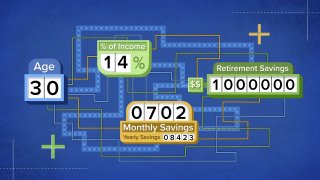

Saving a set percentage of your salary every month is a simple way to grow your retirement account over time. But figuring out how much your monthly contributions will be worth decades down the line can be difficult.

As a rule of thumb, most financial advisors suggest that you save 10% to 15% of your salary. But if your goal is to get to $1 million, the percentage that you need to invest will vary considerably based on how old you are when you start.

This case study takes a look at how much you'll need to save if you make an annual salary of $60,000, broken down by the age at which you start investing. If you start in your 20s, retiring with $1 million won't be so difficult, but the older you get before to salt some money away, the larger the portion of your paycheck you'll need to put away each month.

More from Invest in You:

What students learned about money in College Money 101

This 23-year-old entrepreneur made millions on Amazon and WalmartNBA champion Dwayne Wade shares his three best tips for managing money

Get top local stories in Southern California delivered to you every morning. Sign up for NBC LA's News Headlines newsletter.

The model used here assumes that you start with no savings, plan to retire at 65 and have investments that earn 6% annually. It doesn't account for variables such as pay increases, employer matches, inflation or any other financial curveballs that life may throw at you.

Watch the video to find out how best to save $1 million for retirement on a $60,000 salary.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox. For the Spanish version Dinero 101, click here.

Money Report

CHECK OUT: Supersaver who banked 78% of his income and no longer has to care about money: How I did it with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.