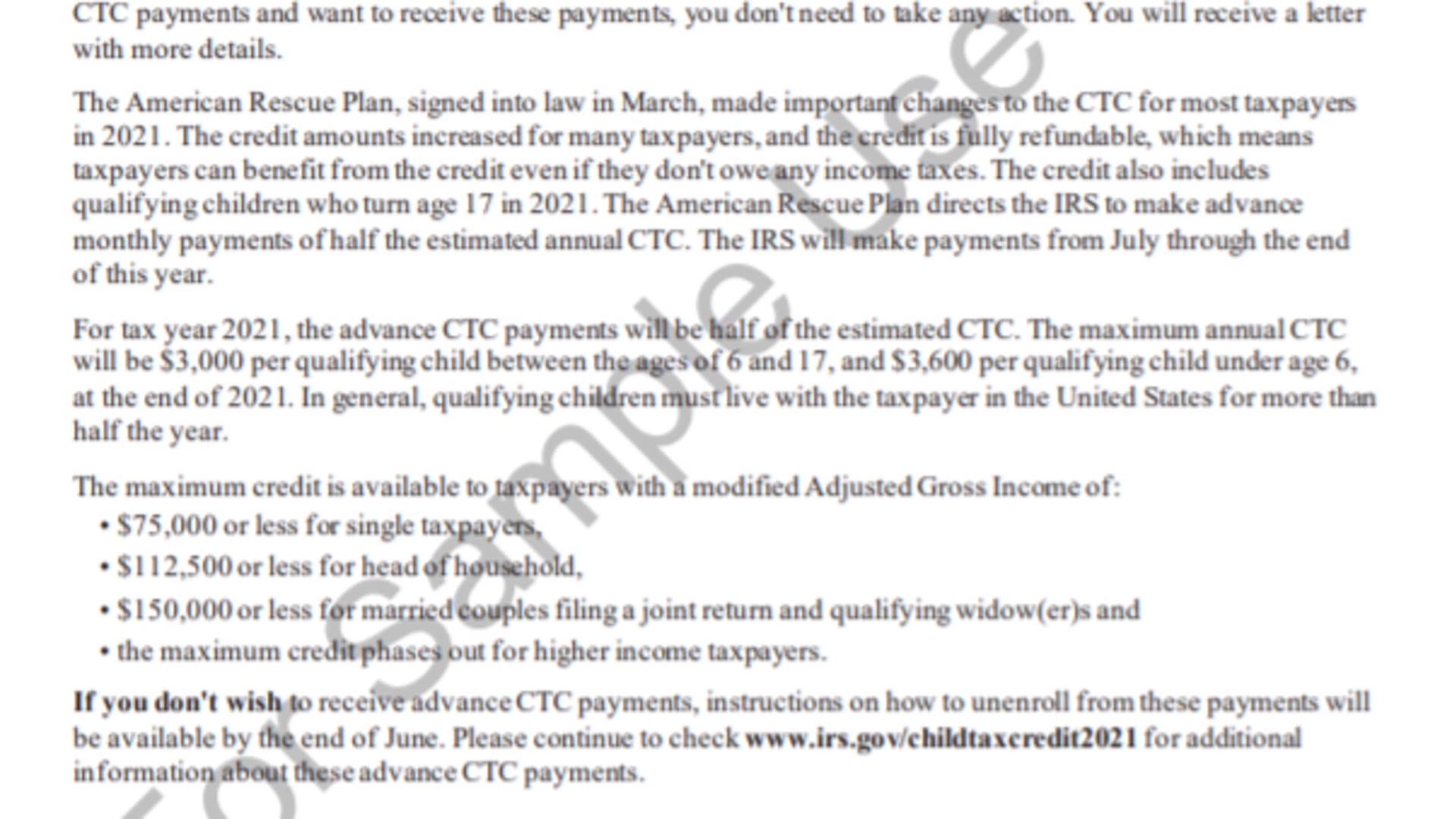

If you recently received two unfamiliar letters from the IRS, they are likely part of the agency's outreach for the expanded and newly refundable child tax credit.

By now, more than 35 million families have received, or will receive in the coming days, the first CTC payment. And earlier this summer, those households also should have received Letters 6416 and 6416-A, which detail each household's eligibility for the credit and estimate the monthly payment amounts for tax year 2021.

This year, the CTC is worth up to $300 per month for each qualifying child under age 6, and up to $250 per month for each qualifying child ages 6 to 17. Families will receive payments amounting to half of the credit paid out monthly from July 2021 to December 2021, and the rest next year when they file their taxes. The temporary increase and advanced refund is part of the American Rescue Plan, passed in March.

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

The payments will be based on the parent's most recent tax return (2020, for most people), and the payments are automatic.

Other updates to watch for

The IRS has been rolling out information about and tools for the enhanced CTC over the past few months.

Money Report

One tool is an online portal that low-income households can use to ensure that the IRS has their up-to-date banking information. Right now, that portal works best on a desktop, rather than mobile.

Additionally, those who do not want to receive advance credits can opt out using the Child Tax Credit Update Portal. Taxpayers can also update their personal information, such as their income or number of children, via the portal.

Finally, the IRS will send Letter 6419 in January 2022 detailing the total amount of advance CTC payments that were sent to each household during 2021. It's encouraging recipients to hold on to that letter in case they need it when they file their 2021 taxes next year.

Sign up now: Get smarter about your money and career with our weekly newsletter

Don't miss: Why some divorced parents may want to opt out of the advance child tax credit