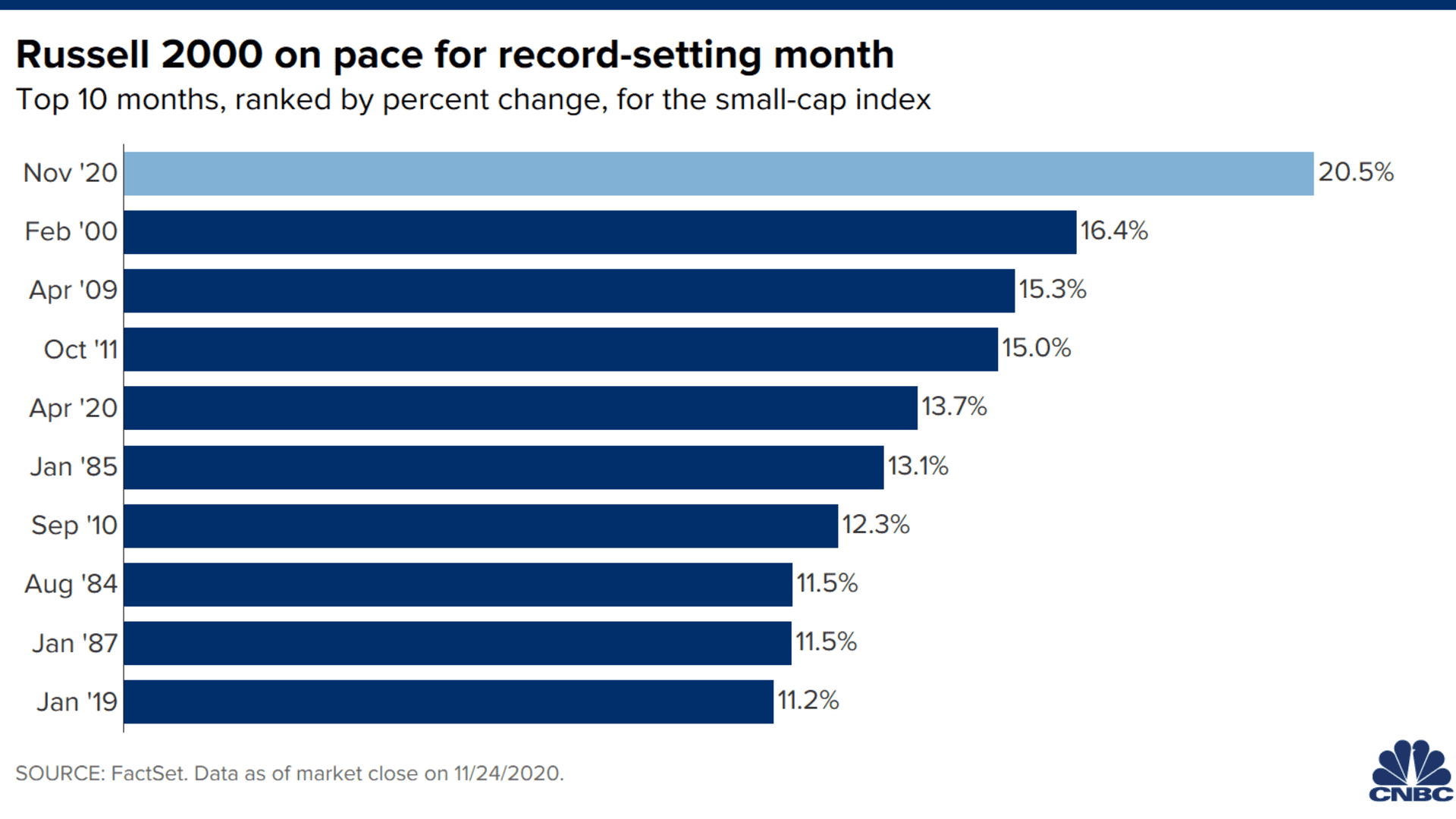

- The Russell 2000 hit another record high on Tuesday and is up more than 20% in November, on pace for its best month ever.

- Optimism about an economic recovery is spurring a rally in small cap stocks, which are often seen as cyclical plays for investors.

- On Nov. 9, when Pfizer announced that its vaccine candidate appeared to be effective against Covid-19, the small cap index jumped 3.7% for its best day since June.

The Russell 2000 index is on pace for its best month in history as a rotation into stocks with the most to gain from a vaccine reopening the economy has vaulted the small cap benchmark to a record.

The index hit another intraday record high Tuesday and has ripped more than 20% higher in November, as positive news on the vaccine front has fed optimism about an economic recovery in 2021. That puts the index on pace for its best monthly performance since its inception in 1984, according to YCharts.

Small cap stocks are often seen as riskier investments than their large cap peers, and they tend to trade like cyclical shares. In an economic downturn, concerns about sharp profit declines and even bankruptcies can hit smaller stocks particularly hard because those companies may have less developed revenue streams and less access to the credit markets than more established companies.

In recent weeks, positive data from several vaccine trials has spurred hope for a strong economic recovery in 2021, leading to a spike for cyclical stocks. On Nov. 9, when Pfizer announced that its vaccine candidate appeared to be effective against Covid-19 in its phase three trials, the small cap index jumped 3.7% for its best day since June.

"The overall macro backdrop is just getting better. With people feeling a little bit better about prospects for 2021, you want to own the laggards, that's small cap. You want to own stuff that's tethered to economic growth, that's going to be small cap," said Steven DeSanctis, small and mid-cap equity strategist at Jefferies.

Money Report

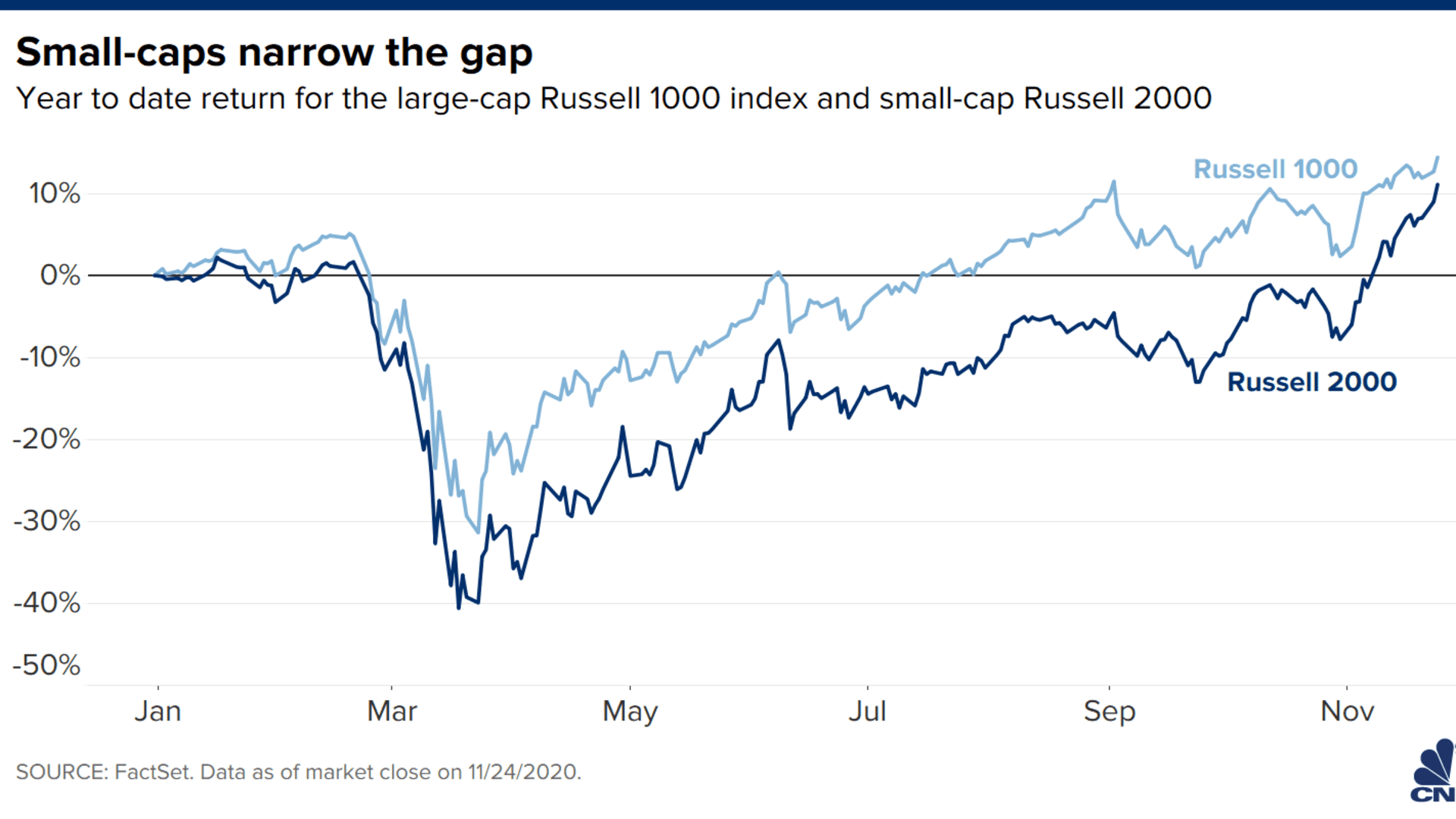

The leadership for small caps represents a reversal of the pattern that held for much of the year, where Big Tech stocks surged while names tied to the strength of the economy lagged as the pandemic hit businesses around the country.

"While FANGs have underperformed, the stocks of smaller companies have come into their own. The average stock is still lagging the market for the year, but this month has seen the Russell 2000 at least break out of a range in place more or less since June," technical analyst Frank Gretz of Wellington Shields said in a note to clients on Friday.

Even with the dramatic rally in November, small cap stocks still need to outperform just to catch up with their larger peers. The Russell 2000 has gained 11% year to date, while the large-cap Russell 1000 is up over 14%. The Nasdaq 100, which measures the 100 biggest non-financial stocks in the tech-heavy index, is up more than 38%.

On longer time horizons, the small cap underperformance is even more pronounced.

However, The factors fueling the current rally should continue to push small caps higher and close that gap, DeSanctis said.

"There's still more tailwind for small cap, money is just starting to come into the group and there's a lot of money coming back to equities and you get a little portion of it into small, which clearly drives performance. I think that its going to continue to drive performance," DeSanctis said.

— With reporting from Maggie Fitzgerald and Gina Francolla