- The cost of college has never been higher.

- This year’s incoming freshman class can expect to borrow nearly $40,000 to help cover the cost of a bachelor’s degree, according to a report.

Beyond highlighting the overwhelming burden of student loan debt, the pandemic has also shed light on the sky-high cost of college.

Average tuition and fees for the 2021-2022 academic year increased by 1.6%, to $10,740, for in-state students at four-year public colleges, according to the College Board, which tracks trends in college pricing and student aid. The data also showed tuition and fees at four-year private institutions rose by 2.1% to $38,070.

Get Southern California news, weather forecasts and entertainment stories to your inbox. Sign up for NBC LA newsletters.

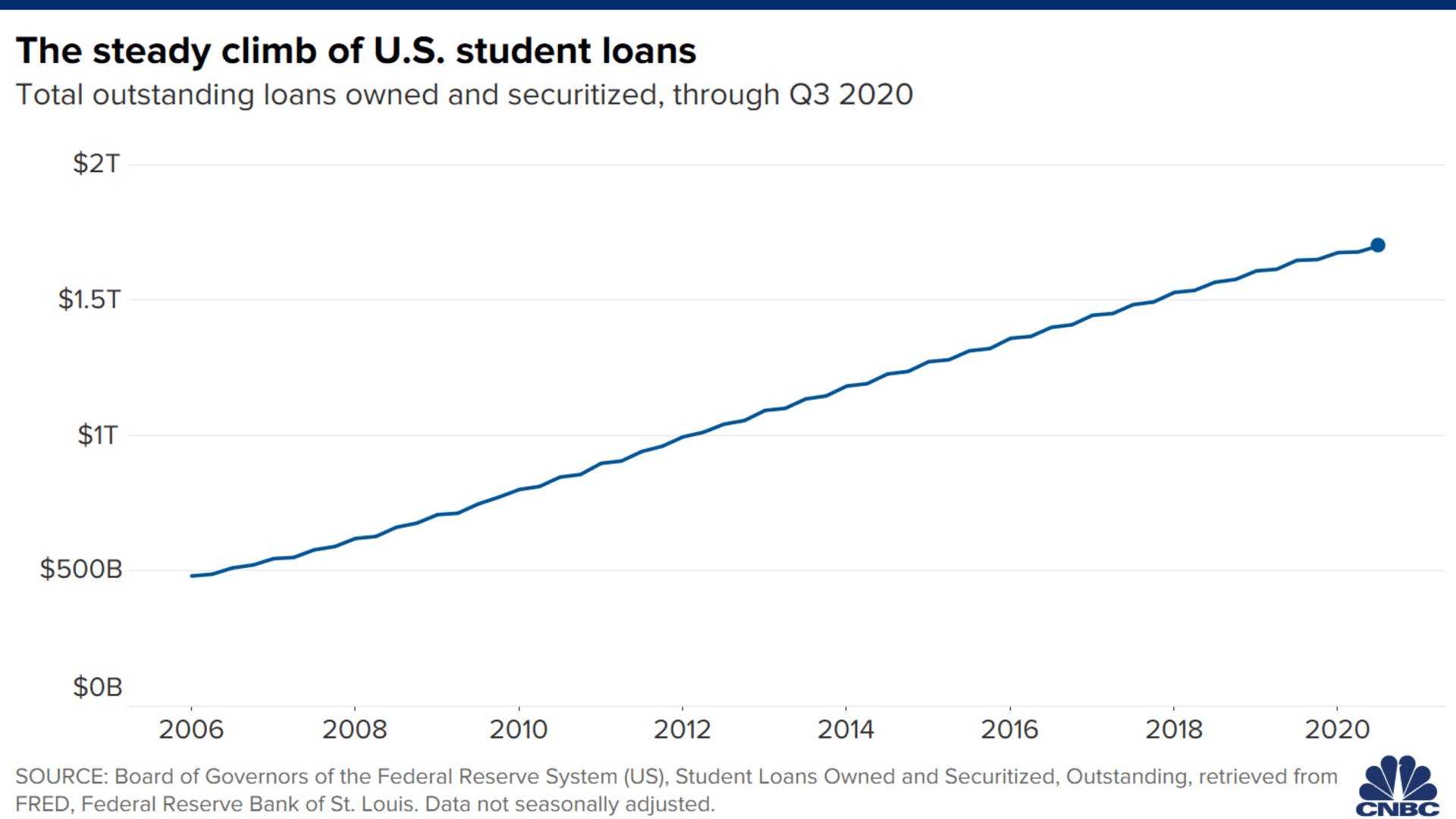

Many students must borrow to cover the cost, which has already propelled collective student loan debt in the U.S. past $1.7 trillion.

More from Personal Finance:

Biden extends payment pause on federal student loans

These are the country's 'dream' colleges

Is college really worth it?

This year's incoming freshman class will rely on loans even more in pursuit of a degree at a public college or university, new data shows.

Money Report

Typically, 7 in 10 college seniors graduate in the red, owing nearly $30,000 per borrower, according to data from the Institute for College Access & Success.

Meanwhile, a 2022 high school graduate could take on as much as $39,500 in student loans, on average, according to a recent NerdWallet analysis of data from the National Center for Education Statistics. That's up from $38,147 for 2021 high school grads.

The share of parents taking out federal parent PLUS loans to help cover the costs of their children's college education has also grown significantly, NerdWallet found.

The report factors in that it now takes five years, on average, to complete a four-year bachelor's degree, given that more undergraduates are taking time off.

For those already struggling under the weight of student debt, President Joe Biden used his executive powers to extend the pause in federal student loan payments until September.

Nearly 43 million federal borrowers are hoping massive student loan forgiveness might be Biden's next major move.

Although Biden has expressed skepticism about sweeping student loan forgiveness in the past, the president recently indicated he was currently looking to provide some form of student debt cancellation, according to multiple reports.

Meanwhile, nearly two-thirds of parents are still worried about being able to cover the cost of higher education in the years ahead, according to a separate report by Discover Student Loans.

Experts say reducing the amount you borrow at the outset will go a long way to easing your long-term debt burden. Here are three ways to do that.