This was CNBC's live blog covering European markets.

European markets closed higher Tuesday as investors continue to ponder last week's central bank policy decisions in Europe and the U.S.

The benchmark Stoxx 600 index closed up 0.3%, erasing losses from earlier in the session. Sectors largely ended the session in positive territory, with retail stocks up 1.5% while mining stocks fell 0.5%.

Grocery delivery service Ocado rose 3.2% after reporting a 10.6% year-on-year revenue increase in its retail division for the first quarter.

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

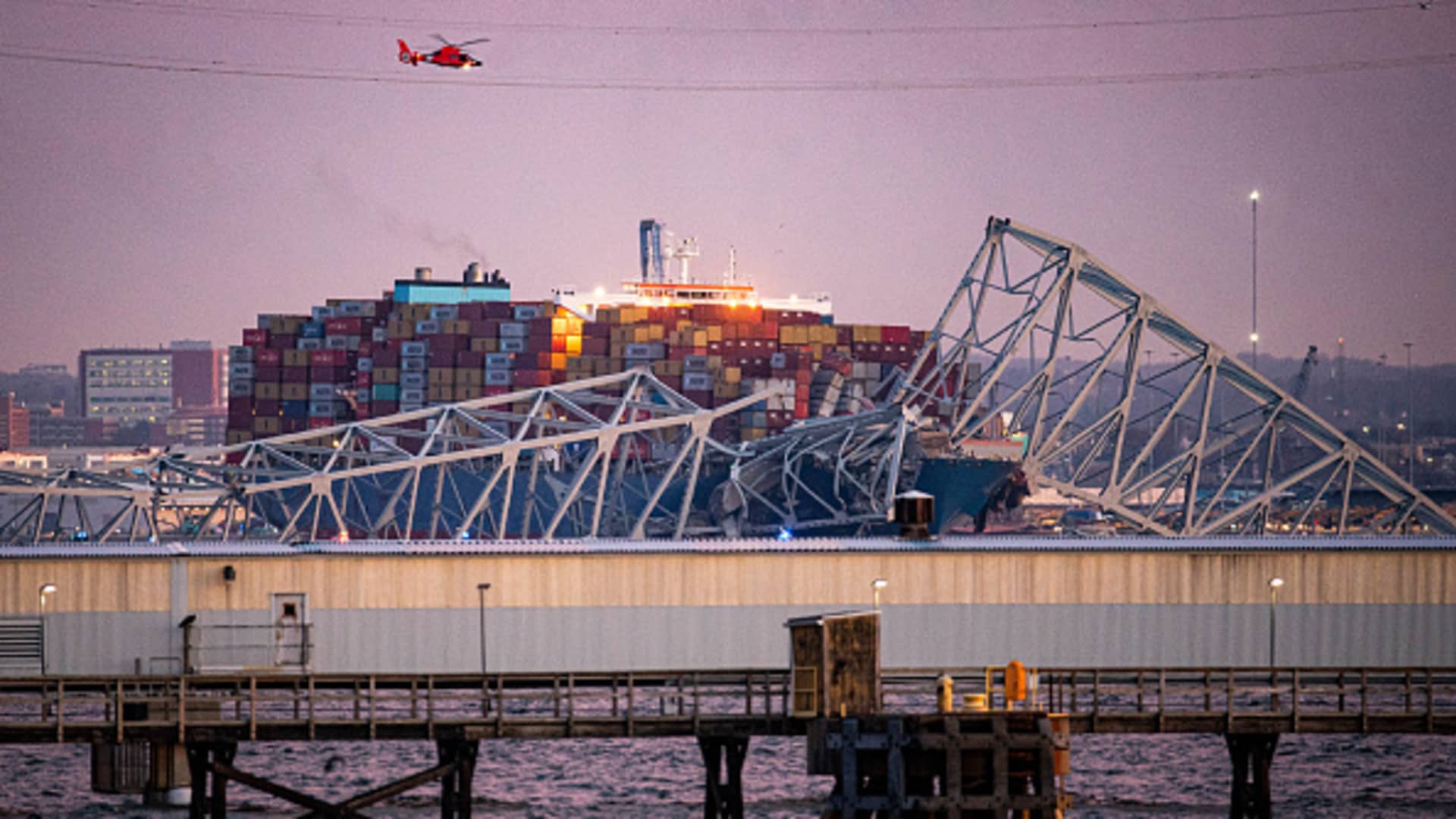

Meanwhile, Maersk pared losses slightly, having dipped 3.6% earlier in the session, after confirming it had chartered the container ship which crashed into the Francis Scott Key Bridge in the U.S. city of Baltimore in the early hours of the morning.

Earnings also came in from Smiths Group, Asos, Bellway, Flutter and A.G. Barr.

Investors, meanwhile, reacted to Nigeria's latest interest rate hike.

Money Report

U.S. stocks were cautiously higher in early deals as market participants tried to resume the rally that took equities to record highs.

Asia-Pacific markets were mixed Tuesday as the U.S. market took a breather after a rally sparked by optimism over the Federal Reserve's interest rate stance at its latest meeting.

Stocks on the move: Tui shares rise 7%, Auto Trader falls 5%

Shares of German holiday group Tui were up over 7% in afternoon trade even as the company warned that travelers should expect delays this Easter holiday period due to strike action.

At the other end of the index, British online car marketplace Auto Trader was down 5% after JP Morgan Cazenove placed the company on "negative catalyst watch" ahead of its full-year earnings release in May.

— Karen Gilchrist

Nigeria hikes interest rate to 24.75%

The Central Bank of Nigeria on Tuesday hiked its key interest rate by 200 basis points, as Africa's largest economy looks to recover from a historic currency crisis and soaring inflation.

The CBN announced that its main monetary policy rate would rise to 24.75% from 22.75%, in its second consecutive hike.

Read the full story here.

— Elliot Smith

U.S. stocks open higher

Stocks rose to begin the session on Tuesday morning.

The S&P 500 added 0.2%, while the Dow Jones Industrial Average gained 52 points, or 0.1%. The Nasdaq Composite inched 0.4% higher.

— Lisa Kailai Han

Cocoa prices cross $10,000 per metric ton in historical rally

Cocoa prices hit a record level on Tuesday, crossing above $10,000 per metric ton for the first time in history.

Dry weather conditions, wildfires and an onslaught of the cacao swollen shoot virus have all propelled the commodity to unprecedented levels. Year to date, cocoa prices have soared nearly 139%.

— Lisa Kailai Han

Maersk confirms it chartered ship that collided with Baltimore bridge

Danish shipping giant Maersk confirmed it had chartered the container ship which crashed into the Francis Scott Key Bridge in the U.S. city of Baltimore in the early hours of the morning.

The bridge partially collapsed following the incident, which occurred at 1:35 a.m. local time Tuesday, according to local officials. A rescue operation is underway.

"We are horrified by what has happened in Baltimore, and our thoughts are with all of those affected. We can confirm that the container vessel "DALI", operated by charter vessel company Synergy Group, is time chartered by Maersk and is carrying Maersk customers' cargo," the company said in a statement.

"No Maersk crew and personnel were onboard the vessel. We are closely following the investigations conducted by authorities and Synergy, and we will do our utmost to keep our customers informed."

Maersk shares were 4.35% lower at 11:45 a.m. in London.

— Jenni Reid

S&P Global lowers euro zone growth forecast

S&P Global on Tuesday trimmed its 2024 growth outlook for the euro zone by 0.1 percentage point to 0.7%.

The Organization for Economic Co-operation and Development and International Monetary Fund also recently lowered their growth forecasts, to 0.6% and 0.9%, respectively.

"The European economy remains on track for activity to improve and employment growth to moderate. However, uncertainty over productivity trends and slow implementation of the Next Generation EU recovery package may cause the rebound in growth to be weaker than we expected," S&P Global said in a note.

It also lowered its 2025 growth forecast to 1.3% from 1.5%.

Economists at the group expect three interest rate cuts from the European Central Bank this year, starting in June. However, they see less scope for cuts next year than previously thought, owing to high labor costs limiting disinflation.

— Jenni Reid

Stocks on the move: Smiths Group, Flutter, Asos all gain on results

Several firms gained after posting results Tuesday, with engineering group Smiths up by 2.5% after reporting a 2.1% rise in operating profit for the first half and reaffirming its full-year outlook.

Online retailer Asos gained 4.8% despite a significant drop in its half-year sales, as investors focused on an improvement in free cash flow and guidance for a slowdown in its sales decline.

Sports betting firm Flutter Entertainment nudged 0.9% higher as it forecast 30.2% earnings growth, after losses widened in 2023.

— Jenni Reid

Europe stocks open lower

Europe's Stoxx 600 index was 0.15% lower at 8:10 a.m. in London as last week's positive momentum stalls.

Bourses were mixed, with France's CAC 40 index up 0.05%, Germany's DAX trading flat and the U.K.'s FTSE 100 down 0.3%.

— Jenni Reid

German consumer confidence continues 'sluggish' recovery

German consumers were slightly more upbeat in March, though the recovery in sentiment remains slow, according to a monthly survey from GfK and the Nuremberg Institute for Market Decisions.

People are still reluctant to spend and the figures do not suggest a sustained recovery for the struggling German economy, the companies said.

"The recovery in the consumer climate is slow and very sluggish," said Rolf Bürkl, consumer expert at NIM.

"Real income growth and a stable job market themselves provide good conditions for rapid improvement in consumer sentiment, but there's still a lack of planning security and optimism about the future among consumers."

— Jenni Reid

CNBC Pro: As inflation fades, buy these 2 stocks, HSBC says — giving one 85% upside

As high inflation appears to be waning, a long-neglected set of stocks stands to benefit from consumers settling into a new normal spending pattern, according to HSBC.

The investment bank named two stocks that will benefit from the emerging trend—one of which uses AI to enhance its products. The bank also expects the stock to rise by more than 85% over the next 12 months.

CNBC Pro subscribers can read more here.

— Ganesh Rao

CNBC Pro: Forget Nvidia: Here are four stocks one investor is betting on instead

Chipmaker Nvidia has been in the spotlight over the past year, especially since its shares logged an astronomical 240% rise in 2023, on the back of the artificial intelligence buzz.

However, one investor is steering clear, saying the stock looks far too expensive.

"Even if some may say it's not as expensive because earnings have gone up dramatically ... when you see stocks start to triple over a year and a half to become one of the top on the S&P 500, you need to be cautious," said David Dietze, managing principal and senior portfolio strategist at Peapack Private Wealth Management, which has over $10 billion of assets under management and administration.

Instead, he named the sectors — and four stocks — to consider buying instead.

CNBC Pro subscribers can read more here.

— Amala Balakrishner

European markets: Here are the opening calls

European markets are set to open flat Wednesday.

The U.K.'s FTSE 100 index is expected to open 2 points lower at 7,930, Germany's DAX up 2 points at 18,400, France's CAC 1 point lower at 8,183 and Italy's FTSE MIB down 12 points at 34,135, according to data from IG.

Data releases include Spanish inflation data for March and French consumer confidence figures also for March. H&M releases its latest three-month update.

— Holly Ellyatt