The S&P 500 came frustratingly close to a record high but failed to cross that hurdle.

Still, several stocks have managed to make new highs this week, including ADP, Target, eBay, T-Mobile and Nvidia.

Todd Gordon, founder of TradingAnalysis.com, told CNBC on Wednesday that one of those stocks should continue its hot streak on the back of a rotation back into technology.

Get top local stories in Southern California delivered to you every morning. >Sign up for NBC LA's News Headlines newsletter.

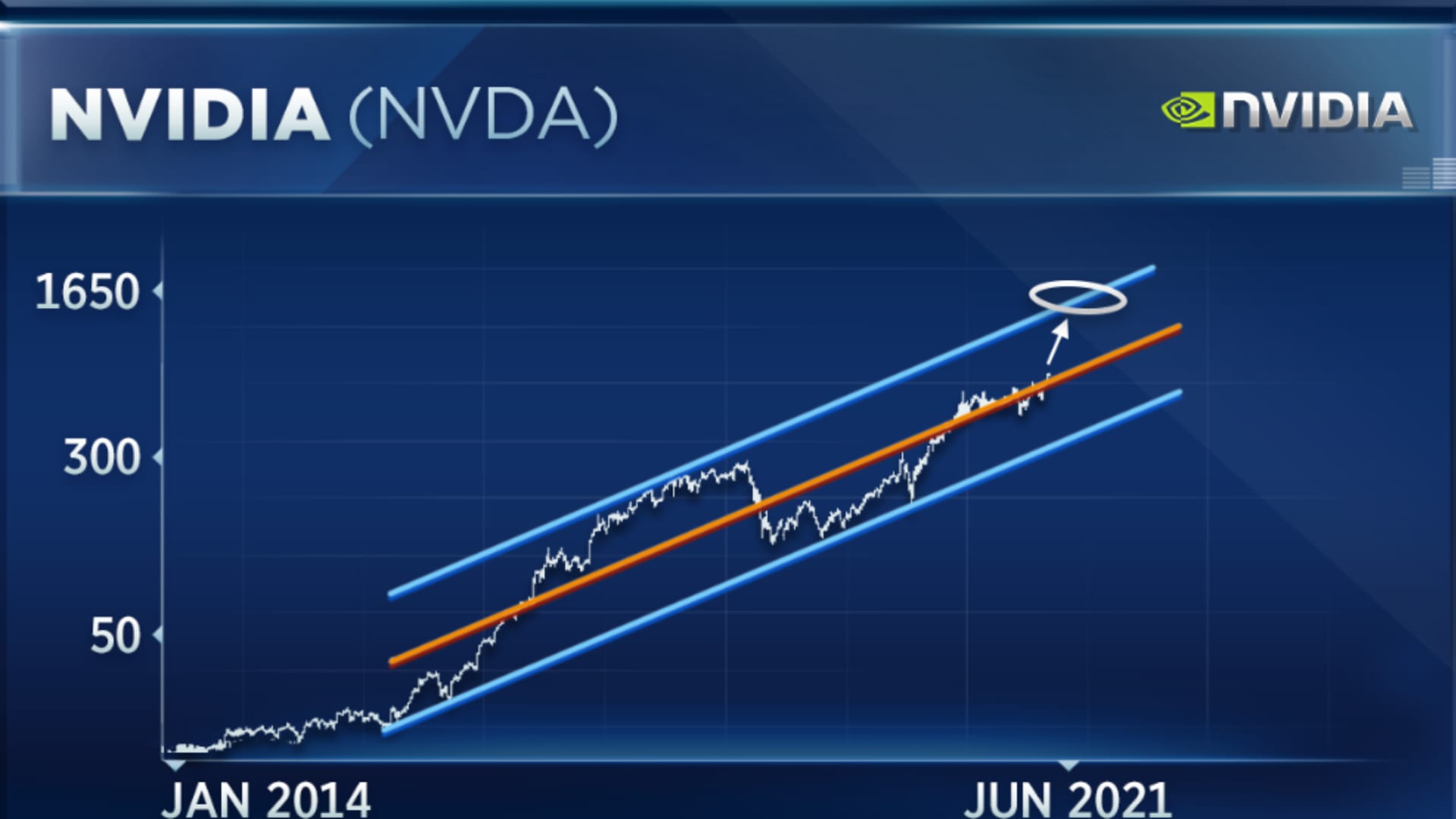

"You're seeing a rotation back into the large-, medium-cap growth relative to value, … and Nvidia is the play. This is obviously the largest GPU and AI play out there," Gordon said on "Trading Nation."

"We've been in a massive uptrend since 2015. We don't show resistance until about $,1650. Nvidia is the second largest holding stock in my portfolio, behind Apple," said Gordon.

Money Report

Nvidia would need to climb more than 137% to reach Gordon's target. He said there's still opportunity to buy the stock in any near-term dip.

"We just broke out of year-long range between about $650 and $500. ... So if you have any pullback to $650 it's buyable," he said.

Nvidia closed Wednesday above $694. A move to $650 implies a 6% pullback.

Delano Saporu, founder of New Street Advisors, has his eye on a different record-breaking stock.

"I really like ADP here," Saporu said during the same interview. "Their highest margin business, their employer services segment, that's going to have a lot of tailwinds with our expanding economy. We're back on the mend. These are things that benefit well for the … business."

ADP's employer services business makes up 69% of total revenue. Overall sales are expected to increase by 9% for its June-ended quarter, according to analysts surveyed by FactSet.

"They're returning money and rewarding shareholders with $1 billion in share repurchases. They also had about $1.5 billion in dividends. This is a company that I really think is strong," said Saporu.

Disclosure: Gordon holds NVDA.