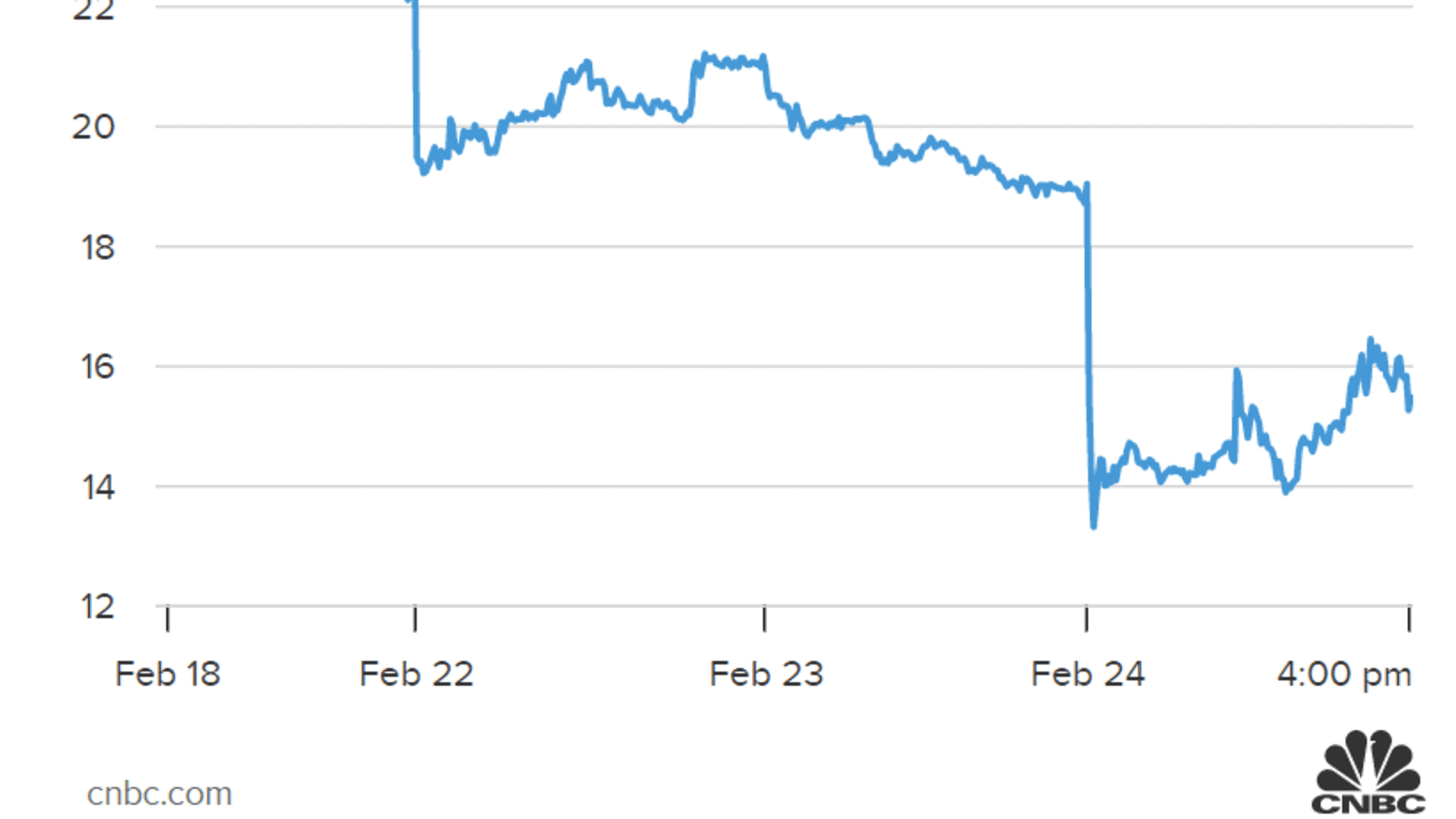

The VanEck Russia ETF fell 19% on Thursday, shedding a huge chunk of its already depressed value after Russia invaded Ukraine.

The fund was down more than 28% year to date before Thursday's sharp decline. This marked the fifth-straight negative session for the fund, which came under pressure late last week as tensions increased on the border between the two countries. The fund was down more than 23% at it lowest point on Thursday.

Exchange-traded funds represent a basket of equities, allowing investors to get exposure to a broad basket or sector of stocks with one purchase. This ETF is designed to track MVIS Russia Index, meaning that it holds stocks of Russian companies or those who generated at least half of their revenue from the country.

Get top local stories in Southern California delivered to you every morning. >Sign up for NBC LA's News Headlines newsletter.

Though the ETF gives investors exposure to the Russian economy, it is not necessarily a perfect representative of the country's stock market, according to a report about the fund from FactSet.

"The fund, however, doesn't [necessarily] look like the broad Russian equity space. It tends to be less top-heavy, as it limits its exposure to giant energy firms. This approach produces a more diverse basket that's still highly concentrated," the report said.

The fund's top holdings include Gazprom, the partially state-owned energy company, mining company Norilsk Nickel and Sberbank. The fund had $1.2 billion in net assets as of Wednesday, according to VanEck.

Money Report

President Joe Biden announced expanded sanctions against Russia on Thursday afternoon, including some targeting the country's banking sector.

ETFs representing other parts of the European market were also under pressure on Thursday. The iShares Europe ETF, which has roughly $2 billion in net assets, fell 2%.