The S&P 500 fell Thursday as the benchmark inched closer to a bear market. Investors continued to dump equities on fears Federal Reserve rate hikes to fight rapid inflation would tip the economy into a recession.

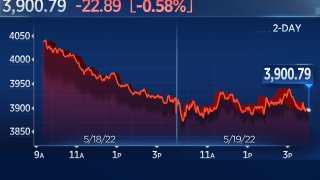

The broad market index fell 0.58% to 3,900.79, after falling 4% on Wednesday. The index is teetering on bear market territory sitting about 19% below its record reached in January.

The Dow Jones Industrial Average dropped 236.94 points, or 0.75%, to 31,253.13 — a day after it too experienced the biggest one-day drop since 2020 in the prior session, losing 1,164 points. The Nasdaq Composite was down 0.26% to 11,388.50 — following a 4.7% decline on Wednesday.

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

"The main takeaway for investors is to brace for extended volatility," said Greg Bassuk, CEO at AXS Investments. "We believe that volatility is going to be the investor narrative for the balance of Q2, and frankly, you know, for the balance of 2022."

The S&P 500 and Nasdaq are both down more than 3% for the week, while the Dow has lost 2.9%. Those losses were driven in part by back-to-back quarterly reports from Target and Walmart that showed higher fuel costs and restrained consumer demand hurting results amid the hottest inflation in decades. Even after a 24% drop on Wednesday, Target shares were lower again Thursday by 5.1%.

"The sharp sell-off in these companies (as well as other goods/consumer companies this quarter) shows that inflationary pressures are finally having an impact on earnings," Maneesh S. Deshpande, head of U.S. equity strategy at Barclays, said in a Thursday note. "Despite heightened inflation for a better part of a year, [S&P 500] margins and forward earnings have remained resilient, which no longer seems to be the case."

Money Report

Cisco was the latest major company to plunge on results with the tech bellwether down 13.7% on Thursday. Cisco said after the bell Wednesday that quarterly revenue fell short of analysts expectations and it warned revenue would disappoint in the current quarter.

On the other hand, a rebound in some tech stocks boosted the S&P 500 and the Nasdaq Composite at various points during Thursday trading. Shares of Synopsys gained 10.3% in Thursday trading after the software company posted an earnings beat. Shares of cloud company Datadog jumped 9.6%.

Nvidia and Amazon also closed into the green Thursday.

Stocks have been under pressure all year with investors first pivoting away from highly-valued tech stocks with little profits. But the sell-off has since spread to more sectors of the economy, including banks and retail, as growing fears of a recession spooked investors.

A number of notable stocks in the S&P 500 hit new 52-week lows on Thursday. Target shares are trading at lows not seen since November 2020. Walmart shares are trading at their lowest point since July 2020. Shares of Bank of America and Charles Schwab dropped to their worst level since February 2021. Intel shares have fallen to lows not seen since October 2017.

"The issue now is there really appears to be nowhere to hide," wrote Jonathan Krinsky, chief market technician with BTIG. On Wednesday, "they came for consumer names, but they still sold beaten down growth. In other words, money is rotating into cash instead of between different sectors."

"While it won't be a straight line, [this] is confirmation that selling rallies in bear markets is much easier than buying dips," Krinsky said.

Several Wall Street strategists issued some dire forecasts for stocks should the Fed's rate increases tip the economy into a recession. GDP in the first quarter decreased at a 1.4% rate so some slowing is already being seen.

Deutsche Bank cut its official target for the S&P 500 overnight, but said a recession would bring even bigger losses.

"In the event we slide into a recession imminently, we see the market selloff going well beyond average, i.e., into the upper half of the historical range and given elevated initial overvaluation, -35% to -40% or S&P 500 3000," wrote Binky Chadha, Deutsche Bank's chief global strategist in a note.

During a Wall Street Journal conference earlier this week, Federal Reserve Chair Jerome Powell reiterated his comments that "there won't be any hesitation" to bring down inflation.

Meanwhile, U.S. weekly jobless claims rose to 218,000 for the week ending May 14, the Labor Department said Thursday, the latest hint that economic growth is slowing.