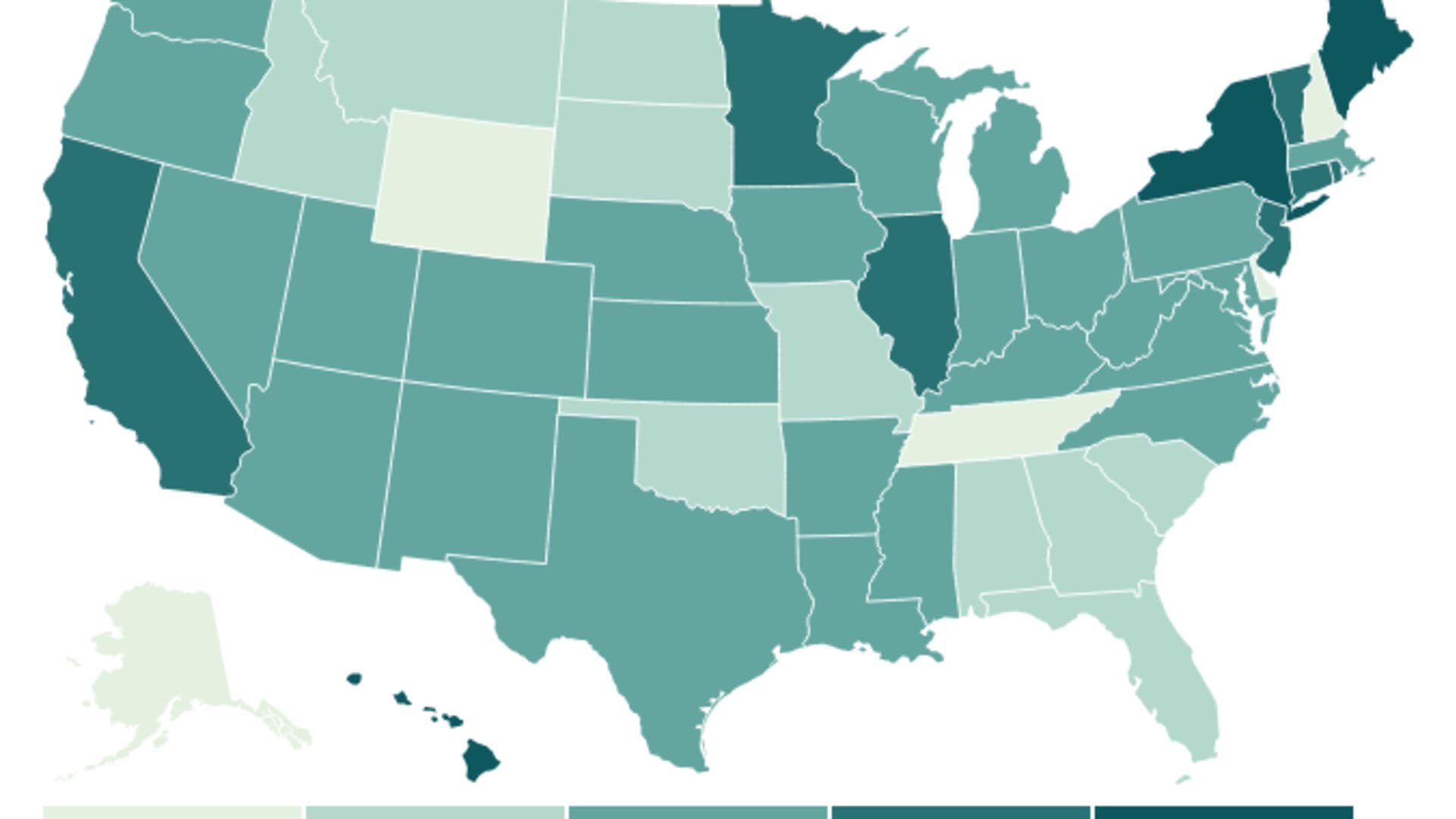

- You may have a wildly different tax bill depending on where you live.

- That's because your tax burden — individual income, property, sales and excise taxes as a share of total personal income — varies by state.

- You can expect to spend the most in New York, Hawaii, Maine, Vermont and Minnesota, according to a WalletHub report.

As this year's tax deadline approaches, you may have a wildly different bill depending on where you live, according to a WalletHub report ranking how much residents pay by state.

The report compares total tax burdens — individual income, property, sales and excise taxes — as a share of total personal income.

"Tax burden is a simpler ratio and helps cut through a lot of the confusion, especially when you're looking to relocate," WalletHub analyst Jill Gonzalez said.

While it's easy to focus solely on income taxes, other levies can have a significant effect on your family's budget.

Here are the states with the highest and lowest tax burdens, according to WalletHub.

States with the highest tax burdens

- New York (12.75%)

- Hawaii (12.70%)

- Maine (11.42%)

- Vermont (11.13%)

- Minnesota (10.20%)

- New Jersey (10.11%)

- Connecticut (10.06%)

- Rhode Island (9.91%)

- California (9.72%)

- Illinois (9.70%)

States with the lowest tax burdens

- Alaska (5.06%)

- Tennessee (5.75%)

- Delaware (6.22%)

- Wyoming (6.32%)

- New Hampshire (6.41%)

- Florida (6.64%)

- South Dakota (7.12%)

- Montana (7.39%)

- Alabama (7.41%)

- Oklahoma (7.47%)

"States without income tax or with very low income tax tend to be less burdensome overall," Gonzalez said.

Money Report

However, it's important to consider how tax burdens affect Americans by income level, she said. That's because low income tax states may charge more for property or sales tax, which typically hits lower earners harder.

The WalletHub findings come as bipartisan lawmakers from cash-rich states are cutting taxes to offer relief from rising prices, including income, corporate, grocery, gas and property taxes.

In 2022, Idaho, Indiana, Iowa and Utah have enacted income tax cuts, and similar legislation awaits the governor's signature in Mississippi, as of March 29, according to the Tax Foundation.

And there are proposals to cut levies on income in Colorado, Missouri, Nebraska, New York, Oklahoma and South Carolina.

There's a list of each state's tax proposals and relief here.

Migration from high-tax states

Several high-tax states have lost residents during the pandemic.

The $10,000 cap on the federal deduction for state and local levies for Americans who itemize, known as SALT, has been a pain point for areas with steep income and property taxes.

From April 2020 to July 2021, California, Hawaii, Illinois, New York and the District of Columbia were the top five jurisdictions to shed residents, according to a Tax Foundation report.