Since becoming a "dogecoin millionaire" on April 15, Glauber Contessoto has continued to hold rather than sell — despite the coin's ups and downs, he tells CNBC Make It. And now he says he's a millionaire twice over.

Contessoto says he invested over $250,000 in dogecoin on Feb. 5, when it was priced at about 4.5 cents, and hasn't looked back.

"I had already anticipated that [dogecoin] would drop," Contessoto, 33, says, "and sure enough, it happened."

Indeed, after reaching an all time high of about 73 cents on Saturday in anticipation of Elon Musk's appearance on NBC's "Saturday Night Live," dogecoin then fell below 50 cents as the Tesla CEO called the cryptocurrency a "hustle" on TV.

Get top local stories in Southern California delivered to you every morning. >Sign up for NBC LA's News Headlines newsletter.

Contessoto likened what happened around SNL to what happened with the price around the community-proclaimed "Doge Day," April 20.

"The whole week leading up to it, everyone was hyping it up, prices going up, and then it crashes," he says. "It's the same pattern."

On Thursday, dogecoin continued its decline below 40 cents after Musk announced that Tesla would no longer accept bitcoin as payment for its vehicles over environmental concerns.

Money Report

But the price then started to go up again Thursday night after Musk tweeted that he's "working with doge devs to improve system transaction efficiency. Potentially promising." Musk had recently taken a Twitter poll as to whether Tesla should accept dogecoin.

This volatility is a reason why experts are very skeptical of dogecoin, even more than other cryptocurrencies, saying it's highly speculative and a so-called meme trade based on social media buzz. They warn that investors could get burned.

For instance, Mike Novogratz, a crypto bull and founder and CEO of Galaxy Digital, previously told CNBC's "Squawk Box" that while bitcoin is "a well-thought-out, well-distributed store of value that's lasted for 12 years and is growing in adoption," while dogecoin "literally has two guys that own 30% of the entire supply." Bitcoin also has an extensive and well-funded ecosystem that does not exist with dogecoin, he said. And dogecoin does not have a supply cap like bitcoin does, all of this making it a much more risky investment, according to experts.

But the volatility doesn't worry Contessoto, and he's very bullish on the meme-inspired cryptocurrency long-term. In fact, he has since spent more money buying the dip — on Sunday, for example, he invested another $17,500 when dogecoin was trading around 47 cents, he says.

Contessoto says he used money he earned by selling other cryptocurrency he owned, along with money leftover after paying bills from his day job paycheck, he says. (Contessoto works at a music company in Los Angeles.)

"It's taken me a long time, but I've learned how to stomach things like this," Contessoto says. "The only way you're going to guarantee your profit is holding long-term, like Warren Buffett has said about stocks. And I believe that wholeheartedly." (Buffett is not a fan of cryptocurrency and says it has no value.)

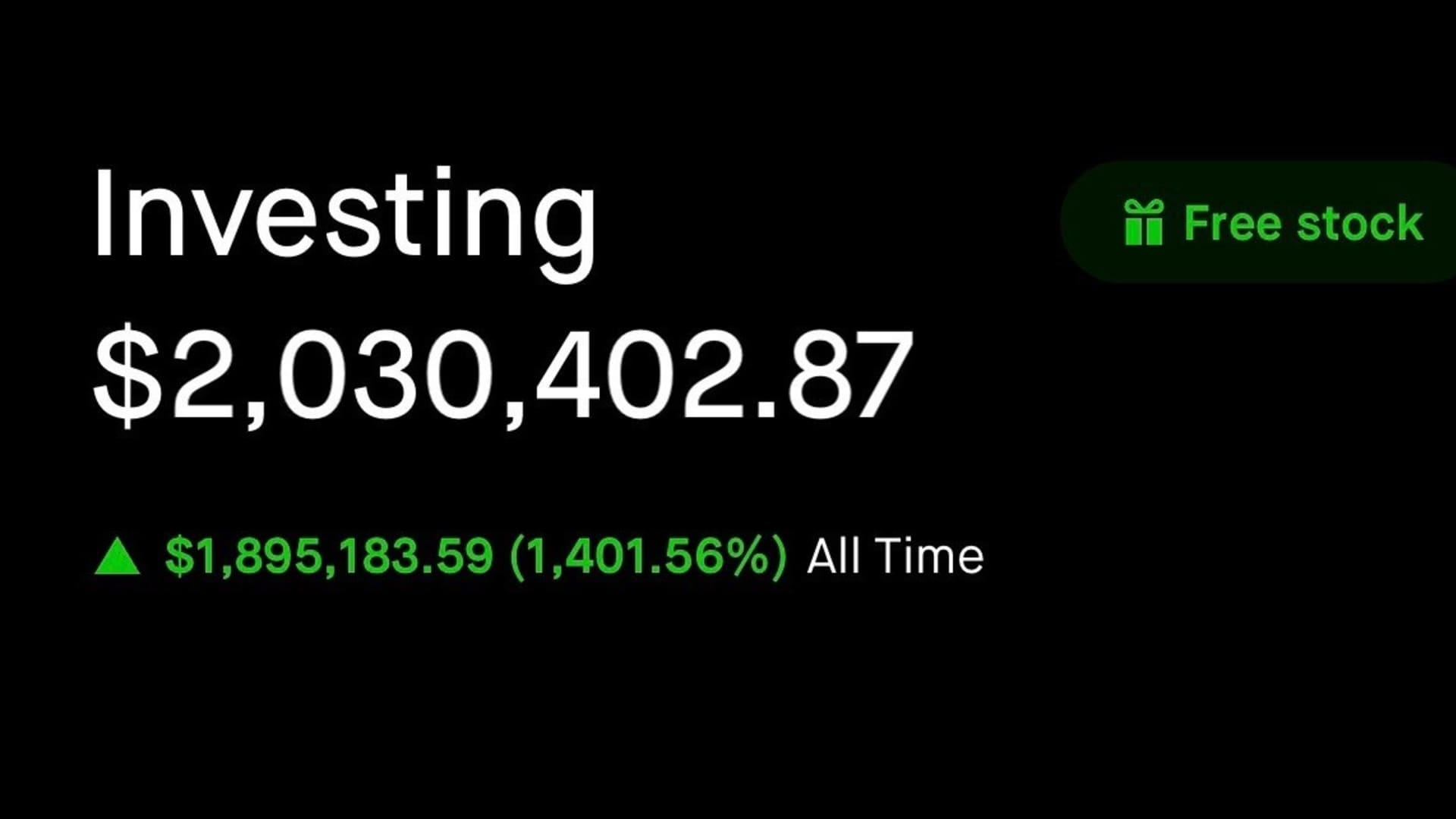

As of about 7 p.m. EST on Thursday, Contessoto's dogecoin balance is over $2.03 milion.

Contessoto is confident that dogecoin will remain a top cryptocurrency, he says, even though it started as a joke in 2013 based on the "Doge" meme of a shiba inu dog.

"People always ask me, 'Why are you so bullish? Why do you think dogecoin is going to take over?'" he says. "I believe that memes are the language of the millennials. Memes are the language of our generation, of Gen Z. I truly believe that."

Indeed, "for dogecoin, the meme is the message," Meltem Demirors, CoinShares chief strategy officer, previously told CNBC Make It. "As the influence of FinTwit [financial industry twitter] grows, so will the memes and the way they move our markets."

"Doge is powered by the regular, everyday person, retail investor that just wants to make a difference for themselves and a difference in the world," he says. "Doge is the most fun crypto. And if you don't get that, you're probably not a very fun person, I'm sorry."

Along with his ongoing love of memes, Contessoto also remains inspired by Musk.

If Musk allows Tesla to accept dogecoin, which some think his most recent tweet signals, "that's going to be the biggest catalyst ever," he says. "That would just flip everything on its head."

Contessoto says he will sell 10% of his dogecoin holdings once he hits a $10 million value, but will leave the rest invested.

"I'm the birth of the new investor. I'm the new retail investor," he says.

"It means more to me to actually hold, to stick to my word, than it does for me to make a profit right now. I'm doing this for the dogecoin community. I'm doing this for everybody that wants to change the way things work with the economy and fiat currency. I feel like I represent that little guy. I came from nothing and made something," he says.

Nonetheless, cryptocurrency is a risky investment, according to experts, because the price is highly volatile. Experts warn investors to proceed with caution before buying dogecoin, deeming its rally to be highly speculative, and advise that people should only invest money that they can afford to lose.

Dogecoin is currently trading at around 49 cents with a market value of $63 billion, according to CoinMarketCap.

Sign up now: Get smarter about your money and career with our weekly newsletter

Don't miss: Dogecoin millionaire invested his savings in the meme cryptocurrency with inspiration from Elon Musk

Correction: This story has been corrected to reflect that Contessoto initially purchased over $250,000 worth of dogecoin on Feb. 5. This story has been updated to reflect an additional purchase Contessoto made of dogecoin on Sunday.