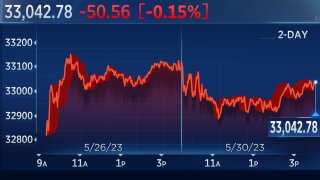

The Dow Jones Industrial Average fell on Tuesday as Wall Street considered the likelihood of Congress passing a tentative deal on raising the U.S. debt ceiling.

The 30-stock index lost 50.56 points, or 0.15%, to end at 33,042.78. The S&P 500 eked out a 0.002% gain to close at 4,205.52, after trading both above and below the flatline during the session. The Nasdaq Composite added 0.32% to finish at 13,017.43, paring gains after trading up as much as 1.4% earlier in the day.

President Joe Biden and House Majority Leader Kevin McCarthy reached an agreement to raise the debt ceiling and avoid a default over the weekend, with Congress set to vote on the legislation as early as Wednesday. Both Republican and Democratic support is needed for the proposed bill to pass.

Get top local stories in Southern California delivered to you every morning. >Sign up for NBC LA's News Headlines newsletter.

The agreement comes just days before the so-called X date on Monday, which is the earliest date the Treasury Department has signaled the U.S. could default on debt obligations. The long negotiations between the White House and congressional leaders raised concern among investors that a default could take place. Despite the tentative agreement, obstacles remain on the path to passage for the compromise bill in the House amid growing opposition within the GOP.

"Markets climb walls of worry at the end of the day, and the debt ceiling is obviously some type of worry," said Chris Barto, investment analyst at Fort Pitt Capital. "But I think the market is kind of pricing in some sort of deal does get done."

Concern over the potential for another interest rate hike also weighed on investor sentiment. Traders are pricing in a 68.8% chance of a Federal Reserve rate increase next month, according to the CME Group's FedWatch tool.

Money Report

Richmond Fed President Tom Barkin also said at a National Association of Business Economics event Tuesday that he hasn't "backed off" from his rate forecast, which he said is among the higher ones within the central bank.

"The Fed is still a major focus for all investors," said Brian Price, head of investment management at Commonwealth Financial Network. "It's really a tug of war between what the Fed is likely to do: whether or not they are going to hike one or two more times, or just sit tight and wait and see how incoming inflationary data is over the next couple of months."

The Nasdaq was helped by a nearly 3% rally in Nvidia. The artificial intelligence-related stock reached a $1 trillion market cap — an elite marker surpassed by just a handful of stocks — at one point in Tuesday's session, as shares continued to rally following its strong earnings report last week.

— CNBC's Christina Wilkie and Fred Imbert contributed reporting

Dow finishes lower

The Dow finished Tuesday lower about 0.2%.

The S&P 500 finished little changed after flickering around the flatline for much of the session. The Nasdaq Composite ended 0.3% higher but was off the session high of nearly 1.4%.

— Alex Harring

Tesla is 'set up well' for share growth despite lingering demand constraints, Barclays says

Despite some near-term headwinds, Tesla looks "set up well" for share gains over the long run, according to Barclays.

"Simply, not only is Tesla set up to be the primary beneficiary of the global EV transition with a significant lead on cost, but it is also the leader in establishing the software-defined vehicle of the future," wrote analyst Dan Levy in a Tuesday note to clients.

Even amid demand constraints and recent price cuts introduced by the company, Levy views the Model 1 and Cybertruck as "key steps forward" in Tesla's share expansion opportunity. These models should offer Tesla access to the pickup market and lower price tiers, he wrote.

"Overall, we reaffirm our OW rating and Tesla, and see it as a long-term winner in the global EV race," he said. "Yet we believe the question of model concentration must be addressed on its path of volume growth."

— Samantha Subin

'Up in the first half and down in the second half' still reasonable for 2023, Trivariate Research says

Investors should still expect stocks to go "up in the first half and down in the second half" in 2023, according to Trivariate Research founder Adam Parker.

He said mega-cap technology stocks remain for risk management, not the "alpha group." And he said investors who use an S&P 500 benchmark should own close to benchmark weight of Meta, Alphabet, Microsoft, Apple and Amazon, while being exposed to other sectors.

The S&P 500 has added 9.6% so far this year. Within the index, the communication services and information technology sectors have been the two best performers on the year, with each rallying more than 30% year to date.

— Alex Harring

BofA hikes Nvidia price target

Bank of America raised its price target on Nvidia to $500 per share from $450. The new target implies upside of 28.4% from Friday's close.

"We reiterate Buy on top pick NVDA following CEO keynote at Computex (Annual computer expo) in Taiwan over the holiday weekend," analyst Vivek Arya wrote. "Transforming into a data center powerhouse, NVDA highlighted how its full-stack platform has supported AI leadership, with company already partnered with >1,600 genAI startups (plus top hyperscalers). Indeed, AI upside is driving strong performance YTD (+180% vs. SOX +40%), but we believe we are only at the start of the story.

— Fred Imbert, Michael Bloom

Quanta shares rise more than 3% Tuesday

Bernstein wrote in a client note Tuesday morning on electric power infrastructure company Quanta Services "in a full embrace of the energy transition." Quanta shares were up 3.3% Tuesday afternoon.

"PWR owns the picks and shovels that will be used to make the energy transition a reality," analyst Chad Dillard wrote in a Monday note.

Dillard estimated transitioning the entire U.S. economy to electric power will require $2 trillion of power grid spending.

CNBC Pro subscribers can read more about the call here.

— Hakyung Kim

RBC raises year-end stock market forecast

RBC Capital lifted its year-end target for the S&P 500 to 4,250 from 4,100 as the tech-led market rally continued, seeing double-digit gains for 2023.

The new target is only about 1% higher than the S&P 500′s Friday close of 4,205.45 but it would represent a 10% gain for the year.

RBC's new target stands above the average year-end forecast of 4,157 from Wall Street strategists, according to CNBC Pro's market strategist survey, which rounds up the top 15 strategists' predictions.

— Yun Li

Dow remains down heading into final hour

The Dow was the sole major index trading down as investors entered the final hour of the trading day.

The 30-stock average slid around 0.3%.

Meanwhile, the S&P 500 was little changed after flickering around the flatline for much of the session.

The Nasdaq Composite was solidly up with a 0.5% advance, helped by a nearly 3% rally in Nvidia. But the technology-heavy index was off its session high of nearly 1.4% up.

— Alex Harring

Atlantic Equities says Coinbase could provide notable returns to investors in the long-term

While crypto exchange Coinbase may seem volatile, the stock presents attractive returns for investors willing to wait out until the longer term, according to Atlantic Equities.

The firm upgraded Coinbase shares to overweight from neutral. Analyst Simon Clinch maintained his price target of $70, which implies shares rallying 23% from Friday's close.

"The company is regaining custody asset share and is also leveraging its trust credentials to exercise pricing power – both important steps towards building resilience in the model," Clinch said in a Tuesday note.

Read more about his upgrade here.

— Hakyung Kim

Russell 1000 growth ETF notches high not seen in more than a year

The Russell 1000 Growth ETF (IWF) reached a high not seen in more than a year.

The ETF was up 0.2% to hit an intraday high of $262.09. That's a level not seen since April 20, 2022, when the fund closed at $264.61.

Ginkgo Bioworks, ChargePoint and Carvana led the way up for the ETF with jumps larger than 10%.

— Alex Harring, Gina Francolla

Fed's Barkin warns of stubborn inflation

Richmond Fed President Thomas Barkin warned that he thinks inflation will remain stubborn going forward, noting that he hasn't "backed off" from his rate forecast — which he said is among the higher ones within the central bank.

— Fred Imbert

Energy stocks fall as oil declines

Energy stocks were among the worst performers in the S&P 500. The moves dragged the sector down 1.5%.

The decline in energy stocks came as oil prices fell 4%.

Some of the biggest laggards in the sector included APA Corp, Devon Energy, Halliburton and Coterra Energy, all down at least 3% each. EQT Corporation lost 4.7%, while Marathon Oil and Diamondback Energy lost 2.7% and 1.7%, respectively.

— Samantha Subin

Roth bullish on Boston Beer this summer

Roth upgraded shares of alcoholic beverage maker Boston Beer to buy from neutral.

The bank was previously cautious on the beverage group's shares — but it now says warmer weather and gross margin improvements make it optimistic.

"We believe Seltzer and Truly will benefit in the summer from Bud Light share losses (occasion overlap increases with warmer weather) and gross margin lift from production shift will be realized in 2Q (given inventory days timing)," the firm said in a Tuesday note.

CNBC Pro subscribers can read more about the upgrade here.

— Hakyung Kim

Nvidia, Tesla among Tuesday's biggest movers

Here are some of the stocks moving the most during midday trading:

- Nvidia — Shares of the chipmaker and AI beneficiary popped nearly 6%, building on its recent gains on the heels of a blowout quarter. The moves pushed Nvidia's market value above $1 trillion.

- Tesla — Shares gained 6% following a Reuters report that a private jet used by CEO Elon Musk arrived in China, his first visit in three years. Musk is expected to meet with senior Chinese officials and visit Tesla's Shanghai plant, Reuters said.

- Coinbase – Shares of the crypto services business rose more than 5% following an upgrade by Atlantic Equities, which called the company the "best expression of crypto." The analyst kept his price target on the stock, still implying it could rally 23% from Friday's close.

Read the full list of stocks moving here.

— Samantha Subin

Apple, Salesforce hit new 52-week highs

Three Dow components are trading at new 52-week highs on Tuesday even as the 30-stock average lags the broader market.

Microsoft, Apple and Salesforce are all trading at recent highs.

Outside of the Dow, several semiconductor stocks have hit all-time highs, including Broadcom, ON Semiconductor and KLA Corp.

Meanwhile, Dow component 3M is one of the stocks hitting new 52-week lows on Tuesday. Other notable names include Target, Dollar General, Bristol-Meyers and Keurig Dr Pepper.

—Jesse Pound, Gina Francolla

Cathie Wood’s Ark Invest misses out on Nvidia’s powerful rally

Ark Invest's Cathie Wood, known for her investments in next-generation technologies, missed out on the jaw-dropping rally in Nvidia — the biggest winner in artificial intelligence this year.

Her flagship Ark Innovation ETF (ARKK) exited Nvidia entirely in early January, before the chipmaker went on to enjoy a powerful rally that propelled it to a $1 trillion market capitalization.

Wood revealed that her reason for dumping Nvidia was its high valuation.

"At 25x expected revenue for this year, however, $NVDA is priced ahead of the curve," Wood said in a Twitter post on Monday.

— Yun Li

Oil slides more than 4%

Oil prices were down more than 4% on Tuesday as market observers weighed the likelihood of Congressional approval of the U.S. debt ceiling agreement and looked to the OPEC+ meeting slated for this weekend.

Brent crude dropped $3.28, or 4.3%, to $73.79 a barrel. U.S. West Texas Intermediate crude lost $3.06, or 4.2%, to $69.61.

Energy stocks were the worst performer in S&P 500, down around 1.5% in Tuesday's session. With Wednesday marking the last trading session of the month, the sector is also set to see the worst performance in May with a 9.3% drop so far.

— Alex Harring

Dow lags in Tuesday's session

The Dow underperformed in Tuesday trading, losing more than 100 points while the Nasdaq Composite and S&P 500 traded up.

Visa, Merck and Procter & Gamble all weighed on the 30-stock index, with losses of more than 1.6%.

But nine stocks were able to avoid the drawdown. Intel was the best performer of Dow stocks in the session, gaining 2.8%.

— Alex Harring

Ford shares rise more than 3% following Jefferies upgrade

Ford Motor could be in for big gains ahead, according to Jefferies. The firm said Ford's recent investor event raised its confidence that the automaker has a solid plan and management that will help it close a gap with its rivals.

Jefferies upgraded the company's shares to buy from hold. Shares were up 3% Tuesday.

"Ford has in recent months refined a strategy to leverage group strengths and fill the gap between the quality of its product franchises and returns that have lagged peers and lacked consistency," analyst Philippe Houchois wrote in a Tuesday note.

CNBC Pro subscribers can read more about his upgrade here.

— Hakyung Kim

Weak market breadth could portend a correction for stocks, chart analysts say

Wall Street's chart analysts are warning that market breadth is alarmingly weak, with recent market gains powered largely by the AI boom lifting stocks like Nvidia and Alphabet.

CanaccordGenuity technical analyst Javed Mirza said in a note to clients on Monday that an "intermediate-term equity market correction looms" if market breadth does not improve.

Entering Tuesday, the Nasdaq-100 had gained more than 18% over the past three months, and the S&P 500 has advanced nearly 6%. Meanwhile, the Invesco S&P 500 Equal Weight ETF (RSP) has fallen more than 3%.

Read more about technical analysis on CNBC Pro.

— Jesse Pound

Consumer confidence tops expectations

The Conference Board's consumer confidence index came in above expectations for May, with a reading of 102.3. Economists polled by Dow Jones expected a print of 99. To be sure, that's still down from a revised April reading of 103.7.

"Consumer confidence declined in May as consumers' view of current conditions became somewhat less upbeat while their expectations remained gloomy," said Ataman Ozyildirim, senior director of economics at The Conference Board.

"Their assessment of current employment conditions saw the most significant deterioration," Ozyildirim added. "Consumers also became more downbeat about future business conditions. ... However, expectations for jobs and incomes over the next six months held relatively steady."

— Fred Imbert

Broadcom soars as Nvidia lifts chipmakers, artificial intelligence stocks

Shares of Broadcom climbed as much as 11% Tuesday to an all-time high for the stock at $902.50. The chipmaker is up 55% from the start of the year.

Stocks with large exposure to artificial intelligence including AMD and Marvell Technology climbed after Nvidia reached a pivotal $1 trillion market capitalization on Tuesday. Nvidia is riding a wave of investor excitement stemming from a better-than-expected quarterly result last week.

The firm is also benefiting from a deal with tech giant Apple announced on May 23 to develop 5G components in the US.

-- Brian Evans

Mountain Valley Pipeline operator surges

Shares of the Mountain Valley Pipeline operator Equitrans Midstream surged more than 40% at the opening bell Tuesday after the tentative debt ceiling deal included measures to accelerate the development of the controversial pipeline.

The natural gas pipeline, which spans more than 300 miles from West Virginia to Virginia, has been under litigation for years.

— Pippa Stevens

Nvidia reaches $1 trillion market cap

Nvidia shares added to a recent string of gains on Tuesday to hit a $1 trillion market cap.

With Tuesday's moves, Nvidia joins an elite club of companies with a $1 trillion market cap or more. That group includes Alphabet, Apple and Microsoft.

Shares gained more than 4% in early morning trading to last trade at around $405.56. Shares need to hold above $404.86 to maintain that distinction during Tuesday's trading.

— Samantha Subin

Nasdaq and S&P 500 open higher

The Nasdaq Composite and S&P 500 were trading higher shortly after the opening bell.

The Nasdaq added 1.1%, followed by the S&P 500 with a 0.5% advance. The Dow lagged, trading around its flatline.

— Alex Harring

Major indexes are on pace for mixed month with two trading sessions left

Wednesday's session is the last of the May trading month. With just two trading days left, the indexes are on pace to post varied performances.

The technology-heavy Nasdaq Composite has been the relative star as of Friday's close, rallying more than 6% so far this month. The S&P 500 is on pace for a relatively modest advance of 0.9% month to date.

But the Dow has lagged, shedding nearly 3% on the month. Drops larger than 10% in Nike, Walgreens and Disney have weighed on the 30-stock, blue-chip average in May.

— Alex Harring

Tesla shares rise following reports of Musk in China

Tesla shares rose more than 3% in premarket trading following reports of CEO Elon Musk's trip to China.

Reuters reported Monday that a private jet used by Musk arrived in China. He's expected to meet with senior Chinese officials and visit the electric vehicle maker's Shanghai plant, according to Reuters.

The trip comes as Bank of America analyst Matty Zhao said Monday that China would likely be the world's largest electric vehicle market by 2025, accounting for between 40% and 45%. That would mark a decrease as the country current made up about 60% of global market share in 2022, but Zhao said growth in the U.S and Europe would not be enough to make another country the biggest market in 2025.

— Alex Harring

See the stocks making the biggest moves before the bell

These are some of the stocks making notable premarket moves:

- ChargePoint — Shares of the electric vehicle charging station company jumped 5% premarket after Bank of America upgraded the stock to buy.

- Nvidia — Shares continued to near $1 trillion in market value, up 3.7% in premarket trading. The AI semiconductor company has been soaring since its blockbuster earnings report last Wednesday.

— Alex Harring, Michelle Fox

ChargePoint Holdings shares gain more than 5% during premarket trading

Shares of electric vehicle charging company ChargePoint rose 5.2% Tuesday before the bell following an upgrade to buy from Bank of America.

"The reason for our upgrade is simple – CHPT has proof of execution, line of sight to profitability and with its story largely unchanged since the PIPE offering, valuation is compelling against shares making all-time lows," analyst Alex Vrabel wrote in a Tuesday note.

"CHPT [is] a best-in-class way to play [the] EV charging theme," he added.

To read more about his upgrade, click here.

— Hakyung Kim

Premarket Nvidia rally puts semiconductor maker on track to enter $1 trillion market cap club

A 3.8% premarket rally in Nvidia shares is putting the semiconductor maker on pace to join just a handful of stocks that have a market cap larger than $1 trillion.

A market capitalization is the combined total value of a company's outstanding shares and can help investors understand a company's relative size in the stock market. Apple and Microsoft are among stocks who have already passed the $1 trillion threshold.

Nvidia shares rallied on the back of its strong earnings report last week. Investors have been increasingly excited about the stock given its exposure to artificial intelligence trends.

— Alex Harring

Debt ceiling not a 'sustainable positive' for the market, trader warns

Tom Essaye of The Sevens Report noted Tuesday that the market will need more than a debt ceiling deal to sustain a rally.

"From a market standpoint, the news may cause a temporary knee-jerk rally, but this will not be a sustainable positive and is not a reason to buy stocks by itself, as extending the debt ceiling merely removes a potential catastrophic negative and does not add anything new and positive into the macro set up," Essaye wrote.

"Conversely, the deal will not be a material negative for growth, either, as it does not drastically reduce federal spending (i.e. putting more pressure on an already slowing economy)," he added.

— Fred Imbert

Europe stocks choppy

European stocks were mixed in morning trade, with the Stoxx 600 index moving between narrow losses and gains.

Investors are watching key votes on the U.S. debt ceiling and more clues from central banks on the path of interest rates.

Germany's DAX index was up 0.25% by mid-morning, though France's CAC 40 and the U.K.'s FTSE 100 declined by 0.5% and 0.14%, respectively .

— Jenni Reid

Everyone can be a programmer, says Nvidia CEO

Fresh off Nvidia's stellar earnings report and subsequent stock rally, its CEO Jensen Huang is predicting that the world is entering a "new computing era".

Speaking at the Computex forum in Taiwan. He says anyone can be a programmer, just by speaking to the computer, and the desired functions will come forth.

No longer will programmers need to write lines of code, only for it to display the dreaded "fail to compile" because of a missing semicolon.

"This computer doesn't care how you program it, it will try to understand what you mean, because it has this incredible large language model capability. And so the programming barrier is incredibly low," Huang pointed out.

Nvidia says that generative AI is the "most important computing platform of our generation" as individuals and companies move to create new apps and leverage on generative AI in the process.

— Lim Hui Jie

Toyota's April sales increase as demand from Japan and China rises

Toyota's global sales rose almost 5% year-on-year in April, with strong demand from home market Japan and China.

Sales to Japan saw the largest gains, increasing 21.5% compared with April 2022 as parts shortages eased.

China sales saw a year-on-year jump of 46.3% to 162,554 units in April, rebounding from the impact of Covid-19 on the economy a year ago.

In contrast, sales to Europe slid 22.8% to 75,869 units. Toyota said despite solid demand, sales were lower due to operations being suspended, caused by the impact of shortages of semiconductors and other parts.

Shares of Toyota closed 0.6% higher on Tuesday.

— Lim Hui Jie

Australia's building approvals fall to lowest in 11 years

Building approvals in Australia fell 8.1% month-on-month to 11,594 – marking its lowest level since April 2012 – when the number of total approved units stood at 10,860, government data showed.

Private sector houses fell 3.8% to 7,939 while private sector dwellings excluding houses fell 16.5% to 3,469.

Meanwhile, the value of total building rose by 4.7% – the value of new residential building fell 2.7%, while the value of non-residential building rose 13.5%.

– Jihye Lee

Softbank shares slide almost 4%, leads losses on Topix

Shares of Softbank Group tumbled almost 4% on Tuesday, leading losses on the Japan's Topix index.

This comes after Softbank owned chip designer Arm announced it rolled out new technology for mobile devices and Taiwan smartphone chip maker MediaTek Inc said it will be using it for its next-generation product.

Shares of Softbank surged 8.8% on Monday.

— Lim Hui Jie

Biden, Congressional leaders iron out debt ceiling agreement set for a vote this week

President Joe Biden and Congressional leaders reached an initial agreement on over the weekend to avoid a U.S. default, with the bill set for a vote as soon as this week.

House Majority Speaker Kevin McCarthy and Biden had been at odds for weeks over raising the debt ceiling, with the first inklings of real progress coming last week. Key provisions that necessitated compromise included keeping non-defense spending flat for the next two years as well as increasing work requirements of food stamp benefits.

Still, the bill will need both Republican and Democratic support to make it to President Biden's desk before the so-called "X date" on June 5, which is the earliest time the Treasury Department has signaled the U.S. could default.

— Brian Evans

S&P 500 and Nasdaq coming off weekly gains

Both the Nasdaq Composite and S&P 500 posted weekly gains of 2.5% and 0.3% on Friday, respectively, while the Dow Jones Industrial Average slipped 1%.

The tech-heavy Nasdaq heads into the new trading week looking to add to a stretch of five consecutive gains. Nvidia's meteoric rise has added more hype to the investor optimism over artificial intelligence stocks.

— Brian Evans

Stock futures open higher

Futures tied to the major averages opened higher on Monday night.

Dow futures were up about 70 points, or 0.2%. S&P 500 futures climbed 0.3%, while Nasdaq-100 futures popped 0.5%.

— Fred Imbert