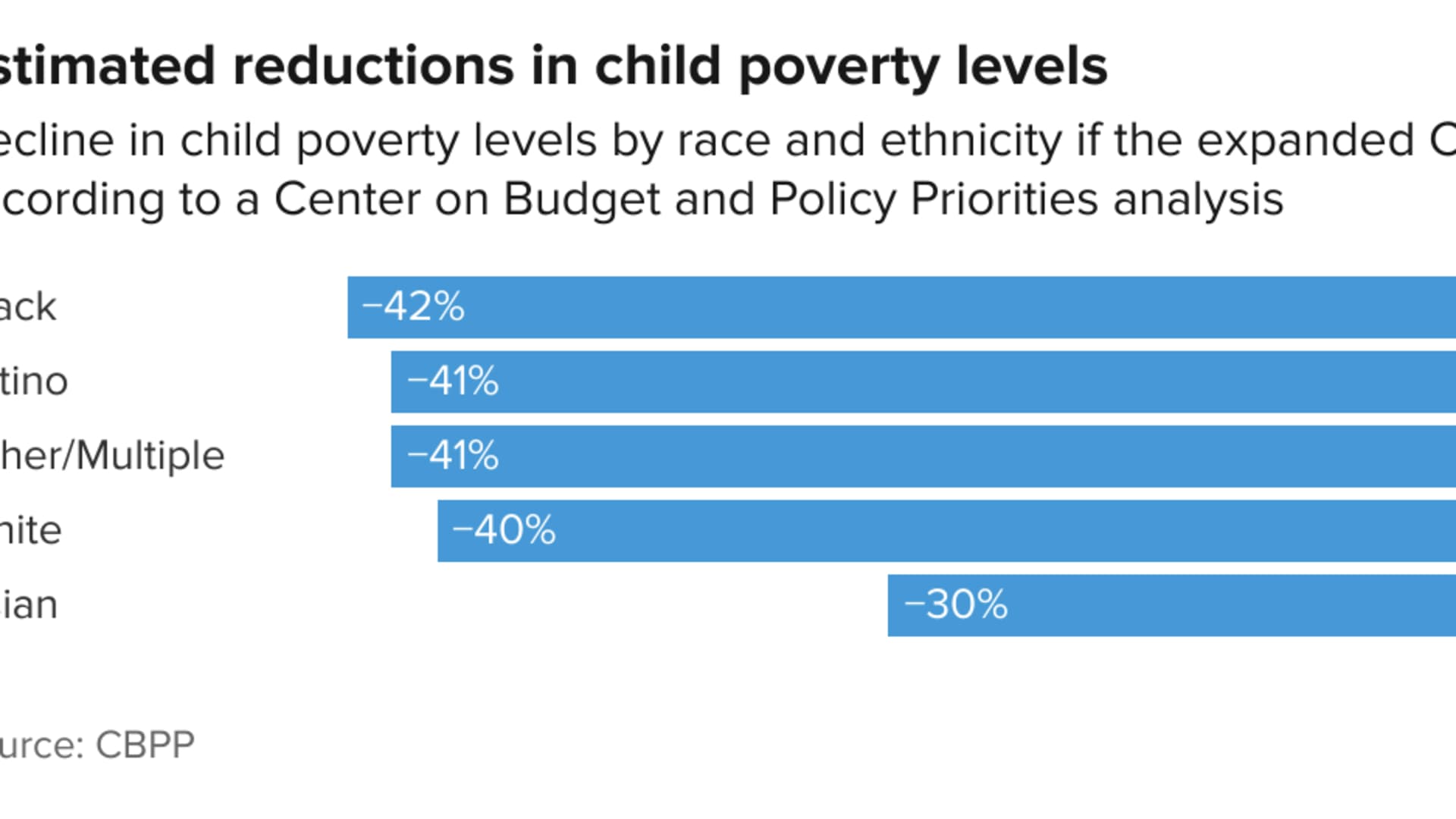

In addition, the changes to the child tax credit proposed by the act would lift 4.1 million children out of poverty, cutting the overall poverty rate by about 40%, the study found.

More from Invest In You:

How to get monthly child tax credit without a permanent address

Lack of workers hurts small business ability to keep up with demand

How this 26-year-old TikTok creator makes over $100,000 per month

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

The child tax credit was enhanced in the American Rescue Plan Act, signed into law by Biden in March. For 2021, the maximum enhanced child tax credit is $3,600 for children younger than age 6 and $3,000 for those 6 to 17. Part of the credit will be given as monthly payments: $300 per child younger than 6 and $250 for those 6 to 17, starting July 15.

Biden's American Families Plan proposes keeping the expanded child tax credit through 2025 and making the regular child tax credit permanently refundable so that families with the lowest incomes can still benefit from the tax break.

"The anti-poverty effects are historic and important," said Kris Cox, deputy director of federal tax policy at the Center on Budget and Policy Priorities and one of the study's authors. The research found that an expanded continued child tax credit will benefit nearly all children in the U.S., she said.

Money Report

Helping children from the lowest-income families

Part of Biden's proposed plan would make the regular child tax credit, which extends $2,000 per eligible child per family each year, permanently refundable.

Before Covid-era changes to the child tax credit, the regular benefit was only partially refundable, meaning that families with the lowest incomes were excluded from getting the full $2,000 when they filed their taxes.

Making the full credit available to all families, even those with low or no income, would help some 27 million children, according to the study. It would also help many children of color. Of those 27 million who would become eligible for more money, 9.9 million are Latino, 5.7 million are Black and nearly 1 million are Asian, the study estimates, while 8.8 million are white.

"It is especially important to make the credit fully available to children regardless of their parents' income to push back against historical racial inequities," said Cox.

Calls for a permanent expanded credit

Though the American Rescue Plan would significantly reduce child poverty, some are pushing for even more support to families with kids.

One proposal is that the expanded credit — the $3,600 for children under age 6 and $3,000 for those 6 to 17 — also be made permanent, instead of ending in 2025.

A group of Democrats in Congress, including Sens. Michael Bennet of Colorado. Sherrod Brown of Ohio, Cory Booker of New Jersey, and Reps. Rosa DeLauro of Connecticut, Suzan DelBene of Washington and Ritchie Torres of New York are pushing to make the enhanced credit a permanent one.

In addition, Democrat Rep. Richard Neal, chairman of the House Ways and Means Committee, has introduced legislation to make the changes to the credit permanent.

"It would lift more than 4 million children over the poverty line," said Cox. "No one wants to see those gains reversed in 2026."

The continued monthly payments would also represent a major step forward for the U.S., which Cox pointed out is one of the only developed countries that doesn't have a permanent child allowance.

"It really comes down to a question of do we want to invest in children across the country or not," she said. "We know that children in homes with more income do better in school, live healthier lives and earn more as adults.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: How to make money with creative side hustles, from people who earn thousands on sites like Etsy and Twitch via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.