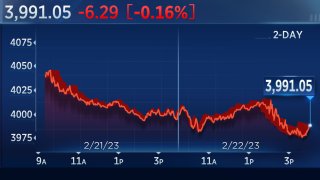

Stocks ended lower on Wednesday as traders parsed through a summary of the Federal Reserve's most recent meeting, looking for clues on the central bank's next move against inflation.

The Dow Jones Industrial Average dropped 84.50 points, or 0.26%, ending at 33,045.09. The S&P 500 fell 0.16% and closed at 3,991.05. Meanwhile, the Nasdaq Composite rose 0.13% to close at 11,507.07.

The Fed's meeting minutes showed inflation remained "well above" the central bank's 2% target, adding that the labor market is still "very tight, contributing to continuing upward pressures on wages and prices."

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

Fed officials also noted that "inflation data received over the past three months showed a welcome reduction in the monthly pace of price increases but stressed that substantially more evidence of progress across a broader range of prices would be required to be confident that inflation was on a sustained downward path," the minutes said.

The minutes were released after St. Louis Fed President James Bullard cautioned earlier Wednesday that the central bank's fight against inflation is far from over.

Mounting concerns that the Fed will continue hiking rates spooked investors Tuesday and pushed stocks to their worst day of 2023.

Money Report

LPL Financial's chief global strategist Quincy Krosby said that the release of the meeting minutes did not change the market's trajectory, as investors remain steadfast in their belief that the Fed will not continue much further with its rate hikes.

"This is not a market that thinks that the Fed is going to have to continue beyond June with rate hikes," Krosby said. "It's a market that has been concerned about earnings about margins, margins pressure, and margin compression."

Shares of Palo Alto Networks popped 12.5% after the cybersecurity company lifted its earnings forecast{

Palo Alto Networks pops on guidance lift

Palo Alto Networks' stock jumped more than 7% in extended trading after the cybersecurity provider beat Wall Street's estimates for the recent quarter and management lifted third-quarter fiscal earnings guidance.

For the recent quarter, the software maker posted adjusted earnings of $1.05 per share on $1.66 billion in revenue. Analysts expected EPS of 78 cents on $1.65 billion, according to Refinitiv. Revenues also grew 26% year over year.

Management said its expects adjusted earnings for the 2023 fiscal year to range between $3.97 and $4.03 a share. That's up from the $3.37 to $3.44 EPS guidance from November.

— Samantha Subin, Jordan Novet

CoinbaseLea la cobertura del mercado de hoy en español aquí.

Headwinds should persist even with worst of inflation in the "rear view," says Morgan Stanley's Loewengart

Minutes from the Federal Reserve's latest meeting seem to confirm that while inflation is easing, it's too early to expect a pivot just yet, said Mike Loewengart, head of model portfolio construction at Morgan Stanley Global Investment Office.

"The worst of inflation may be in the rear view, but it remains well-above the Fed's target," he wrote. "Bottom line is that many market headwinds aren't going away and investors should expect volatility to stay as they parse over the impact rates being higher for longer will have."

— Samantha Subin

Intel slashes dividend

Shares of Intel retreated more than 2% on Wednesday after the struggling chipmaker slashed its dividend.

Intel announced on Wednesday morning that its quarterly dividend would be reduced to $0.125 per share from $0.365, a decrease of more than 60%.

"The decision to decrease the quarterly dividend reflects the board's deliberate approach to capital allocation and is designed to best position the company to create long-term value. The improved financial flexibility will support the critical investments needed to execute Intel's transformation during this period of macroeconomic uncertainty," Intel said in a press release.

The divided follows an earnings miss for the fourth quarter reported last month.

— Jesse Pound

This year's stock market rally is borrowing from the future, GMO says

Every month, the firm co-founded by noted value investor Jeremy Grantham assembles its best guess as to future returns from various asset classes over the next seven years.

The latest outlook shows that this year's early stock market rebound has already diminished future returns. Think of it as front-loading returns — or borrowing from the future.

Emerging market value stocks are still forecast to give the best return looking out to 2030, at 8.2% a year after inflation, according to the latest quarterly projection (as of 1/31/23) from Grantham Mayo Van Otterloo & Co. But that's down a hefty 1.6 points from 9.8% per annum in the last notice (and 9% annually the month before that).

Emerging market stocks as a whole are forecast to return 4.8% annually, down from 5.6% annually seen in the December estimate and 5.2% in November, the Boston-based money manager said.

International small-cap stocks are now projected to return a real 4.2% per year, down from 5.2% and 4.5% the prior two months, while international large-cap stocks come in at 2.2% a year, down from 3.2% a year in the prior month's projection.

U.S. small caps will lag, shrinking 1.7% a year (instead of losing 0.4% annually which was seen last time), and U.S. large caps are now estimated to fall an average 1.6% annually over the next seven years (instead of the previous -0.7%).

The best returns in fixed income are still expected to come in emerging market debt, but that's narrowed too, to 3.4% annually, after inflation, from the prior forecast of 4.1%, followed by U.S. cash at +1.1% (down from +1.2%), U.S. inflation-linked bonds at +0.4% (+0.9%) and U.S. bonds at +0.1% (vs +0.6% previously). International bonds hedged against currency exposure are now forecast to lose 1.0% year — worse than the 0.6% annual loss seen last time.

GMO ran about $72 billion in assets under management as of early 2022, according to auf13f.com.

— Scott Schnipper

Baird's names its top A.I. picks

Microsoft isn't the only technology stock positioned to benefit from artificial intelligence trends overtaking the investing community.

Baird named some of its top picks to play the buzzing technology frenzy, including Apple, Palo Alto Networks and several major software names.

"These picks are not directly related to the hype surrounding generative AI and LLMs, but contain a variety of growth, margin, and market cap profiles," wrote analyst Colin Sebastian.

Check out some of Baird's top picks here.

— Samantha Subin

Piper Sandler says obsession with office building loans are overblown

Even as companies like Amazon and Disney push employees to return to the office more regularly, investors are still concerned that today's office building loan portfolios are a disaster waiting to happen. Piper Sandler's Mark Fitzgibbons has responded to these fears by taking a closer look at the banks he covers to see if there are risks he could uncover. The result was encouraging.

"In short, we came away feeling quite a bit better about the risk embedded in these loans," he said, citing very few defaults to date and "generally solid" underwriting.

"The average [loan-to-value] ratio at origination ranged from 48% to 62%, which optically looks reasonable to us and provides a fair bit of wiggle room if property values decline," he wrote. Debt service ratios ranged from 1.29x to 2.10x, he said, which suggests building owners have strong cash flow to support their loan payments.

Fitzgibbons said his top three picks to withstand the challenges ahead are overweight-rated Brookline Bancorp, Eastern Bankshares and New York Community Bancorp.

—Christina Cheddar Berk

Fed minutes show members are still committed to fight against inflation

The minutes showed inflation remained "well above" the Fed's 2% target, adding that the labor market is still "very tight, contributing to continuing upward pressures on wages and prices."

Fed officials also noted that "inflation data received over the past three months showed a welcome reduction in the monthly pace of price increases but stressed that substantially more evidence of progress across a broader range of prices would be required to be confident that inflation was on a sustained downward path," the minutes said.

— Jeff Cox

Bank of America strategist says to buy the “capital-deprived industries,” or cyclicals

The last decade's losers might be coming out on top, according to Savita Subramanian, head of U.S. equity and quantitative strategy at Bank of America Securities.

"The old economy (Energy, Materials, Housing, etc.) has been starved of capital for 10+ years, whereas Tech has enjoyed free money," Subramanian wrote in a Wednesday note. "With the end of [zero interest-rate policy] ZIRP, we see the pendulum swinging back to the old economy as prolonged underinvestment has led to supply issues in the old economy."

These "old economy" sectors are trading at a near-record discount to the S&P 500 based on their equity risk premium, Subramanian wrote. The bank recently went overweight on materials and remains overweight on energy, the note said.

Subramanian said that strong economic data has delayed the timing of a recession and increased the chance of reflation and further interest rate hikes, suggesting cyclicals will be the likely winners of this cycle. The strategist added that bear markets have also historically resulted in a leadership change in the market.

"The S&P 500 now trades at 18x fwd P/E, the highest level since March 2022 and 20% above the last decade's average P/E….while the outlook has improved, our bull market signposts remain low at just 40% vs. 80%+ triggered ahead of prior market bottoms," Subramanian wrote.

– Pia Singh

Dick's Sporting Goods shares rise on plans to acquire outdoor retailer from Walmart

Dick's Sporting Goods shares gained 1% amid news that it's buying e-commerce retailer Moosejaw from Walmart.

Shares of Walmart, which purchased Moosejaw for $51 million in February 2017, fell more than 2%.

The deal is expected to close in March.

— Samantha Subin, Gabrielle Fonrouge

Palo Alto Networks and Amazon among stocks making the biggest moves midday

These are some of the stocks moving the most during midday trading:

- Palo Alto Networks — The software company's stock gained more than 11% after its fiscal second-quarter earnings and revenue beat analysts' estimates.

- Amazon — Shares of the e-commerce giant rose 1.7% after the company closed a deal to buy primary care provider One Medical. Amazon agreed to acquire One Medical in July as part of its efforts to deepen its presence in health care.

- CoStar Group — The commercial real estate stock fell more than 3% after the company issued guidance for the current quarter that fell short of analysts' estimates, according to StreetAccount.

— Samantha Subin

AI ETFs don't look 'frothy,' Blackrock's Jay Jacobs says

Artificial intelligence has been a hot topic for investing in 2023, but the companies most involved in the industry may still be trading at something of a discount.

Jay Jacobs, Blackrock's U.S. Head of Thematics and Active Equity ETFs, said in a note on Tuesday the iShares Robotics and Artificial Intelligence Multisector ETF (IRBO) still looks attractively priced relative to the broader market, according to Blackrock.

"Interestingly, valuations for companies in IRBO remain attractive with the ETF sporting a [price to book] of 1.6 vs. 1.8 for ACWI, reflecting a market that isn't frothy," Jacobs said.

That valuation discount comes despite the AI ETF rising 16% already this year.

—Jesse Pound

Investors should expect some payback but stocks can still rally, says Fundstrat’s Tom Lee

The stock market just had one its best Januarys ever — but the second half of February through early March should be a little more tough, based on the seven other years that have so far mirrored this one, according to Tom Lee.

"This year is still going to be a story about how inflation cooling makes the Fed data dependent not data reactive and that means volatility is expected to fall both for yields and equity risk premium, and that's why stocks can rally," the head of research at Fundstrat Global Advisors told CNBC's "Squawk on the Street" Wednesday.

— Tanaya Macheel

Goldman Sachs says hedge funds’ favorite stocks are up 10% in 2023

A group of hedge funds' favorite stocks staged a fierce comeback in the new year with a double-digit return, according to Goldman Sachs.

The Wall Street bank analyzed the holdings of 758 hedge funds with $2.3 trillion of gross equity positions at the start of 2023, based on regulatory filings. It then compiled a basket of the most popular long positions, dubbed Goldman's "Hedge Fund VIP basket," consisting of 50 stocks that most frequently appear among the largest 10 holdings of hedge funds.

CNBC Pro subscribers can read more about the hedge fund darlings here.

— Yun Li

Piper Sandler raises Nvidia's price target, says company is "most likely" to benefit from AI models

Piper Sandler reiterated its overweight rating on Nvidia and raised its price target for the chipmaker to $225 per share. That number indicates an 8.9% upside from Tuesday's close.

"We are bullish going into the January quarter results and April quarter guide for NVDA," analyst Harsh V. Kumar wrote in a note to clients on Wednesday. "NVDA is the one company at this time that is most likely to benefit from AI & transformer models."

Kumar said he believes Nvidia's management will call for a bottom in its data center business during the April quarter, leading the quarter to be flat to slightly down before seeing growth pick up again during the second quarter of 2023. He expects this growth to be led by the company's new product launches, such as the H100 chip and Grace CPU Superchip.

"NVDA is well positioned in the DC business given the need for real-time AI particularly in transformer models which are largely powered by GPUs," the note reads.

Shares of Nvidia are up 0.7% on Wednesday. The stock has gained more than 45% so far this year following a rush of AI-driven interest in the stock.

– Pia Singh

Fed minutes 'highly anticipated' by bond and equity markets

A "parade" of speakers after the Federal Reserve's last meeting have been giving a good indication on the Fed's general views on monetary policy — but LPL Financial's Chief Global Strategist Quincy Krosby believes that today's Fed minutes may still hold some surprises for the markets.

"Today's Federal Reserve release is highly anticipated by bond and equity markets alike, as Treasury yields continue to inch higher, with the 12-month note now offering 5.057% and the 10- year note hovering just below 4.00%, and an equity market that is focused on the Fed's trajectory, as well as the effect of the higher cost of capital on companies, and higher interest rates for consumers," said Krosby.

"Moreover, with two influential, but non-voting members of the Federal Open Market Committee," suggesting that 50 basis points, rather than 25 basis points, would be appropriate to help quell still stubborn inflation, there's concern that this may be more consensus than previously thought," added the strategist.

Krosby notes that many investors still remain hopeful that the Fed will increase interest rates by 25 basis points, rather than 50 basis points.

"With the bond market offering an attractive alternative to equities, the minutes may offer hope that the majority of the FOMC board is comfortable with two more 25 basis point rate hikes for 2023. Any hint that the Fed may revert to 50 basis points could cause another round of equity selling and make Treasury yields more compelling."

— Hakyung Kim

Dillard’s downgraded at JPMorgan

JPMorgan downgraded Dillard's to underweight from neutral, saying there's trouble ahead for the department store chain after its disappointing fourth-quarter results.

"DDS reported 4Q adjusted EPS of $15.14 excluding $1.75 of 1x income tax items (below JPM at $16.35) with both same-store-sales (Flat vs. JPM +1.6%) and gross margin (37.7% vs. JPM at 39.2%) missing our model," analyst Matthew Boss wrote in a note Tuesday.

"Digging deeper, gross profit dollars declined 7.1% YOY or the model's first decline in 7 quarters driven by the combination of a 110bps of sequential same-store-sales 3-year CAGR moderation and a gross margin stacked decline of 320bps relative to 2019," Boss added.

CNBC Pro subscribers can read the full story here.

— Sarah Min

Lithium prices hit lowest levels in five months

Lithium futures prices fell 10% year to date on Wednesday, trading at $76,200 per ton. LME prices hit their lowest levels since Sep. 1, 2022, when lithium traded as low as $76,000 per ton.

Lithium has fallen more than 10% from its record-high of $85,000 per ton on Dec. 1, 2022.

— Hakyung Kim

There's 'nothing thesis-changing' about Coinbase after fourth-quarter beat, some Wall Street firms say

The outlook for Coinbase changed little even after it beat analyst expectations in the latest quarter, some Wall Street firms say.

While the cryptocurrency exchange topped analyst earnings and revenue estimates in its fourth-quarter earnings released Tuesday, it also posted user numbers that disappointed the Street.

Bank of America's Jason Kupferberg was underwhelmed by the results, saying that there was "nothing thesis-changing in the print" despite the solid results. He maintained an underperform rating with a $35 price target, which suggests 43% downside from Tuesday's close of $62.07.

CNBC Pro subscribers can read here for more reactions to Coinbase's latest earnings.

— Sarah Min

Stocks lose early gains

The market gave back its gains shortly after the open, with the major averages trading slightly lower. Cisco and Walmart led the way down for the Dow, losing more than 1% each.

— Fred Imbert

UBS downgrades Logitech to neutral

UBS downgraded Logitech to neutral from buy, saying the Swiss-American computer peripherals company is dealing with greater competition, as well as a weaker consumer.

"We did various industry analysis and expert calls and conclude the environment for Logitech is getting incrementally tougher," analyst Joern Iffert said to clients in a Tuesday note.

CNBC Pro subscribers can read more about the downgrade here.

— Sarah Min

Stocks open higher on Wednesday

U.S. stocks opened higher on Wednesday.

The Dow Jones Industrial Average rose by 70 points, or 0.2%. The S&P 500 and Nasdaq Composite increased by 0.3% and 0.5%, respectively.

— Hakyung Kim

The trade down to private label brands is underway

Walmart's earnings Tuesday provided more evidence that consumers are watching their budgets carefully and starting to shift from national brands to store brands. The retailer said the trend accelerated as the quarter progressed, and boosted its profitability.

"We think this will benefit WMT as it can appeal to shoppers up and down the value spectrum," UBS analyst Michael Lasser wrote in a research note Wednesday. UBS has been reporting that its surveys and research are finding evidence that shoppers are under more stress than the market may appreciate.

Lasser also called out that Walmart is gaining a bigger share of spending from higher income households. If this continues, it would be a big boost for Walmart, which has long struggled with this demographic.

"Walmart's unrivaled value should continue to resonate with consumers," he said, adding that he thinks its stock is underpriced. His $168 price target, is about 14% higher than where the stock closed Tuesday.

CNBC Pro recently reported that consumers are expected to accelerate the shift to private label brands, a move that could benefit retailers like Walmart and Costco and manufacturers of private label goods.

—Christina Cheddar Berk

Morgan Stanley says a 'no landing' scenario is unlikely

Don't bet on a "no landing" scenario, says Morgan Stanley's Chief Investment Officer Lisa Shalett.

"Significantly better-than-expected retail sales and a resilient labor market have encouraged equity investors to price a "no landing" scenario, whereby growth remains robust and downwardly-revised earnings estimates are achievable," Shalett wrote in a Wednesday note.

However, Shalett said that the risks of a hard landing are growing as inflation metrics begin to inch upwards — which she believes is not being reflected in the equity market.

"Bond markets have priced the new data," said Shalett. "Equities, on the other hand, continue to shrug off inflation, bonds and Fed guidance—unwinding historical correlations under the guise of 'looking through' the fog."

She added, "While that may simply reflect a "good news is good" narrative, such framing could be upset by realities later this year, suggesting not only a higher neutral rate but lower multiples. With consumption and inflation reheating, risks of a hard landing resembling a boom/bust are growing, even if the pain may be delayed a quarter or two."

— Hakyung Kim

Stocks making the biggest moves premarket: Palo Alto Networks, Toll Brothers and more

Here are the companies making headlines before the bell on Monday:

- Palo Alto Networks — The software company added 9.3% after posting adjusted earnings and revenue for the fiscal second quarter that topped Wall Street expectations. It was the third consecutive quarter of profitability after a decade of losses. Palo Alto Networks' forecast for fiscal third-quarter adjusted earnings also beat expectations.

- Toll Brothers — Shares of the homebuilder rose more than 2% on the back of better-than-expected fiscal first-quarter results. Toll Brothers earned $1.70 per share, beating a Refinitiv consensus estimate of $1.41 per share. Home sales revenue of $1.75 billion also topped expectations of $1.73 billion.

- Keysight Technologies — The electronics company dropped 7.9% after issuing a weaker-than-expected outlook for the fiscal second quarter. Keysight expects earnings per share to be in the range of $1.91 and $1.97 with revenue in the range of $1.37 billion to $1.39 billion, which fall short of FactSet analysts' estimates of $1.94 and $1.4 billion, respectively.

Click here to read more companies making moves before the open.

— Pia Singh

Fed's Bullard says there's a 'good shot' of inflation in 2023

St. Louis Fed President James Bullard said Wednesday he was confident that the central bank can reach its inflation goals this year.

"It has become popular to say, 'Let's slow down and feel our way to where we need to be.' We still haven't gotten to the point where the committee put the so-called terminal rate," he said during a live "Squawk Box" interview. "Get to that level and then feel your way around and see what you need to do. You'll know when you're there when the next move could be up or down."

— Jeff Cox

Citi raises its forecast for global growth in 2023

Global growth in 2023 appears stronger than was anticipated last year, according to Citi.

"We now envision a 'less hard' landing for the global economy," wrote Nathan Sheets, global chief economist of Citi Research. "The growth outlook in China is stronger and less uncertain than we envisioned [it] a few months ago. In tandem, on the back of the warmer-than- usual weather, the euro area is seeing stagnation rather than outright contraction. And the recent US data have shown resilience."

The firm raised its global growth projection to a 2.2% pace, more than 0.25% higher than its projections last year. However, Sheets added that the new growth projection remains in the bottom quartile of performance of the past 40 years.

"Bottom line, in 2021 inflation surged, and many central banks sat idly on the sidelines. In 2022, central banks recognized their mistakes and vigorously tightened policy. It appears that 2023 will be the year when the effects of that hiking cycle more fully play through," said Sheets.

"For now, our baseline forecast calls for a step down in global growth, gradually slowing global inflation, and "rolling" country-level recessions."

— Hakyung Kim

RBC Capital says debt ceiling drama could lead to a 'significant' hit to U.S. equities

While the debt ceiling drama might not be at the top of investors' minds, RBC Capital is worried it may pose a risk to the stock market this summer.

According to the Congressional Budget Office, the Treasury is currently on track to a debt default sometime between July and September unless Congress raises the $31.4 trillion debt limit

"Many investors, including this author, remember all too well the stock market volatility that accompanied the US debt downgrade in 2011," the firm's head of U.S. equity strategy Lori Calvasina wrote in a note on Tuesday.

"Our review of the historical playbook makes us worry that the debt ceiling drama poses a risk to the stock market this summer, though the extent of the impact may depend on what else is going on in financial markets," the strategist added.

Calvasina noted that if current market worries — such as the Federal Reserve' interest rate hikes, recessionary fears, stubbornly high inflation, and geopolitical tensions — don't worsen, any debt-ceiling related drop in U.S. equities would fall under a "modest" range between 5–7%.

But, she warned, "If financial markets are still on edge for other reasons, debt ceiling drama could contribute to a more significant sell-off."

— Hakyung Kim

U.S. experiencing 'rolling recessions,' Wolfe Research says

Wolfe Research's Chris Senyek said the U.S. is "experiencing a series of rolling recessions, including downturns in housing, crypto, several areas within Big Tech, industrial activity and capital spending. However, the biggest question for the U.S. economy is whether consumer spending (~70% of GDP) is going to hold up."

Senyek doesn't expect expect consumer spending to "fall off a cliff," but noted that it "will meaningfully disappoint relative to consensus expectations looking for growth of +1.1% in full-year 2023."

"More specifically, we believe that labor market strength is going to be more than offset by several factors, including negative real income growth, tightening credit standards, and rising delinquencies," he added.

— Fred Imbert, Michael Bloom

Alcoa rise after Citi upgrade

Shares of Alcoa rose 1% in the premarket after the aluminum producer was upgraded by Citi to buy from neutral, citing a potential boost from China's economy reopening.

"Aluminum has relatively light positioning, tends to arrive late to bull market parties, is relatively lightly positioned, and has a myriad of idiosyncratic upside risks," Citi said in a note.

— Sarah Min

Jeep, Dodge maker Stellantis posts record annual profit, announces $4.47 billion shareholder payout

Carmaker Stellantis on Wednesday announced record full-year results, reporting a 26% rise in net profit to 16.8 billion euros ($17.9 billion) and a 41% annual jump in global battery and electric vehicle sales.

The Dutch-headquartered company, formed in 2021 from the merger of Italian-American conglomerate Fiat Chrysler group and France's PSA Group, said net revenues rose 18% to 179.6 billion euros.

Stellantis CEO Carlos Tavares said the results also demonstrated the effectiveness of the company's electrification strategy in Europe, with 288,000 battery and electric vehicle (BEV) sales in 2022 and 23 BEVs now on the market.

"We now have the technology, the products, the raw materials, and the full battery ecosystem to lead that same transformative journey in North America, starting with our first fully electric Ram vehicles from 2023 and Jeep from 2024," Tavares said.

— Elliot Smith

Where the major averages stand after Tuesday's selloff

This is where all the major averages stand for 2023 and February after posting their worst session of the year and worst day since Dec. 15.

Dow Jones Industrial Average:

- Down 0.05% in 2023

- Down 2.81% in February

- 10.35% off record high

- 81.89% off pandemic low

S&P 500:

- Up 4.11% for the year

- Down 1.94% in February

- 17.04% off record high

- 82.37% off pandemic low

Nasdaq Composite:

- Up 9.8% for the year

- Down 0.8% this month

- 29.11% % off record high

- 73.30% off pandemic low

— Samantha Subin, Chris Hayes

Palo Alto Networks pops on guidance lift

Palo Alto Networks' stock jumped more than 7% in extended trading after the cybersecurity provider beat Wall Street's estimates for the recent quarter and management lifted third-quarter fiscal earnings guidance.

For the recent quarter, the software maker posted adjusted earnings of $1.05 per share on $1.66 billion in revenue. Analysts expected EPS of 78 cents on $1.65 billion, according to Refinitiv. Revenues also grew 26% year over year.

Management said its expects adjusted earnings for the 2023 fiscal year to range between $3.97 and $4.03 a share. That's up from the $3.37 to $3.44 EPS guidance from November.

— Samantha Subin, Jordan Novet

Toll Brothers, Coinbase among stocks moving after hours

These are some of the stocks moving in extended trading:

Coinbase — Shares of the crypto trading platform were last down more than 1%. The company beat analysts' expectations on the top and bottom lines, according to Refinitiv.

Toll Brothers — The homebuilding stock added 3% on a better-than-expected earnings report. The company also said it has seen a rise in demand since the start of 2023.

CoStar Group — The commercial real estate stock plummeted more than 16% after sharing guidance for the current quarter that fell short of estimates, according to StreetAccount.

Read the full list of stocks moving after the bell here.

— Samantha Subin

JPMorgan chief strategist sees another 5% drop in equity market

The equity market might see a 5% drop in the near-term, while high-beta tech stocks could move between 5% and 10% lower, JPMorgan's Marko Kolanovic told CNBC's "Closing Bell: Overtime" on Tuesday.

The chief global market strategist holds a 4,200 price target on the S&P 500 for 2023. This, he said, leaves room for a potential near-term selloff, followed by potential lows, before the Fed begins — or signal — cutting rates.

"We really think the Fed will need to cut the rates for the market to rally on a sustainable basis," Kolanovic said.

The broader index slid 2% on Tuesday to close 3,997.34 and complete its worst day since Dec. 15, when it fell 2.5%.

– Pia Singh

Stock futures open slightly higher

Stock futures opened slight higher on Tuesday evening.

Futures tied to the Dow Jones Industrial Average gained 30 points, or 0.09%. Meanwhile, futures linked to the S&P 500 added 0.07%, and Nasdaq 100 futures rose 0.11%.

— Samantha Subin