This story is part of CNBC Make It's Millennial Money series, which details how people around the world earn, spend and save their money.

At the end of 2020, Aaron Brock left his home and family in New Jersey and moved to Oklahoma.

Brock and a friend had both applied to the Tulsa Remote program, which pays participants to move to Tulsa, on a whim. When they were both accepted, they knew they wanted to do it. "We were like, 'Man, this is an opportunity we can't turn down,'" Brock, 22, tells CNBC Make It.

Since he works remotely as a technical presales engineer, earning $200,000 per year, Brock was able to qualify for the program and make the move without worrying about cost.

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

Tulsa Remote is a recruitment initiative that aims to attract remote workers to the city. Its primary perk is a $10,000 grant, which is distributed over the course of one year, during which participants are obligated to live and work within Tulsa's city limits.

The program focuses on community building and aims to help participants "integrate into the local fabric, creating strong interpersonal affinities and nurturing relationships," a program representative tells CNBC Make It.

In addition to the money and lower cost of living, the community aspect was a major draw for Brock, who was eager to get involved. "[The program develops] a community and they do a really good job of, 'Hey, I can just jump into a social group,'" he says. "I don't need to move to a new city, be the only person there and have to build it all up from scratch."

Money Report

Before the move, Brock had mostly lived with or nearby his parents. It was difficult for him to leave them, but "there's a time when it's like, 'Hey, I've got to go try by myself, be a proper real adult,'" he says.

Finding his passion

The youngest of four siblings, Brock was homeschooled growing up and spent a significant amount of time with his parents, who allowed him to freely explore his interests and find his passion. He started learning to program when he was about 6, and was immediately hooked.

By 14, Brock was getting paid to work on Minecraft when friends offered him gigs, and at 16, he says he got a longer-term job with a single server earning $1,500 per month for about eight months. "It paid for my first two cars."

When Brock was 18, a mentor he met at a robotics club when he was a kid offered him a job as a DevOps engineer. He decided to accept it instead of going to college. "It just didn't make financial sense to take four years and however much it would have cost to go to college instead," he says.

Though he enjoyed the work, Brock learned some tough lessons early on. For one, he was unknowingly underpaid in his first job as an engineer, he says. "I got paid $15 an hour. I missed out on a large amount of money by not negotiating that salary or having any idea of what the salary was supposed to be." The average base salary for a DevOps engineer was $97,098 per year as of 2021, according to Payscale.

Now four years into his career, Brock earns about $200,000 annually as a technical presales engineer. That includes his base salary of $170,000 and a 20% bonus based on commissions. While his current company offered him $150,000 initially, Brock negotiated up to the amount he earns now.

Brock feels very comfortable living in Oklahoma on this salary, even without the Tulsa Remote program's grant. So much so that he's able to save the majority of what he earns.

How he spends his money

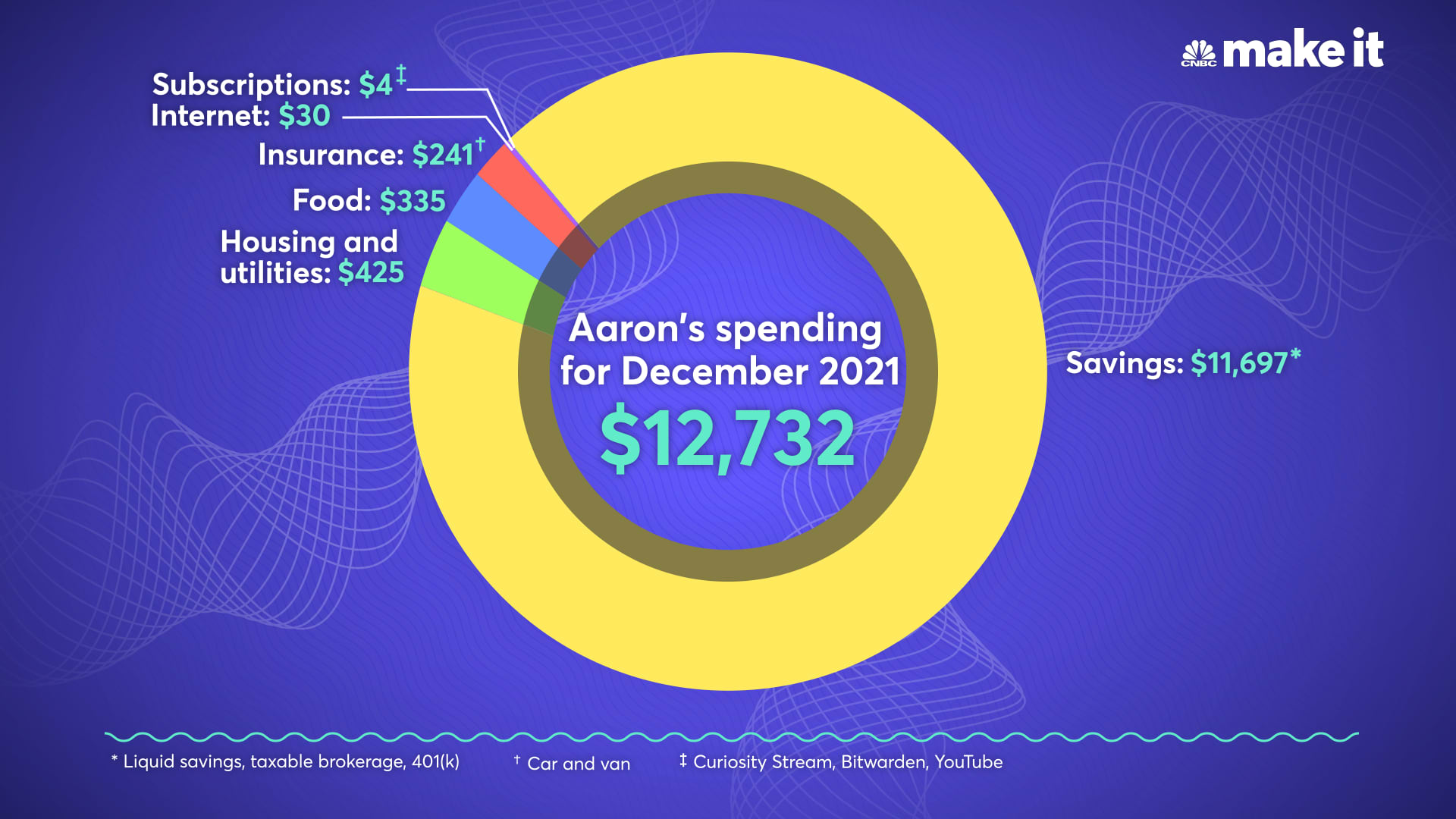

Here are Brock's monthly expenses for December 2021.

- Savings: $11,697 including his liquid savings, taxable brokerage and 401(k)

- Housing and utilities: $425 including rent, electricity, heat and hot water

- Food: $335 including about $300 for groceries and $35 for dining out

- Insurance: $241 for his car and van

- Internet: $30

- Subscriptions: $4 for Curiosity Stream, Bitwarden and YouTube, which he splits with friends

From November 2020 to November 2021, most of Brock's expenses, including rent, utilities and groceries, were covered by the Tulsa Remote program and its grant. To Brock, it was an opportunity to save, especially with his high salary.

"I'm young, I make a lot of money, and I recognize that the money that I make now is more valuable than the money I make later," Brock says. "If I can live very minimally at the moment and save that money, it'll be accruing interest, whereas if I live lavishly now and then live modestly in the future, I won't have that added interest."

To accomplish that, Brock tries to max out all of his retirement vehicles. In December, he allocated $2,649 to his 401(k), bringing his contributions to the maximum $19,500 allowed for the year. Previously, he maxed out his Roth IRA during the years his salary was within the permitted range.

In addition to this 401(k), Brock saved about $9,047, bringing his total savings to around $11,697 in December. He typically saves more and separately invests an additional amount, but in December spent $25,000 to buy a van to travel throughout 2022.

"I have a FIRE mentality," Brock says, referring to the Financial Independence, Retire Early movement. He intends to retire early and plans to have enough saved to do so in his 30s.

Brock also doesn't have any debt. He treats his credit cards like debit cards, paying off the entire balance each month.

Outside of savings and investments, Brock aims to spend just $1,000 to $1,500 on expenses each month. He does have help from his parents, who pay for his phone bill, health insurance, Netflix subscription and Costco membership. Brock has been included on their family plans since before he moved and hasn't branched off yet.

In addition to eating the same meals over and over, Brock chooses to only wear purple. It helps him avoid decision fatigue and limit the number of clothes he owns.

"I really dislike having stuff, just in general. If you own something, you have to take care of it and it owns you," he says. "Also, I like to not have to make decisions each day and always wear the same thing, like Steve Jobs."

Looking ahead

Brock plans to leave Tulsa this year, and start traveling across the country — even though it will cost more than his life in Oklahoma.

"When I looked into getting a van, I determined that this is actually not the best financial decision," he says. "A lot of cost goes into a van, be it insurance, maintenance and all of the fun, weird stops that you have to make along the way."

His budget for the year is $14,000, Brock says, which includes insurance and maintenance for the van; sales tax from buying the van; the added costs of living in it, like potentially having to dine out more; and the depreciation of the van over time. Since he works remotely, Brock will easily be able to keep his current job while traveling.

Brock loves living in Tulsa, and even though he hasn't planned past his adventure for 2022, he says he would be happy to return to the city once he's done traveling. "Down the line, Tulsa is fantastic," he says. "I would not be against moving back once I decide to cease the nomadic lifestyle."

As for leaving the program after a little more than a year, "They have a goal of making me stay there longer, but the agreement is to try it out for a year. I held up that side of the agreement and I tried it out for a year and I thought it was great," Brock says.

But, ultimately, he says he's not ready to settle down anywhere just yet. "I'm gonna be living a very different lifestyle for a bit."

Brock plans to continue saving as well. His goal is to save at least $2 million, so he can retire in his early 30s if he wants to. If he continues to save and invest as much as he does now, Brock is on track to achieve that goal.

"If you follow the 4% rule, that puts me at about $80,000 a year without touching the principal. While $80,000 is a lot less than I make currently, it's a lot more than I spend currently," Brock says. However, he'd ideally prefer to be able to live a bit more "lavish" lifestyle and ultimately have $3 million or $4 million for retirement.

Right now, though, "I'm focused on life experience," he says. "I would like to see the world and experience things that I haven't done before. I'm in a comfortable place to do that."

What's your budget breakdown? Share your story with us for a chance to be featured in a future installment.

Sign up now: Get smarter about your money and career with our weekly newsletter

Don't miss: This 29-year-old USPS mail carrier is on track to make over $90,000 this year—here's how he spends his money