- The CARES Act, which went into effect this spring, established a new above-the-line deduction for charitable giving.

- You can write off up to $300 in cash donations on your 2020 income tax return, which you’ll be filing next spring.

- Normally, you’d have to itemize deductions to write off charitable giving when you file your taxes. About 14.8 million households took a tax break for donating to charity in 2018, according to the IRS.

Giving a few bucks to your favorite charity in time for the holidays? You can finally collect a tax break for it.

The CARES Act, which was signed into law this spring, included a "partial above the line deduction" for charitable contributions.

This allows people who take the standard deduction — which is $12,400 for single filers and $24,800 for married-filing-jointly in 2020 — to claim a deduction of up to $300 in donations.

You'd claim this tax break when you file your 2020 return next spring.

"The only caveat is that the donation must be made directly to charity and it has to be in cash," rather than stocks or other assets, said Mark Alaimo, CPA and member of the American Institute of CPAs' personal financial specialist committee.

Money Report

You can also use a credit card or a check to make your donation.

Claiming charitable donations

Fewer people have been claiming tax breaks for charitable giving since the Tax Cuts and Jobs Act went into effect in 2018.

That's driven by the fact that the tax overhaul also roughly doubled the standard deduction, resulting in fewer taxpayers taking itemized deductions.

In the 2018 tax year, roughly 17.5 million returns claimed itemized deductions — write-offs that include charitable donations, mortgage interest and other breaks, the IRS found.

That's down from 46.9 million returns that itemized deductions during the 2017 tax year.

More from Smart Tax Planning:

Starting a side business? Master these tax tips first

Got Bitcoin? What it means for taxes in 2020

Business owners expecting PPP forgiveness can't deduct costs

Accordingly, fewer people also claimed a tax break for donations: 14.8 million returns claimed a charitable deduction in 2018, down from 37.9 million in 2017.

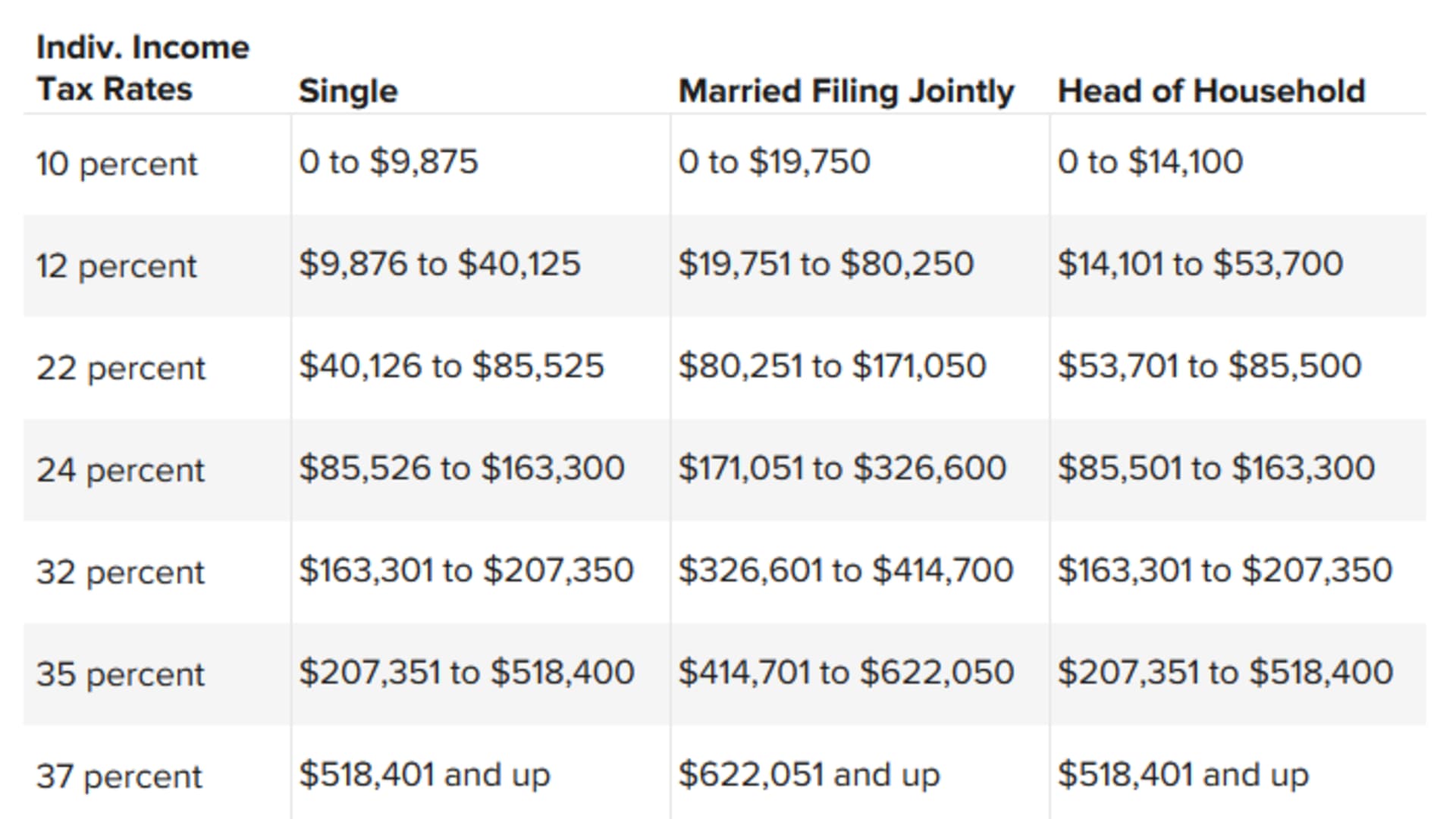

Deductions reduce taxable income based on your federal income tax bracket. This means the higher your bracket, the more you save.

Essentially, that means a $300 deduction is only worth $30 to someone in the 10% tax bracket, according to Marc Goldwein senior policy director for the Committee for a Responsible Federal Budget.

Meanwhile, a $300 deduction is worth $111 to someone in the 37% bracket.

See below for a breakdown of 2020's marginal income tax brackets.

Keep your records

If you expect to take a write-off for the cash you're giving to your favorite charity, make sure you retain any acknowledgement letters or receipts you get in return.

Generally, you can write off a donation of $250 or more if you have written acknowledgement from the charity.

In an age when people use their credit cards to donate to their favorite charities, the "thank you" email you get from the organization is proof of your donation, Alaimo said.

Print out that document or save the e-mail. You'll need it when you file your taxes next spring.