California's budget for the fiscal year starting July 1 touches on people's lives in everything from education and taxes to how much their medical providers get paid. Here are some of the key areas in the $125 billion general fund spending plan that lawmakers will vote on Thursday:

Tax credit for working poor:

The budget makes more people eligible for the Earned Income Tax Credit, which provides cash to the working poor. It allows people with an income up to about $22,000 to qualify, up from $14,161 for adults with three or more children. People could earn up to full-time minimum wage and still be eligible. It also allows people to qualify even if they are self-employed. More than 1 million more households could claim the credit up from fewer than 400,000 households in the 2015 tax year.

Tobacco tax:

Doctors and dentists who treat low-income patients will get more money from a voter-approved $2-per-pack increase in tobacco taxes. About half the money will go to health care providers, including $465 million for doctors and dentists who treat patients in the state's Medi-Cal health insurance program for the needy. Another $50 million goes for family planning providers including Planned Parenthood and $27 million goes to raise rates at intermediate care facilities for those with developmental disabilities.

[2017 UPDATED 12/19] 2017 Southern California Images in the News

Medi-Cal benefits:

Local

Get Los Angeles's latest local news on crime, entertainment, weather, schools, COVID, cost of living and more. Here's your go-to source for today's LA news.

The budget restores full dental and eyeglass benefits that were cut for people on Medi-Cal during the Great Recession. The program currently covers primary and preventive dental care as well as dentures for adults, but does not pay for root canals and other services. Expanded dental coverage would begin Jan. 1 at an annual cost of $73 million, while eyeglass coverage would resume in 2020.

Education funding:

K-12 schools and community colleges get $3.1 billion more than this year, or $74.5 billion. Schools get another $1.4 billion through the Local Control Funding Formula, making it 97 percent complete. Higher education gets $14.5 billion in general fund money, including increases in Cal Grants and community college financial assistance. The budget also includes restrictions on the UC Office of the President following a scathing audit, and redirects money to increase enrollment by 500 graduate students and 1,500 undergraduates from California.

Infrastructure:

The $2.8 billion from higher gas and vehicle taxes approved earlier this year will go to fixing roads and bridges and building mass transit lines. The budget also includes $111 million for dam safety evaluations and other flood planning in response to flooding last winter and problems with the Oroville Dam spillways.

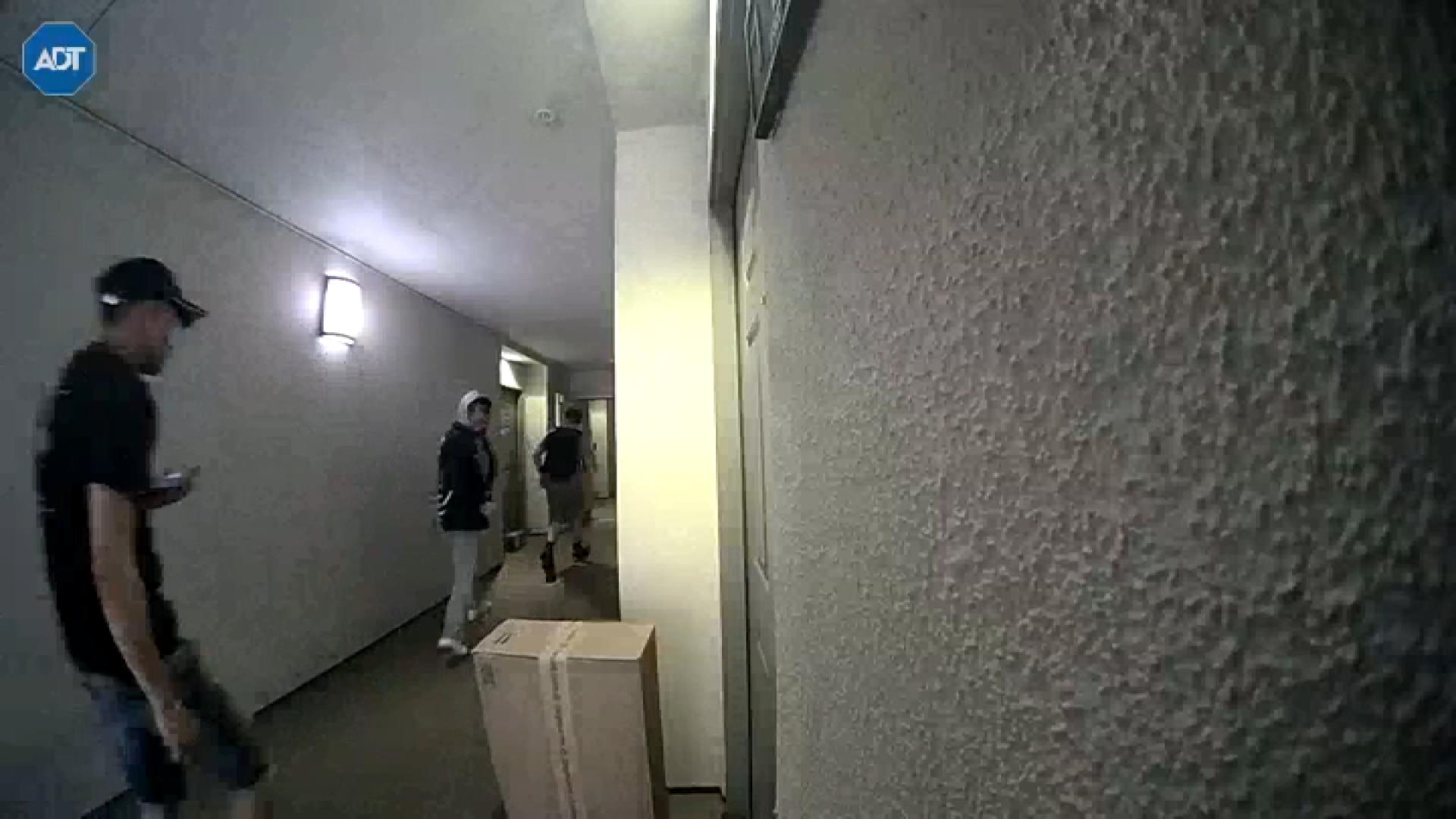

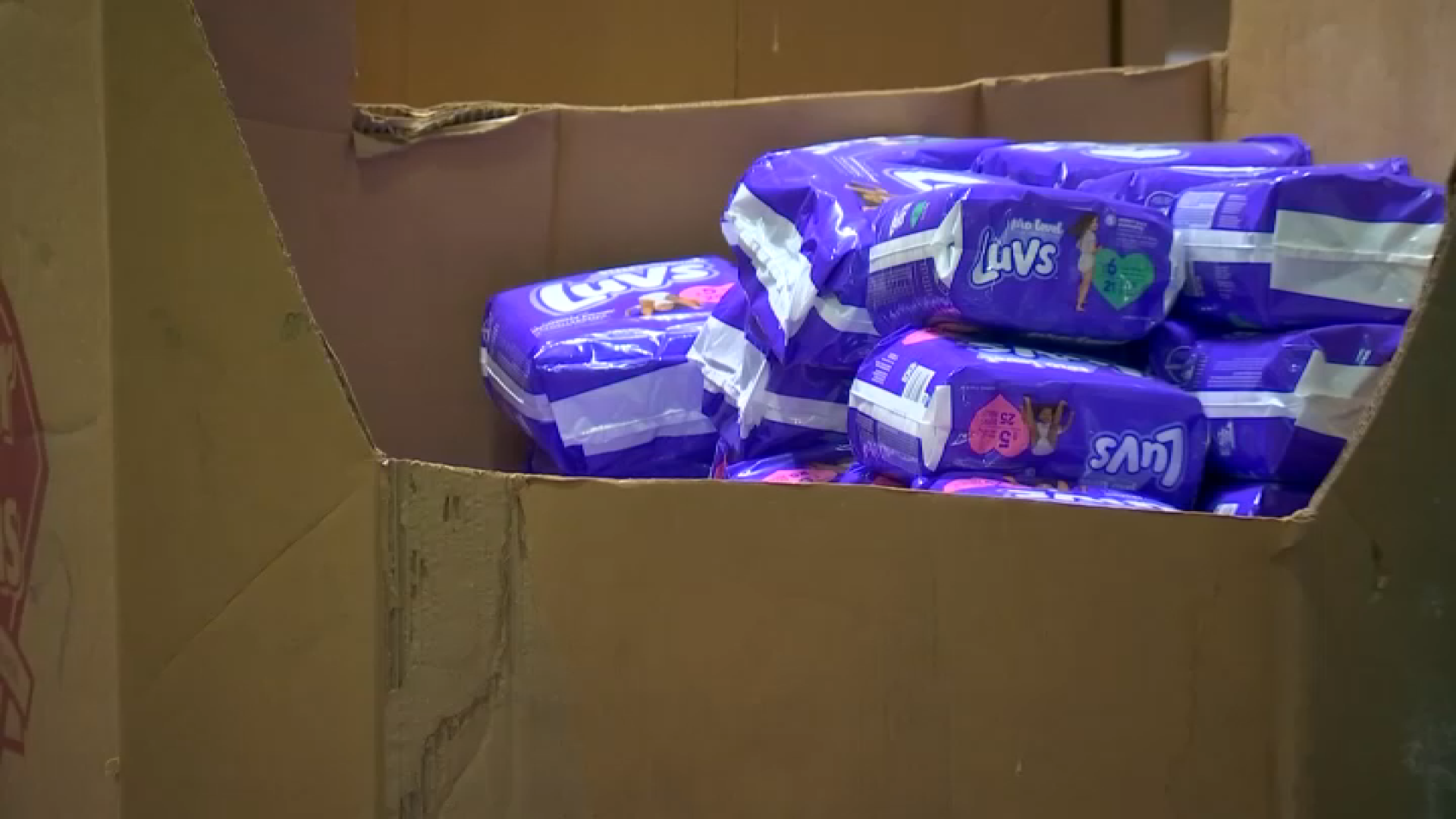

[LA GALLERY UPDATED 12/27] Crimes Caught on Camera in Southern California

Public safety:

The budget targets the federal immigration crackdown by requiring that the state attorney general review each county, local or private detention facility where noncitizens are being held, and by blocking counties from signing new contracts or expanding existing contracts to detain immigrants. It limits county jails' use of video visits instead of in-person visits to inmates. It blocks suspending driver's licenses as a penalty for the driver failing to appear in court. It extends the state's new deadline to register a semi-automatic firearm that does not have a fixed magazine by six months, until July 1, 2018. It extends the current ban on firearm ownership by anyone convicted of a felony or certain misdemeanors to include those facing arrest warrants.

Cannabis:

Finally, $118 million goes to software, personnel and other costs to prepare for next year's start of marijuana sales to adults over 21. It creates a tax office in California's North Coast region, from San Francisco to the border with Oregon — a prime area for growing marijuana — to make it more convenient for farmers to file their taxes.