The S&P 500 finished lower{

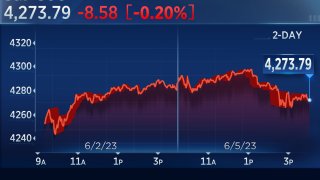

S&P finishes lower, Dow loses nearly 200 points

Stocks finished lower on Monday.

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

The S&P lost 0.2% to finish at 4,273.79, while the Nasdaq Composite dipped 0.09% to close at 13,229.43. The Dow Jones Industrial Average dropped 199.90 points, or 0.59%, to end at 33,562.86.

— Samantha Subin

The S&P lost 0.2% to finish at 4,273.79, while the Nasdaq Composite dipped 0.09% to close at 13,229.43. The Dow Jones Industrial Average dropped 199.90 points, or 0.59%, to end at 33,562.86.

Money Report

Apple lost about 0.8%, retreating from all-time highs{

Apple shares hit all-time high

Apple shares rose on Monday to trade near a record high ahead of the iPhone maker's annual Worldwide Developers Conference where its expected to reveal a highly anticipated mixed-reality headset.

The stock jumped 1.5% to last trade at $183.62 a share.

— Samantha Subin

unveiled its highly anticipated virtual reality headsetIntel shed 4.6% as Apple revealed a new chip{

Intel falls after Apple announces that new Mac Pro will use homemade computer chip

Shares of Intel were down more than 3% in afternoon trading following an announcement from Apple that an upcoming Mac Pro computer will include a new chip made in-house.

Intel chips were previously used in the Mac Pro. The announcement means that all of Apple's computers will use Apple chips going forward. Apple introduced its first chip in 2020.

— Jesse Pound

Nvidia valuation concerns JPMorgan Chase Goldman SachsRegulators reportedly planning big increase to capital requirements at big banks

U.S. regulators are reportedly planning to lift capital requirements for big banks in the the wake of a slew of bank collapses earlier in the year, the Wall Street Journal reported, citing people familiar with the matter.

Regulators will likely propose a plan as soon as this month that will lift overall capital requirements on average by about 20%, according to the report. Potentially larger requirements could come to banks reliant on investment banking or wealth management fees.

— Samantha Subin

Markets are "catching their breath after Friday's broad-based rally," said Ryan Detrick, chief market strategist at the Carson Group. "It's a very lackluster news day, which isn't a bad thing as we consolidate some of those big recent gains we've had."

Stocks rallied last week as Friday's May jobs report signaled to some investors that the long-anticipated recession may no longer be in the cards for the economy — or at least pushed off until 2024. The passage of the debt ceiling bill also boosted investor sentiment.

"What the market is doing ... I think is appropriate, but there are things that we don't know yet and the big issue is the Fed," Mohamed El-Erian told CNBC's "Squawk Box" on Monday.

The Allianz chief economic advisor noted that while major debt and banking fears have dissipated, what comes next hinges on the Federal Reserve's target for bringing down inflation. Markets would appear fairly priced if the central bank "acknowledges that 2% is the wrong target," he said.

Despite recent moves, worries persist over 2023's narrow stock market rally, led by just a handful of tech names, and whether there could be an intermediate-term correction if breadth fails to improve.

"We think as long as the economy continues to chug along and doesn't show any signs of recession —which so far it hasn't — the rest of the market can play catch up, and we'll see some of those other sectors close the gap a little bit," said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance.

Lea la cobertura del mercado de hoy en español aquí.

S&P finishes lower, Dow loses nearly 200 points

Stocks finished lower on Monday.

The S&P lost 0.2% to finish at 4,273.79, while the Nasdaq Composite dipped 0.09% to close at 13,229.43. The Dow Jones Industrial Average dropped 199.90 points, or 0.59%, to end at 33,562.86.

— Samantha Subin

S&P 500 now extremely overbought, Bespoke says

It may be time to pare stock exposure after the market's recent rally.

Data compiled by Bespoke Investment Group showed the S&P 500 is now in "extreme overbought" territory, based on where it's trading relative to the its 50-day moving average.

"After Friday's rally, the S&P 500 closed 2.47 standard deviations above its 50-DMA, which was the most 'extreme' overbought reading for the index since July 2021," Bespoke said in an email.

The broader market index has rallied nearly 6% in the past three months partly due to strong tech gains.

— Fred Imbert

Markets continue climbing 'wall of worry' despite some bullish signals, Bank of America says

Despite a handful of bullish market signs, some flashing warnings signals are giving investors reasons to remain cautious, according to Bank of America.

"Many indicators have flashed bullish backdrop signals that support the case for a much higher equity market well into 2024," wrote Stephen Suttmeier in a Monday note to clients. "Bearish sentiment, light positioning and record high cash levels suggest that investors continue to fight the tape."

The technical research strategist noted that the 2023 S&P 500 trend mimics some "wall of worry bullish" turns in previous years, including 2020 and 2012.

"Risk management support moves up to 4200-4166, which needs to hold to have confidence in last week's upside breakout," he wrote.

— Samantha Subin

Cash on sidelines is a key variable for the market, JEPI portfolio manager says

Hamilton Reiner, the portfolio manager of the wildly popular JPMorgan Premium Income ETF (JEPI), said Monday that the trillions of dollars sitting in money market funds could become a source of support for stocks even if the U.S. enters a shallow recession, as he expects.

"I think you're going to start to see investors suffering from 'FOMO,'" Reiner said at a media event at the Nasdaq market site. "Do I think all that stuff's out there still? I do. Do I think that it's a reason to be on the sidelines? I don't. Market timing tends to not work over the medium to long-term."

Reiner also rang the open bell at the Nasdaq on Monday to celebrate the one-year anniversary of JEPQ, a sister fund of JEPI that is focused on Nasdaq 100 stocks. The funds, which combine active stock selection with an income-generating options strategy, have about $30 billion in combined assets after raking in about $20 billion of inflows over the past year.

— Jesse Pound

Big Tech stocks responsible for more than half of S&P 500's 2023 gain

A handful of major technology stocks are responsible for more than half of the benchmark index's gain in 2023, according to Goldman Sachs.

Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta Platforms have returned 53% since the start of the year, while the remaining 493 companies in the benchmark index are responsible for an average return of 0%.

"The market's extremely narrow YTD rally has been a significant headwind to mutual fund performance," wrote David Kostin, the Wall Street firm's chief U.S. equity strategist,

— Samantha Subin

Morgan Stanley's Mike Wilson is still calling for a correction

Morgan Stanley's Mike Wilson is sticking with his bearish call for a tactical correction despite the recent rally driven by technology stocks.

"Hotter but shorter cycles persist — we continue to forecast an earnings recession this year that we don't think is priced," Wilson, the bank's head of U.S. equity strategy, said in a note. "We still expect a tactical correction as the cyclical bear market concludes."

The widely followed strategist stood by his base case for the S&P 500 to finish 2023 at 3,900, about 9% below Friday's close of 4,282.37. Wilson's forecast is well below the average year-end forecast of 4,157 from Wall Street strategists, according to CNBC Pro's market strategist survey, which rounds up the top 15 strategists' predictions.

— Yun Li

Unity pops 14% on Apple partnership news

Shares of Unity jumped more than 14% after Apple said it's collaborating with the software company on its Apple Vision Pro headset as it develops the app ecosystem for the $3,499 device.

— Jordan Novet, Samantha Subin

Oppenheimer adds Costco back to its top pick list

Club retailer Costco is looking more attractive for investors after a series of weak reports from other retailers, according to Oppenheimer.

Analyst Rupesh Parikh added the retailer back to the firm's top pick list after removing Costco last November. Parikh said in a note to clients that stock could benefit from weakness at other retailers.

"Given the pullback in shares since then, the company's better than expected delivery of bottom-line profitability on a sub 4% comp vs. our forecasts, and more muted buyside N-T comp expectations, we see an improved nearer-term outlook for outperformance," Parikh said. "This includes potential money flows amidst challenges at many discretionary retailers lately."

Oppenheimer has a price target on Costco of $575 per share. The stock was trading at about $518 per share.

— Jesse Pound

Sand Hill Global's Vingiello trims Nvdia position

Brenda Vingiello, chief investment officer at Sand Hill Global Advisors, told CNBC's "Halftime Report" she trimmed her position in red-hot chipmaker Nvidia.

"This is a stock where there's a lot of good news baked in," she said. "Our strategy and our style is to remain disciplined and trim along the way. It's a position we established in March 2020. We've trimmed it once since then."

Nvidia is the best-performing S&P 500 stock year to date, surging nearly 170%.

— Fred Imbert

Intel falls after Apple announces that new Mac Pro will use homemade computer chip

Shares of Intel were down more than 3% in afternoon trading following an announcement from Apple that an upcoming Mac Pro computer will include a new chip made in-house.

Intel chips were previously used in the Mac Pro. The announcement means that all of Apple's computers will use Apple chips going forward. Apple introduced its first chip in 2020.

— Jesse Pound

Evercore ISI raises expectation for S&P 500 as A.I. drums up market excitement

With the S&P 500 surpassing the key 4,200-point level, Evercore ISI now expects the broad index to finish 2023 at 4,450 as excitement around artificial intelligence boosts the market.

Julian Emanuel, Evercore ISI senior managing director, raised his target for the S&P 500 to 4,450 from 4,150. His new target implies the broad index could rally 3.9% from where it finished last week. Emanuel's prior target meant the S&P 500 would need to give up about 3.1% through the rest of 2023. (The index has rallied almost 12% so far this year.)

Emanuel is now above the median and average S&P 500 targets on Wall Street after previously being right around them. And he think that target could be reached well before year end.

CNBC Pro subscribers can click here to read more about Emanuel's prediction for the S&P 500 and how to play what he calls the "Momentum Market."

— Alex Harring

Stocks making the biggest midday moves

These are the stocks making the biggest midday moves:

- Palo Alto Networks — The cybersecurity stock jumped more than 4% after S&P Dow Jones Indices announced Friday postmarket that it will replace Dish Network in the S&P 500, effective June 20. Dish Network dipped about 1%.

- 3M — The industrial manufacturer's shares slid 3% after the judge in the company's multi-district litigation over so-called forever chemicals agreed to delay the first trial by three weeks so parties can finalize a settlement of claims with municipal water providers, Bloomberg reported Monday.

- Coinbase – Shares of the crypto exchange and services company tumbled 10% after the Securities and Exchange Commission sued crypto exchange Binance on Monday, alleging that Binance and its cofounder Changpeng Zhao commingled billions of dollars of investor funds with their own and violated securities laws.

— Tanaya Macheel

Coinbase shares drop 10% after SEC sues crypto exchange rival Binance

Shares of Coinbase tumbled about 10.5% on Monday afternoon after the Securities and Exchange Commission filed 13 complaints against Binance, the largest crypto exchange in the world.

The SEC alleged that Binance and its cofounder, Changpeng Zhao, comingled billions of dollars of investor funds with their own and violated securities laws. This follows a similar complaint against Binance from the Commodity Futures Trading Commission earlier this year.

The suit is the latest development in this year's crackdown on the crypto industry by U.S. regulators. Since January, the SEC has charged Kraken, Genesis and Gemini Trust with offering unregistered securities to investors and has warned Coinbase of potential securities charges.

— Tanaya Macheel

TD Cowen initiates Formula One coverage with outperform rating

TD Cowen thinks Liberty Formula One Group Class A can soar thanks to commercial rights to the racing World Championship.

"Formula One has minimal working capital impacts, low capital intensity, and an efficient tax structure in the utilization of its acquired FIA agreement for commercial rights to the World Championship, driving the ability to earn race promotion fees, media rights, and sponsorship fees (carrying annual escalators that can be repriced at the end of ~3-7 year durations)," analyst Stephen Glagola said.

Formula One Class A shares are up 22% from the start of the year.

Read the full analyst call here.

— Brian Evans

Technology stocks outperform

Technology stocks rallied on Monday, lifting the S&P 500 communications services and information technology sectors about 1% and 0.5%, respectively.

The majority of those gains came from technology giants, with Apple and Netflix last up about 2% each. Alphabet added 1.7%, while Oracle rose 1%. Amazon, Microsoft and Meta Platforms also moved slightly higher.

The move in technology names also boosted the Nasdaq Composite a little over 0.5%

— Samantha Subin

Caterpillar retreats after posting best day since March 2020

Caterpillar slid nearly 2% on Monday as investors assessed the share price following its best day in more than three years.

On Friday, the construction manufacturer rallied 8.4%. That's the biggest one-day jump for the stock since March 24, 2020, when the stock advanced 10.3%.

Monday's retreat made it the third worst performer in the 30-stock Dow, which was down a relatively modest 0.2% in the session. Intel and 3M slipped further than Caterpillar with losses of 2.7% each.

Banking stocks JPMorgan and Goldman Sachs also struggled.

— Alex Harring

Apple and Oracle hit all-time highs

Apple and Oracle rose to record highs dating back to their respective IPOs in 1980 and 1986, respectively. Meanwhile, Epam Systems traded a lows not seen since March 2022, and Amcor hit its lowest level since June 2020.

Here's a look at other S&P 500 names that made fresh 52-week highs:

- Alphabet traded at levels not seen since April 2022

- Netflix hit a high not seen since April 2022

- Royal Caribbean reached its highest level since April 2022

- Cintas hit an all-time high going back to its 1983 IPO

- Martin Marietta hit its highest level since January 2022

- Vulcan Materials reached a high not seen since January 2022

— Fred Imbert, Chris Hayes

SEC files 13 charges against Binance alleging billions worth of user funds were comingled

The Securities and Exchange Commission filed 13 charges against crypto exchange Binance and co-founder Changpeng Zhao. In the charges, the SEC alleged that billions of dollars worth of user funds were sent to a European company under Zhao's control.

"Through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law," SEC Chair Gary Gensler said.

— Rohan Goswami, Alex Harring

Oppenheimer marks down cosmetics giant Estee Lauder on unrealistic Street expectations

Oppenheimer downgraded Estee Lauder stock on Monday, noting that Wall Street expectations for the cosmetics company are too high.

"As we look forward, we are harder pressed to see shares outperforming from current levels amidst aggressive Street estimates, a still premium valuation vs. history, and risks of a conservative management guide in August," analyst Rupesh Parikh said.

Estee Lauder stock has pulled back more than 26% this year, falling 2.6% on Monday.

CNBC Pro subscribers can read the full story here.

— Brian Evans

Tech-focused market rally looks rocky from here, Barclays says

Technology stocks have outperformed year to date as investors veer back into the growth trade, with five major stocks fueling the rally higher.

But despite the recent gains, Barclays remains cautious about the path ahead.

"The YTD rally has been narrow and Tech-focused, and we believe its foundations are tenuous," wrote Venu Krishna, head of U.S. equity strategy in a Monday note to clients.

"The easy money has been made, and the pain trade/path of least resistance may no longer be to the upside," he added, noting that technology valuations hover near historical highs as earnings revisions linger in the red.

— Samantha Subin

Utilities, communications services sectors rise

Utilities and communications services stocks were among the best performers during early morning trading, lifting both S&P 500 sectors by 1% and 0.8%, respectively.

Xcel Energy and Dominion Energy gained about 2% each, while Consolidated Edison, Exelon and Edison International added at least 1%.

The communications services sector got a boost from Netflix and Charter Communications, last up about 2% each. Alphabet, Comcast and Verizon gained 1% each, contributing to those gains.

— Samantha Subin

Citi upgrades Ford to buy

Citi upgraded Ford Motor to buy from neutral, citing an improved outlook for U.S. auto sales following a proprietary survey.

"Simply put, our survey suggests that recent U.S. auto demand resilience isn't some fluke but rather a genuine increase in wallet share. This goes heavily against consensus thinking," analyst Itay Michaeli wrote.

Ford shares were up more than 1%.

— Fred Imbert

ISM services reading misses expectations

The services side of the U.S. economy barely expanded in May, according to an report Monday from the Institute for Supply Management.

The ISM services index registered a 50.3 reading, representing the percentage of businesses reporting expansion versus contraction. A reading above 50 represents expansion. Economists surveyed by Dow Jones were looking for 52.3 after April's 51.9.

Order backlogs fell nearly 9 points to 40.9 while new orders also declined, falling to 52.9, a slip of 3.2 points. Employment also dipped into contraction territory with a reading of 49.2, while prices fell 3.4 points to 56.2, a reading that still shows inflationary pressures.

— Jeff Cox

Nasdaq headed for best first half since 1991

The surge in technology stock so far in 2023 has put the Nasdaq on pace for its best first half since 1991.

As of Friday's close, the tech-heavy index is up 26.51% for the year. In 1991, the Nasdaq gained 27.31% in the first half.

The VanEck Semiconductor ETF has gained 44% since the start of the year, putting it on track for its best first half on record since its inception in 2000.

The Nasdaq was last up 26.75%.

— Samantha Subin

Apple shares hit all-time high

Apple shares rose on Monday to trade near a record high ahead of the iPhone maker's annual Worldwide Developers Conference where its expected to reveal a highly anticipated mixed-reality headset.

The stock jumped 1.5% to last trade at $183.62 a share.

— Samantha Subin

Stocks open little changed

The Dow opened about 13 points lower, while the S&P 500 and Nasdaq rose slightly.

— Fred Imbert

Market outlook still looks 'unfavorable' from here, UBS says

Despite the recent rally in equity markets and the aversion of a potential catastrophic debt default, the outlook looks "unfavorable" in the near term, according to UBS.

"The US equity market rally looks vulnerable — both due to its narrowness and elevated valuations," wrote Mark Haefele, the bank's global wealth management chief investment officer said in Monday note to clients, adding that the risk-reward balance looks particularly "unfavorable" in the U.S.

Many recent market developments have fueled some investors to gain hope that a a pause from the Federal Reserve may come later this month.

"The strength of the US labor market, along with stubbornly high inflation, do not yet justify a final end to the Fed's rate hiking cycle," Haefele added.

— Samantha Subin

Spotify cuts 2% of workforce

Spotify said Monday it's laying off 200 employees within its podcast division, or about 2% of its workforce, as the streaming company refocuses on how it manages partnerships with some of its top podcasters.

"This fundamental pivot from a more uniform proposition will allow us to support the creator community better," Spotify vice president Sahar Elhabashi wrote in a memo to employees.

Shares were little changes before the bell.

— Rohan Goswami, Samantha Subin

Dollar General stock isn't as defensive as previously thought, Morgan Stanley says

Morgan Stanley downgraded shares of Dollar General on Sunday and said the discount retailer isn't as defensive due to macroeconomic headwinds.

"While we anticipated some near-term choppiness on macro/low income consumer weakness in Q1, we underestimated the comp shortfall," analyst Simeon Gutman said. "DG's business has not proven as resilient through this current cycle as we expected given its backbone of high consumables mix and its usual status as a trade down beneficiary."

Dollar General stock has slipped nearly 33% from the start of the year. Shares were 1.3% lower in premarket trading.

CNBC Pro subscribers can read the full story here.

— Brian Evans

Apple, Palo Alto Networks among biggest movers before the bell

These are some of the stocks making the biggest moves premarket:

Apple — The tech giant's shares rose about 1% ahead of Apple's Worldwide Developers Conference, which kicks off Monday in Cupertino, California. Apple is widely expected to announce a "Reality Pro" headset that incorporates virtual reality.

Palo Alto Networks — The chip stock jumped 4.5% after S&P Dow Jones Indices announced Friday evening that the cybersecurity company will replace Dish Network in the S&P 500, effective June 20. Dish Network's stock fell 3% in premarket.

Valley National Bancorp — The regional bank climbed more than 5% after JPMorgan upgraded the stock to overweight from neutral. The Wall Street firm said the concern around Valley National's commercial real estate appears "overblown" as Manhattan offices represents less than 1% of its loans.

Read the full list here.

— Yun Li

KeyBanc says Target stock will suffer from a resumption in student loan payments

KeyBanc downgraded Target stock on Sunday and said a resumption in student loan payments will slam margins.

"Given the recent selloff in shares, we believe NT [near-term] downside may be limited, but we see the growing risk of student loan payments as likely pushing out the margin recovery story at least another year, thus pushing us to downgrade," analyst Bradley Thomas said.

Shares of Target have slipped more 19% in the past three months alone. The firm noted sluggish sales growth in its latest quarterly earnings report.

CNBC Pro subscribers can read the full story here.

— Brian Evans

Market rally participation is still light, Wolfe Research says

Wolfe's Rob Ginsberg pointed out that, while tech, consumer discretionary and communication services have done well over the past month, other sectors have not participated in the rally.

"The strength seen out of Cyclicals this past month is almost impossible to write off," wrote the firm's strategist. "As objective disciples of the charts we have to respect it, but just wish industrials, materials, retail and financials were participants in this move."

"8 of the 11 sectors were lower in the past month and over 66% of stocks trade beneath their 50 Day MA. This [is] up from 39% of stocks just a month ago," he added.

— Fred Imbert, Michael Bloom

Regulators reportedly planning big increase to capital requirements at big banks

U.S. regulators are reportedly planning to lift capital requirements for big banks in the the wake of a slew of bank collapses earlier in the year, the Wall Street Journal reported, citing people familiar with the matter.

Regulators will likely propose a plan as soon as this month that will lift overall capital requirements on average by about 20%, according to the report. Potentially larger requirements could come to banks reliant on investment banking or wealth management fees.

— Samantha Subin

U.S. Treasurys rise as investors weigh interest rate outlook

U.S. Treasurys climbed Monday as investors considered what could be next for interest rates and weighed key economic data that could affect the Federal Reserve's next policy moves.

Uncertainty about whether the central bank will pause its rate-hiking campaign when it meets later this month has spread, owing to mixed messages from Fed officials and economic data reflecting resilience in the labor market.

At 4:36 a.m. ET, the yield on the 10-year Treasury was up by over four basis points to 3.737%. The 2-year Treasury yield was trading at 4.5389% after rising by more than three basis points.

— Sophie Kiderlin

European equity markets open higher

European markets opened muted after ending on a high on Friday, as traders digest the U.S. debt ceiling agreement and euro zone inflation data.

The pan-European Stoxx 600 index was up 0.1% as markets opened, with sectors and major bourses a mixture of marginal gains and losses.

Oil and gas stocks led gains with a 1.1% uptick after Saudi Arabia announced voluntary cuts to its output Sunday, starting in July. OPEC+ on Sunday announced it would make no changes to its planned oil production cuts for the rest of the year.

Travel and leisure stocks dipped into negative territory, with a 0.5% downturn, followed by retail, which was down 0.4%.

— Hannah Ward-Glenton

Japan's services sector activity expands at record pace in May

Japan's service sector saw a record rate of expansion in May, according to private surveys by au Jibun bank.

The country's services purchasing managers' index came in at 55.9, surpassing the previous record of 55.4 set last month and extending its streak to six straight months of quickening expansion.

The bank wrote that "anecdotal evidence suggested that the increase in customer demand was sustained as the impacts of the Covid-19 pandemic continued to wane."

It also added that firms' outlook for business activity remained "strongly optimistic," with "particular emphasis placed on the strength of the tourism sector."

— Lim Hui Jie

Hong Kong private sector expansion slows in May as reopening momentum wanes

In May, Hong Kong's private sector expanded at its slowest rate this year, according to a private survey by S&P Global. The city's composite purchasing managers' index fell to 50.6 in May from 52.4 in April.

The PMI index encompasses services and manufacturing, and is seen as a reliable gauge of economic health. A reading above 50 indicates expansion, while a reading below 50 indicates contraction.

S&P Global said the recent boost to growth in Hong Kong, from the full resumption of travel between the city and mainland China, "was beginning to wane."

The survey pointed at signs — such as lower new sales, slower new order growth and higher input cost inflation — putting pressure on firms' margins.

— Lim Hui Jie

China's Caixin services purchasing mangers' index climbs to 57.1 in May

China's private Caixin Services purchasing managers' index (PMI) reached 57.1 in May, inching higher to the second-highest rate since November 2020.

The reading saw a recent peak of 57.8 in March, rebounding from a recent low of 46.7 in November as the economy emerged from China's stringent Covid restrictions.

The upturn coincided with a steeper increase in total new orders and sustained rise in new export business amid reports of stronger market conditions and increased customer turnout, Caixin said in a Monday release.

May's services PMI marked the fifth consecutive month of an expansionary reading above the 50-mark that separates growth and contraction, as services remain a bright spot in China's uneven economic recovery.

"Service providers remained optimistic partly because the market environment improved in the post-Covid era," Wang Zhe, Senior Economist at Caixin Insight Group said.

— Jihye Lee

The Russell 2000 Index of small caps joined Friday's broad market rally

Despite all talk of the "Magnificent 7" tech stocks driving 2023 gains, Friday's market rally was broad.

Beyond tech, the S&P 1500 regional bank index surged 5.5% Friday.

The Russell 2000 Index of small cap stocks rallied 3.6%, both far outperforming the 1.5% gain in the S&P 500. Almost six stocks advanced on the New York Stock Exchange for every one that fell.

The Russell also closed above its 200-day moving average level of 1,812.99 for the first time since March 8. Small caps closed 3.56% higher for their best day since Nov. 10.

— Tanaya Macheel, Scott Schnipper

Stock futures open little changed Sunday night

Stock futures were flat to begin trading on Sunday evening. Dow Jones Industrial Average futures added 13 points, or 0.04%. S&P 500 futures were 0.01% higher. Nasdaq 100 futures were 0.01% lower.

— Tanaya Macheel