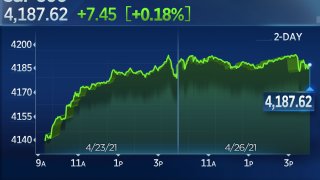

The S&P 500 rose slightly to a new record high on Monday as investors geared up for one of the busiest weeks of the first-quarter earnings season.

The broad equity benchmark inched 0.2% higher to a closing record of 4,187.62. The Nasdaq Composite climbed 0.9% to 14,138.78, hitting its first fresh record close since Feb. 12. The Dow Jones Industrial Average lost 61.92 points, or 0.2%, to 33,981.57, however, dragged down by Procter & Gamble, Walmart and Coca Cola. The consumer staples sector was the biggest loser Monday, falling more than 1%.

The decline in consumer companies came amid surging commodity prices, which fueled fears of inflation. Corn futures hit their highest level in more than seven years in volatile trading, while copper climbed to its highest level in nearly a decade. Commodities are a big portion of costs for consumer staples.

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

Bank of America data showed the number of "inflation" mentions during earnings calls this reporting season has tripled compared to last year, the biggest jump since 2004 when the bank started tracking the number.

With the global economy gradually reopening, firms like Boeing, Ford and Caterpillar are expected to note cost pressures they are facing from rising materials and transportation prices when they report earnings this week.

"Inflation is arguably the biggest topic during this earnings season," Savita Subramanian, head of U.S. equity and quantitative strategy at Bank of America, said in a note. "Raw materials, transportation, labor, etc. were cited as major drivers of inflation and many plan to (or already did) raise prices to pass through higher costs."

Money Report

Tesla shares climbed more than 1% ahead of the electric carmaker's earnings report after the bell Monday.

About a third of the S&P 500 this week is set to update investors on how their businesses fared during the three months ended March 31. Some of the largest tech companies in the world are scheduled to report results this week, including Apple, Microsoft, Amazon and Alphabet.

Corporations have for the most part managed to beat Wall Street's forecasts thus far into earnings season. With 25% of the companies in the S&P 500 reporting first-quarter results, 84% have reported a positive per-share earnings surprise and 77% have topped revenue estimates.

"Growth is still improving and liquidity is still abundant," Andrew Sheets, chief cross-asset strategist at Morgan Stanley, said in a note. "The bull market remains intact, and I struggle to see the type of calamity that defined the summers of 2010, 2011, 2012 and 2015. But a harder, choppier, more range-bound summer does seem likely."

If 84% is the final percentage, it will tie the mark for the highest percentage of S&P 500 companies reporting a positive EPS surprise since FactSet began tracking this metric in 2008.

Still, strong first-quarter results have been met with a mostly lukewarm reception from investors. Strategists say already-high valuations and near-record-high levels on the S&P 500 and Dow have kept traders' enthusiasm in check. Both indexes are within 1% of their all-time highs.

"Despite the strong earnings reports we've seen thus far, the market is really taking beats in stride amid already high valuations," said Chris Larkin, managing director of trading and investing product at E-Trade.

Data out Monday showed new orders for capital goods rebounded less than expected in March. The Commerce Department said orders for non-defense capital goods excluding aircraft rose 0.9% last month, missing Dow Jones estimates of a 2.2% increase.

Equity markets came under pressure last week after multiple outlets reported that Biden will seek to increase the capital gains tax on wealthy Americans to help pay for the second part of his Build Back Better agenda. The president is expected to detail the $1.8 trillion plan, including spending proposals aimed at worker education and family support, to a joint session of Congress Wednesday evening.

The S&P 500 ended the volatile week down 0.13% and snapped a four-week win streak. The Dow and the Nasdaq fell 0.5% and 0.3% last week, respectively.

The Federal Reserve, which meets on Tuesday and Wednesday, is expected to defend its policy of letting inflation run hot, while assuring markets it sees the pick-up in prices as only temporary. Chairman Jerome Powell will host a press conference Wednesday afternoon to discuss the Federal Open Market Committee's decision.

Become a smarter investor with CNBC Pro.

Get stock picks, analyst calls, exclusive interviews and access to CNBC TV.

Sign up to start a free trial today