The major averages fell on Monday as investors grappled with the resurgence of Covid cases spurred from the newfound omicron variant.

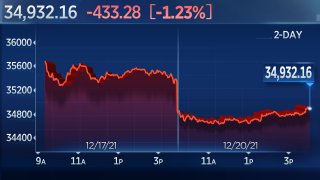

The Dow Jones Industrial Average dropped 433.28 points to 34,932.16, dragged down by losses in Boeing, Goldman Sachs and American Express. The S&P 500 dipped 1.1% to 4,568.02 and the technology-focused Nasdaq Composite declined 1.2% to 14,980.94. The small-cap benchmark Russell 2000 lost nearly 1.6%.

The S&P 500 fell 3.01% over the past three days, as of Dec. 20, making it the worst decline over a three-day span since September. The Nasdaq Composite has also tumbled 3.76% over the past three days, marking the worst three-day stretch since May.

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

The omicron variant is raging across to the world as the winter holiday season approaches. U.S. cases are jumping into year-end with more than 156,000 reported on Friday, according to data from the Centers for Disease Control and Prevention.

The strain has been found through testing in 43 out of 50 U.S. states and around 90 countries, and the number of cases is doubling in 1.5 to 3 days in areas with community transmission, according to the World Health Organization.

Caterpillar, Boeing and General Electric all lost ground on Monday. The aircraft maker was off by about 2.2%. Caterpillar and General Electric fell 2.9% and 1.5%, respectively.

Money Report

Reopening plays were among the biggest losers once again on Monday. Las Vegas Sands shed 3.6%. Alaska Air Group and Southwest fell nearly 1.4% and 0.7%, respectively. Darden Restaurants also lost close to 1.3%.

Energy stocks also dipped as U.S. oil prices fell. Devon Energy slid 2.4% and Exxon Mobil shed about 1.5%.

Financials were in the red with Goldman Sachs down 2.6% and Wells Fargo down nearly 2.3%. JPMorgan and Bank of America also dropped 1.8% and 1.6%, respectively.

The downward move in markets "reflecting growing uncertainty surrounding whether the omicron surge will bring new widespread economic shutdowns, an unexpected shelving of additional fiscal stimulus from President Biden's Build Back Better plan, and a breach by the S&P 500 index of its 50-day moving average," said Jim Paulsen, chief investment strategist at the Leuthold Group.

While some tech stocks suffered, streaming giant Netflix bucked the broader market's trend, adding nearly 1.2% on Monday.

On the political front, Sen. Joe Manchin, a conservative Democrat from West Virginia, said Sunday he won't support the Biden administration's "Build Back Better" plan. Manchin's decision will likely kill the $1.75 trillion social spending and climate policy bill as it stands now.

Goldman Sachs cut its GDP forecast on the Manchin news, trimming its first quarter 2022 forecast to 2% from 3%. The firm also lowered its second-quarter and third-quarter growth forecasts.

"In light of Manchin's comments, the odds have clearly declined and we will remove the assumption from our forecast," Goldman's economist Jan Hatzius wrote. "With headline CPI reaching as high as 7% in the next few months in our forecast before it begins to fall, the inflation concerns that Sen. Manchin and others have already expressed are likely to persist, making passage more difficult."

The major averages are coming off a negative week, with the S&P 500 declining 1.9%. The tech-heavy Nasdaq Composite dropped nearly 3% last week as investors dumped high-flying growth stocks on the prospect of higher interest rates, while the Dow slipped about 1.7%.

Last week's declines came as the Federal Reserve announced a more aggressive plan to wind down its asset purchases, and said that it will potentially raise interest rates three times next year.

Some investors are hoping for a Santa Claus rally into the year-end, which calls for positive market performance in the last five trading days of the year and first two trading days of January, according to Stock Trader's Almanac.

"On the one hand, corners of the market are oversold," Adam Crisafulli, founder of Vital Knowledge, said in a note. However, "the aggressive 'buy the dip' mentality, which proved so profitable for the last 1.5+ years, especially in the high-multiple corners of the market, was underwritten by a tidal wave of stimulus that is now receding."